|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

自选举日以来,像比特币 (BTC -0.18%) 这样的加密货币已经绝对起飞。投资者押注特朗普政府下更宽松、更友好的监管环境将继续推动该行业再创新高。

Cryptocurrencies have soared since Election Day as investors anticipate a favorable regulatory climate under the Trump administration. Among the top crypto assets, Bitcoin (CRYPTO: BTC) has an interesting relationship with Ethereum (CRYPTO: ETH). The two are linked but distinct, and their relative performance can provide insights.

自选举日以来,由于投资者预期特朗普政府将创造有利的监管环境,加密货币价格飙升。在顶级加密资产中,比特币(CRYPTO:BTC)与以太坊(CRYPTO:ETH)有着有趣的关系。两者既有联系又有区别,它们的相对表现可以提供见解。

Recently, the Ethereum-Bitcoin ratio has reached lows not seen since April 2021, potentially signaling a coming move for Ethereum. Here's what to know.

最近,以太坊与比特币的比率已达到 2021 年 4 月以来的最低点,这可能预示着以太坊即将采取行动。以下是需要了解的内容。

The Ethereum-Bitcoin ratio

以太坊与比特币的比率

Given their history and the difficulty in valuing cryptocurrencies due to their lack of intrinsic value, many investors have used trends between Ethereum's and Bitcoin's prices to gauge their relative value. After all, groups of stocks are often compared to determine their relative valuation. A simple way to track Bitcoin and Ethereum is by looking at the relationship between Ethereum's and Bitcoin's prices, which is done by dividing the price of Ethereum by the price of Bitcoin. Observing where this ratio has moved over time can offer clues as to which cryptocurrency appears undervalued or overvalued relative to the other.

鉴于其历史以及由于缺乏内在价值而难以对加密货币进行估值,许多投资者利用以太坊和比特币价格之间的趋势来衡量它们的相对价值。毕竟,经常对股票组进行比较以确定它们的相对估值。跟踪比特币和以太坊的一个简单方法是查看以太坊和比特币价格之间的关系,这是通过将以太坊的价格除以比特币的价格来完成的。观察这一比率随时间的变化可以提供线索,了解哪种加密货币相对于另一种加密货币似乎被低估或高估。

ETH/BTC Ratio data by TradingView. Chart by Daniel Foelber.

ETH/BTC 比率数据由 TradingView 提供。图表由 Daniel Foelber 绘制。

As you can see in the chart, the Ethereum-Bitcoin ratio fell toward 0.035 recently, marking the lowest level seen since April 2021. The average ratio since 2020 is 0.0538. Ethereum has risen about 38% since Election Day, compared to Bitcoin's 44%. However, Bitcoin has outperformed significantly this year.

从图表中可以看出,以太坊与比特币的比率最近跌向 0.035,这是 2021 年 4 月以来的最低水平。2020 年以来的平均比率为 0.0538。自选举日以来,以太坊上涨了约 38%,而比特币则上涨了 44%。然而,比特币今年的表现明显优于其他市场。

Bitcoin Price data by YCharts

YCharts 提供的比特币价格数据

Cryptocurrency has performed admirably during an uncertain period and a high-interest-rate environment where investors have been primarily concerned with inflation and its potential to slow the economy. Bitcoin has held up particularly well as investors have grown more confident in the token's ability to hedge against inflation given its finite supply.

在不确定时期和高利率环境下,加密货币的表现令人钦佩,投资者主要担心通货膨胀及其可能放缓经济的可能性。比特币的表现尤其出色,因为鉴于其供应有限,投资者对该代币对冲通胀的能力越来越有信心。

Returning to the Ethereum-Bitcoin ratio, the last time it dropped to these levels, Ethereum went on to rally 120% over the following two months. Notably, Bitcoin and Ethereum trade 24/7, so things can obviously change quickly. The ratio was 0.0380 on Nov. 30, so Ethereum has already begun to close the gap slightly.

回到以太坊与比特币的比率,上次跌至这些水平时,以太坊在接下来的两个月里继续上涨了 120%。值得注意的是,比特币和以太坊的交易是 24/7 的,所以事情显然会很快发生变化。 11 月 30 日该比率为 0.0380,因此以太坊已经开始小幅缩小差距。

Could Ethereum be set for a rally?

以太坊能否迎来反弹?

Of course, past trends don't always guarantee future success. As you can see in the chart above, the Ethereum-Bitcoin ratio has gone lower before, so it could continue to do so now.

当然,过去的趋势并不总能保证未来的成功。正如您在上图中看到的,以太坊与比特币的比率之前已经走低,所以现在可能会继续这样。

However, I believe recent trends in the Ethereum-Bitcoin ratio bode well for Ethereum, particularly if the crypto rally continues. As we've seen in the stock market this year, markets and sectors tend to broaden over time. A large component of crypto has always been sentiment. Bitcoin and the broader market have rallied significantly, but it typically takes a while for sentiment to peak and then begin to decline again. I don't think we've seen a peak yet in positive sentiment toward crypto. The positive regulatory environment could continue to be a tailwind well into 2025, and the more that crypto rallies, the more larger investors will be forced to chase it.

