|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在周末,加密货币市场在几个月内经历了最大的纠正,据报道,美国对加拿大,墨西哥和中国的新关税所推动。

The crypto market experienced its largest correction in months over the weekend, fueled by the new US tariffs on Canada, Mexico, and China. The market closed the first two days of February in red, with a 21% retrace from Friday’s highs.

加密市场在周末的几个月中经历了最大的纠正,这是由于新的加拿大,墨西哥和中国的新关税所推动的。市场于2月的前两天以红色关闭,从周五的高点回顾了21%。

The news also ignited a massive leverage liquidation worth billions of dollars. Despite the initial estimates suggesting a lower number, Bybit’s CEO revealed that the total market’s crypto liquidation could be significantly higher than the $2 billion reported.

该消息还激发了价值数十亿美元的大量杠杆清算。尽管最初的估计表明数量较低,但Bybit的首席执行官显示,总市场的加密货币清算可能会大大高于报告的20亿美元。

As February began, US President Donald Trump announced new tariffs on his three largest trading partners: Canada, Mexico, and China. According to the report, Trump is implementing an additional 25% tariff on imports from the two neighboring countries, and 10% on China’s imports.

2月开始,美国总统唐纳德·特朗普(Donald Trump)宣布了他的三个最大贸易伙伴的新关税:加拿大,墨西哥和中国。根据该报告,特朗普正在对两个邻国进口的进口额额外征收25%的关税,而中国进口商品则有10%。

After the news, the crypto market started to freefall from its Friday highs, with Bitcoin (BTC) falling 12.5% over the weekend to $91,000. The rest of the market followed BTC’s lead, with the second-largest cryptocurrency by market capitalization, Ethereum (ETH), dropping over 35% to $2,100, its lowest price since September.

新闻后,加密货币市场从周五的高点开始自由,比特币(BTC)在周末下降了12.5%,至91,000美元。其余市场遵循BTC的领先优势,以市值以太坊(ETH)为第二大加密货币,下降了35%以上,至2,100美元,这是自9月以来的最低价格。

As the fear of a global tariff war increased, most altcoins fell to monthly lows, momentarily retracing to their pre-December breakout range. As a result, the total crypto market capitalization plunged 21% over the weekend, its largest correction since August 2024’s “Red Monday.”

随着对全球关税战争的担忧增加,大多数山寨币都落到了每月的低点,暂时回到了他们十年前的突破范围。结果,周末的加密货币市值跌落了21%,这是自2024年8月的“红色星期一”以来的最大纠正。

A recent report from Nansen noted that the crypto market seems to be “satiated with good news for now,” making it more “reactive to negative sentiment than positive news,” as seen with last week’s DeepSeek-triggered correction.

Nansen最近的一份报告指出,加密货币市场似乎“目前是好消息都满足了”,这使其“对负面情绪的反应比积极新闻更具反应性”,这是上周的DeepSeek触发的更正。

The weekend market crash also prompted massive leverage liquidations, with initial reports estimating over $2 billion. The record number represents a larger single-day crash than the COVID-19 and FTX collapse.

周末市场崩溃还引发了大量杠杆清算,初步报告估计超过20亿美元。与Covid-19和FTX崩溃相比,记录数字代表了更大的单日崩溃。

CoinGlass data shows that “In the past 24 hours, 743,002 traders were liquidated, the total liquidations come in at $2.30 billion,” with Ethereum’s $637 million liquidations taking the lead.

Coinglass数据显示:“在过去的24小时中,有743,002家交易员被清算,总清算额为23亿美元”,以太坊的6.37亿美元清算率牵头。

On Monday morning, Bybit’s co-founder and CEO Ben Zhou shared some insight on the total value of the recent crypto liquidations. In an X post, Zhou stated that the “real” total number is “a lot more than $2 billion.”

周一早上,拜比特(Bybit)的联合创始人兼首席执行官本·周(Ben Zhou)分享了对最近加密货币清算的总价值的一些见解。周在X帖子中说,“实际”总数“超过20亿美元”。

According to his estimation, Bybit’s 24-hour liquidation was around $2.1 billion, a 530% increase from the $333 million recorded in CoinGlass. Zhou explained that due to limitations in the application programming interfaces (API), CoinGlass didn’t register all the liquidations.

