|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

贝莱德(BlackRock)的iShares比特币信托(IBIT)继续其强劲的流入率,带领比特币ETF连续六次交易。

A report by Sosovalue has shown that 12 Bitcoin (BTC) exchange-traded funds (ETFs) pulled in more than $785 million in the last six days.

Sosovalue的一份报告表明,过去六天中,12个比特币(BTC)交易所交易基金(ETF)的收入超过7.85亿美元。

Specifically, the 12 Bitcoin ETFs collectively held $94.35 billion worth of BTC by March 22, which is about 5.65% of Bitcoin’s total market capitalization.

具体而言,到3月22日,这12个比特币ETF统称为BTC的价值为943.5亿美元,约占比特币总市值的5.65%。

On March 21 alone, the 12 ETFs tracked—which include BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Bitcoin Trust (BTC)—pulled in more than $83 million. IBIT contributed the most to the rise in trading volume, which reached $1.3 billion by the same date.

仅在3月21日,就进行了12个ETF,其中包括BlackRock的Ishares Bitcoin Trust(IBIT)和Fidelity的比特币信托基金(BTC),收入超过8300万美元。 IBIT贡献了最大的交易量增长,到同一日期到达13亿美元。

The ten other funds—which are Factor’s BTC Factor ETF, Global X Bitcoin ETF, iM Global's Bitcoin ETF, Invesco Bitcoin Trust, and seven other Bitcoin ETFs—showed little or no change over the past six inflow sessions.

其他十项基金(是因子的BTC因子ETF,全球X比特币ETF,IM Global的比特币ETF,Invesco Bitcoin Trust和其他七个比特币ETF)在过去的六个流入式课程中几乎没有变化或没有变化。

Furthermore, cumulative net ETF inflows reached $36.05 billion as of March 21.

此外,截至3月21日,累计净ETF流入量达到360.5亿美元。

The report also noted that IBIT had a rolling total net inflow of almost $40 billion, while Fidelity Capital had total net inflows of $11.48 billion. However, it had no inflows on March 21.

该报告还指出,IBIT的净净流入量近400亿美元,而富达资本的总净流入为114.8亿美元。但是,它在3月21日没有流入。

Also, the other ten funds displayed minor or no variations over the past six inflow sessions.

同样,在过去的六个流入课程中,其他十项资金显示出较小或没有变化。

Meanwhile, the Bitcoin ETFs saw inflows of $785 million in the last week of trading, according to a report by Farside Investors.

同时,根据Farside Investors的一份报告,比特币ETF在交易的最后一周的流入为7.85亿美元。

The report noted that IBIT saw the largest inflows with over $486 million, followed by Fidelity’s FBTC with $70 million and Ark Invest’s ARKB with a little over $100 million in inflows during this period.

该报告指出,伊比特(Ibit)的流入量最大,超过4.86亿美元,其次是富达(Fidelity)的FBTC,在此期间,ARK Invest的ARKB和ARK Invest的ARKB的流入量达到了1亿美元以上。

However, U.S. spot ether ETFs witnessed outflows of about $18.63 million. Analysts pointed out the outflows were caused by Blackrock’s ETHA and Grayscale’s ETH Mini Trust, which recorded losses of $11.94 million and $6.69 million, respectively.

但是,美国现货Ether ETF目睹了约1,863万美元的流出。分析师指出,流出是由贝莱德(Blackrock)的Etha和Grayscale的Eth Mini Trust造成的,该信托基金分别记录了1194万美元和669万美元的损失。

Earlier this month, the U.S. Securities and Exchange Commission (SEC) again postponed its decision on several spot ether ETF applications from hedge fund managers.

本月早些时候,美国证券交易委员会(SEC)再次将其决定推迟了对冲基金经理的几个位置ETHER ETF申请。

The post Bitcoin ETFs pull in over $785 million in six days as IBIT contributes most to inflows appeared first on CryptoSlate.

Bitcoin后的ETF在六天内赚取了超过7.85亿美元,因为IBIT对流入率最高的贡献最高。

The post Bitcoin ETFs pull in over $785 million in six days as IBIT contributes most to inflows appeared first on Chain Link.

Bitcoin后的ETF在六天内赚取了超过7.85亿美元,因为IBIT对流入率首次出现在链条链路上的最大贡献。

.

。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 以太坊(ETH)目前处于主要支持区。它的交易价格约为$ 2K

- 2025-03-25 20:15:12

- 以太坊目前处于主要支持区。它的交易量约为2,000美元,这恰好是一个突出的趋势线的底部。

-

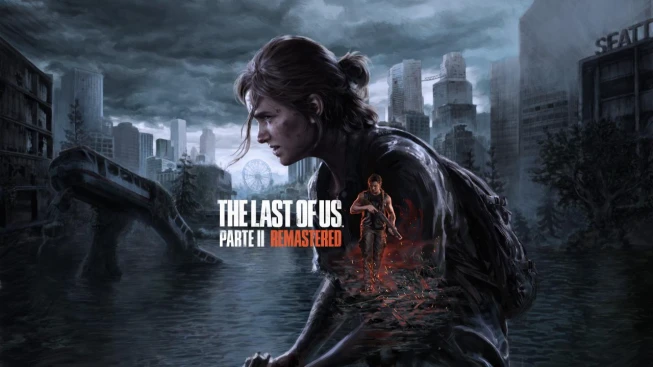

- 本指南涵盖了您在《艾比的西雅图》第二天第2章中可以找到的收藏品。

- 2025-03-25 20:15:12

- 本章总共包含29个收藏品,包括14个文物,9个硬币,2个保险箱,3个工作台和1个武器。

-

-

- 比特币(BTC)中断了$ 88,000:前十名加密货币的反应如何?

- 2025-03-25 20:10:12

- 加密货币市场一直在各种资产中显示出显着的动作,建立的令牌和新兴的人都有价值波动。

-

-

- 富达的大胆步骤:作品中的索拉娜ETF是吗?

- 2025-03-25 20:05:12

- 冷软件(冷):索拉纳(Solana)的Web3竞争对手(SOL)-80%的预售完成,针对物联网

-

-

-

- 上升的三角形崩溃:解开对狗狗的影响

- 2025-03-25 19:55:13

- 这种动荡的景观,可以在眼睛眨眼间就可以赚钱和损失,目前正在为狗狗付出长长的阴影