然而,我认为以太坊与比特币比率的最新趋势对以太坊来说是个好兆头,特别是如果加密货币反弹持续下去的话。正如我们今年在股市中看到的那样,随着时间的推移,市场和行业往往会扩大。加密货币的一个重要组成部分一直是情绪。比特币和更广泛的市场已经大幅上涨,但情绪通常需要一段时间才能达到顶峰,然后再次开始下跌。我认为我们对加密货币的积极情绪尚未达到顶峰。积极的监管环境可能会在 2025 年继续成为推动因素,加密货币反弹越多,就越多的大型投资者将被迫追逐它。

Ethereum doesn't offer the same inflation hedge as Bitcoin, but it provides value in other ways. Its relatively new proof-of-stake method for validating transactions is far more energy-efficient than Bitcoin. Developers also see Ethereum as the primary network for creating decentralized applications and non-fungible tokens, and its smart contract capabilities will likely have use cases in many industries.

以太坊不提供与比特币相同的通胀对冲功能,但它以其他方式提供价值。其用于验证交易的相对较新的权益证明方法比比特币更加节能。开发人员还将以太坊视为创建去中心化应用程序和不可替代代币的主要网络,其智能合约功能可能会在许多行业都有用例。

In my view, Bitcoin and Ethereum are both solid long-term crypto assets, so both could continue to perform well. However, given Bitcoin's impressive rally already, it's possible the rally will broaden to other tokens like Ethereum, though it's very difficult to try to predict near-term price movements of cryptocurrencies.

在我看来,比特币和以太坊都是可靠的长期加密资产,因此两者都可以继续表现良好。然而,鉴于比特币已经令人印象深刻的反弹,涨势可能会扩大到以太坊等其他代币,尽管很难尝试预测加密货币的近期价格走势。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

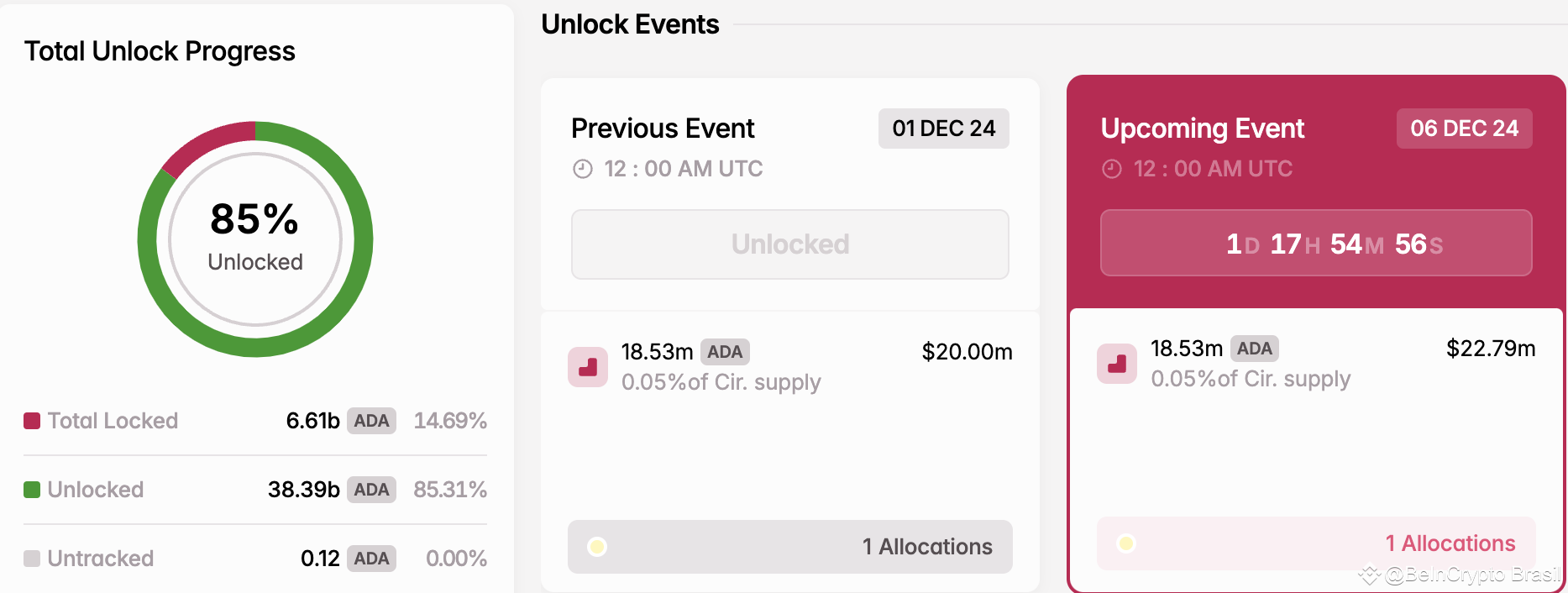

- 鲸鱼在代币解锁前出售卡尔达诺(ADA)——分析

- 2024-12-05 02:30:02

- 卡尔达诺 (ADA) 鲸鱼在过去 30 天内推动加密货币价格上涨 270%,现在在 ADA 解锁之前抛售

-

-

-

- BRP 在魁北克省的三个工厂解雇了 120 名工人和管理人员

- 2024-12-05 02:25:02

- BRP Inc. 表示,其魁北克三处工厂已解雇 120 多名工人和管理人员。

-

- 俄罗斯总统弗拉基米尔·普京表示“没有人可以禁止比特币”

- 2024-12-05 02:25:02

- 在“俄罗斯的召唤!”在莫斯科投资论坛上,弗拉基米尔·普京总统谈到了比特币作为支付手段的作用。

-

-

-

-