|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

以太坊价格连续第二天下跌,空头引发了 9191 万美元的清算。尽管第二季度开局缓慢,但历史数据表明以太坊有潜在收益。 Vitalik Buterin 对“The Purge”(一项旨在增强去中心化和安全性的以太坊改进提案)的见解表明了长期增长前景。

Ethereum Price Faces Downturn, Liquidations Exceed $90 Million

以太坊价格面临低迷,清算额超9000万美元

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has experienced a price decline in the past 24 hours, falling to as low as $3,362 on Tuesday amidst a broader market downturn. This latest price movement follows a trend of bearishness, with ETH also recording losses on Monday.

按市值计算的第二大加密货币以太坊 (ETH) 的价格在过去 24 小时内经历了下跌,在大盘低迷的背景下,周二跌至 3,362 美元。最新的价格走势遵循看跌趋势,ETH 周一也录得下跌。

Bitcoin's Influence and Market Liquidations

比特币的影响和市场清算

The ETH price drop is largely attributed to a decline in Bitcoin (BTC), the leading cryptocurrency whose price movements often have a significant impact on the broader market. Bitcoin's price fell by approximately 6% in the past 24 hours, leading to similar declines in Ethereum.

ETH 价格下跌很大程度上归因于比特币(BTC)的下跌,比特币是领先的加密货币,其价格走势往往对更广泛的市场产生重大影响。比特币价格在过去 24 小时内下跌约 6%,导致以太坊也出现类似下跌。

As a result of the market downturn, liquidations in the crypto market have exceeded $500 million, with over $91.91 million of those liquidations occurring in ETH. The largest single liquidation order for ETH amounted to $7.48 million, and long positions accounted for approximately $75.1 million of the total liquidations.

由于市场低迷,加密货币市场的清算已超过 5 亿美元,其中超过 9191 万美元的清算发生在 ETH。 ETH单笔最大清算订单金额为748万美元,多头头寸约占清算总额的7510万美元。

Historical Trends and ETF Prospects

历史趋势和ETF前景

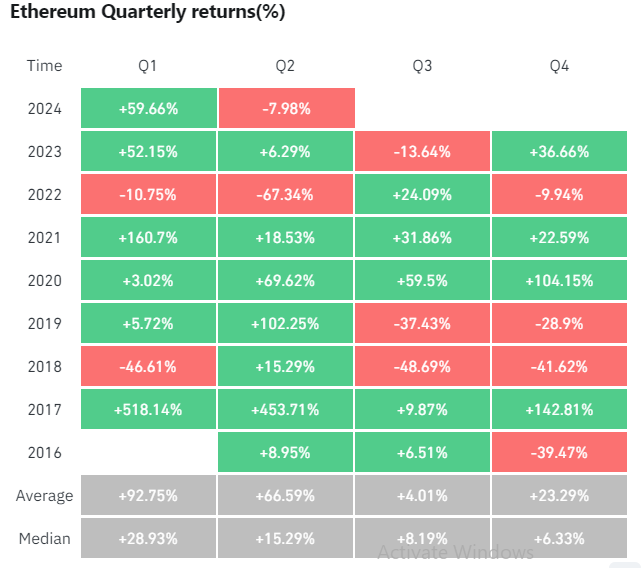

Despite the current downtrend, historical data suggests that the second quarter (Q2) has generally been a positive period for ETH. In all but one year since 2018, ETH has experienced gains in Q2, with an average return of 66.59% and a median gain of 15.29%.

尽管目前呈下降趋势,但历史数据表明,第二季度 (Q2) 总体上对 ETH 来说是一个积极的时期。自 2018 年以来的一年中,ETH 在第二季度都经历了上涨,平均回报率为 66.59%,中位涨幅为 15.29%。

However, the outlook for ETH's price in the near term remains uncertain due to the pending approval of a spot Ethereum ETF by the U.S. Securities and Exchange Commission (SEC). Such an approval could provide institutional backing and exposure to ETH, potentially leading to a price rally. Conversely, a delay or rejection could cause market turbulence.

然而,由于美国证券交易委员会 (SEC) 尚未批准现货以太坊 ETF,因此 ETH 近期价格前景仍不确定。这样的批准可以为 ETH 提供机构支持和敞口,从而有可能导致价格上涨。相反,延迟或拒绝可能会导致市场动荡。

"The Purge" and Ethereum Ecosystem

“清洗”和以太坊生态系统

Beyond the short-term price movements, Ethereum co-founder Vitalik Buterin has highlighted the importance of a recently implemented Ethereum Improvement Proposal (EIP-6780), known as "The Purge." According to Buterin, this EIP is a significant part of a broader effort to "slim down Ethereum and clear technical debt."

除了短期价格变动之外,以太坊联合创始人 Vitalik Buterin 还强调了最近实施的以太坊改进提案 (EIP-6780)(称为“清洗”)的重要性。 Buterin 表示,这个 EIP 是“精简以太坊并清除技术债务”的更广泛努力的重要组成部分。

The Purge aims to shift workload away from Ethereum's main chain, reducing computational and technical resource requirements for running an Ethereum node. By doing so, it is expected to enhance decentralization and security on the Ethereum network.

Purge 旨在将工作负载从以太坊主链转移,减少运行以太坊节点的计算和技术资源需求。通过这样做,预计将增强以太坊网络的去中心化和安全性。

Technical Analysis and Price Predictions

技术分析和价格预测

Technical analysts have suggested that ETH could face further declines if it breaches the support level at $3,400. Some analysts predict a potential fall to $2,800, while others note strong historical bidding in the $3,200-$3,000 range.

技术分析师表示,如果 ETH 突破 3,400 美元的支撑位,它可能会面临进一步下跌。一些分析师预测价格可能会跌至 2,800 美元,而其他分析师则指出历史出价强劲,在 3,200 美元至 3,000 美元之间。

Conclusion

结论

Ethereum's price is currently facing headwinds, with market liquidations and uncertainty surrounding SEC approval of a spot Ethereum ETF contributing to the downturn. However, historical data suggests potential for recovery in Q2, and long-term developments such as "The Purge" indicate ongoing progress for the Ethereum ecosystem. The market's response to potential regulatory decisions and the broader economic climate will be key factors to watch in the coming weeks.

以太坊的价格目前面临阻力,市场清算和 SEC 批准现货以太坊 ETF 的不确定性导致了价格低迷。然而,历史数据表明第二季度有复苏的潜力,而“清洗”等长期发展表明以太坊生态系统正在取得进展。市场对潜在监管决定和更广泛的经济环境的反应将是未来几周值得关注的关键因素。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- XRP 形成看涨旗形,预示潜在的上涨空间

- 2024-12-29 12:45:01

- XRP 正在吸引整个加密货币市场的关注,因为它形成了看涨旗形图案,这是一种经典的技术设置,通常预示着潜在的上涨空间。

-

-

- Qubetics、Solana 和以太坊:现在加入的最佳加密货币

- 2024-12-29 12:45:01

- 当谈到加密货币投资时,您需要的不仅仅是炒作。加密世界充满了提供不同程度机会的项目

-

-

-

-

-

-