根据他的估计,Bybit的24小时清算约为21亿美元,比Coinglass的3.33亿美元增长了530%。周解释说,由于应用程序编程界面(API)的限制,Coinglass并未注册所有清算。

“FYI, Bybit 24hr liquidation alone was $2.1B, As you can see in below screenshot, Bybit 24hr liquidations recorded on Coinglass was around $333m, however, this is not all of the liquidations. We have api limitation on how much feeds are pushed out per second.”

“仅供参考,仅24小时清算的BYBIT是$ 2.1B,正如您可以在下面的屏幕截图中看到的,在Coinglass上记录的24小时清算量约为3.33亿美元,但是,这并不是全部清算。我们对每秒推出多少供稿有API限制。”

The crypto exchange’s CEO considers that other exchanges are likely experiencing the same limited liquidation data, which would potentially increase the total value from the $2.3 billion recorded anywhere between $8 billion to $10 billion.

加密交易所的首席执行官认为,其他交易所可能会经历相同的有限清算数据,这可能会将总价值从记录的23亿美元增加到80亿美元到100亿美元之间。

Based on this limit, some users asked about the potential discrepancy between the real liquidation value from the FTX collapse. Zhou detailed that he estimates this figure to be “at least 4-6 times of what was reported basically.”

基于此限制,一些用户询问了FTX崩溃的真实清算值之间的潜在差异。周详细介绍了他估计这一数字“至少是基本报道的4-6次”。

Ultimately, he pledged to be more transparent in the future, promising that “Moving forward, Bybit will start to PUSH all liquidation data.”

最终,他承诺将来将更加透明,并承诺“向前迈进,bybit将开始推动所有清算数据。”

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 2025年持有的最佳加密货币:码头,声音,比特币现金

- 2025-04-11 03:45:12

- 在快节奏的加密货币世界中,跟踪哪些资产在2025年的其余部分至关重要。

-

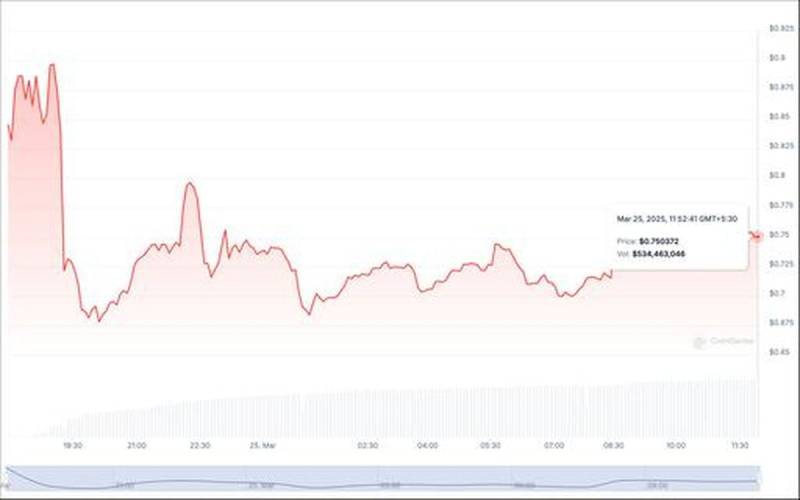

- 自2025年3月25日推出以来,NILLIN的NIL代币的市值经历了巨大的衰退。

- 2025-04-11 03:40:12

- 首次亮相后,代币的价值在最初的24小时内暴跌了12%,这表明投资者对其潜力的早期怀疑。

-

-

-

-

- Shiba Inu(Shib)投资者有一个新的机会来积累令牌

- 2025-04-11 03:30:12

- 希伯的价格变动和当前的机会。尽管从ATH下降了,但有些人认为这是购买蘸酱的机会。

-

- USD1 Stablecoin推出针对机构投资者的目标

- 2025-04-11 03:30:12

- 与特朗普家族有关的加密项目世界自由金融公司(WLFI)宣布推出了一种新的称为USD1的Stablecoin。

-

- REMITTIX(RMX)价格预测今天在十字路口

- 2025-04-11 03:25:13

- 据大多数人称,Remittix是一个新的Defi代币,可能是今年将您的钱投入的最佳加密货币之一。

![super Mario World Koopa Troopa 100%96⭐️ +硬币[AO Vivo] super Mario World Koopa Troopa 100%96⭐️ +硬币[AO Vivo]](/uploads/2025/04/10/cryptocurrencies-news/videos/super-mario-koopa-troopa-coin-ao-vivo/image-1.webp)