|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

随着流动性接近 60,000 美元大关,比特币交易者正在为潜在的价格飙升做好准备。出价流动性集中在当前现货价格以下,表明潜在买家涌入,旨在推高价格。此举恰逢市场情绪转变,融资利率自 2023 年 10 月以来首次短暂转为负值,表明近几周市场的繁荣行为有所降温。

Bitcoin Primed for Upswing as Bulls Gear Up for Liquidity Battle

随着多头为流动性之战做好准备,比特币有望上涨

In a dramatic turn of events, Bitcoin (BTC) traders are bracing for a potential price surge as liquidity dynamics shift in favor of the bulls. Data from CoinGlass, a renowned monitoring resource, indicates a significant buildup of bid liquidity approaching the active trading range above $60,000, signaling a potential shift in market momentum.

随着事态的戏剧性转变,随着流动性动态转向有利于多头,比特币(BTC)交易者正准备迎接潜在的价格飙升。著名监测资源 CoinGlass 的数据表明,出价流动性显着增加,接近 60,000 美元以上的活跃交易区间,这表明市场势头可能发生转变。

Bitcoin's recent price retracement has liquidated a substantial number of long positions, triggering a "flush" of hundreds of millions of dollars in positions. However, the bulls are determined to regain control, with BTC/USD hovering around $63,000 and threatening a further breakdown.

比特币近期的价格回调已经平仓了大量多头头寸,引发了数亿美元的头寸“冲空”。然而,多头决心重新获得控制权,比特币/美元徘徊在 63,000 美元附近,并有进一步崩溃的危险。

The latest order book data reveals a strategic move by bulls to place bids just below the current spot price, a common tactic aimed at attracting sellers and driving the market lower. According to Keith Alan, co-founder of trading resource Material Indicators, this strategy is often a precursor to a bullish breakout.

最新的订单簿数据显示,多头采取了一项战略举措,将出价定在略低于当前现货价格的水平,这是一种旨在吸引卖家并压低市场的常见策略。根据交易资源 Material Indicators 的联合创始人基思·艾伦 (Keith Alan) 的说法,这种策略通常是看涨突破的前兆。

"Historically, an increase in bid liquidity has preceded a run into overhead resistance," Alan explained in a video analysis posted on X. "This is what we want to see before a move with a higher probability of breaking through the current resistance level."

艾伦在 X 上发布的视频分析中解释说:“从历史上看,投标流动性的增加会先于遇到上方阻力。”“这就是我们希望在更有可能突破当前阻力位的走势之前看到的情况。” ”

CoinGlass data confirms the presence of large bid concentrations at $61,200, $62,200, and $62,800, indicating a potential price floor.

CoinGlass 数据证实存在大量出价集中在 61,200 美元、62,200 美元和 62,800 美元的情况,表明潜在的价格下限。

Meanwhile, trader sentiment has taken a bearish turn, as funding rates briefly dipped into negative territory for the first time since October 2023. This shift suggests that shorts, or those betting on a price decline, are gaining an advantage over longs, who anticipate a price increase.

与此同时,交易员情绪出现看跌,融资利率自 2023 年 10 月以来首次短暂跌至负值区域。这种转变表明,空头或押注价格下跌的人比多头获得了优势,而多头预计价格下跌。价格上涨。

"Historically, elevated funding rates, as seen in March during the all-time highs, can lead to occasional leverage flushes," noted popular trader Daan Crypto Trades on X. "We have just experienced such a flush."

著名交易员 Daan Crypto Trades 在 X 上指出:“从历史上看,融资利率的升高(如 3 月份历史高点期间所见)可能会导致偶尔的杠杆冲水。”“我们刚刚经历过这样的冲水。”

DecenTrader, a trading suite, observed that the brief period of negative funding rates serves as an indicator of a cooling market environment. "The funding rates are positive again, but the negative period was a sign of easing exuberance in derivatives trading," the platform stated on X.

交易套件 DecenTrader 观察到,短期的负资金利率是市场环境降温的一个指标。该平台在 X 上表示:“融资利率再次为正值,但负值时期是衍生品交易繁荣放缓的迹象。”

It is crucial to emphasize that this article does not provide investment advice or recommendations. All investment and trading decisions involve risk, and individuals should conduct thorough research before making any financial commitments.

需要强调的是,本文不提供投资建议或推荐。所有投资和交易决策都涉及风险,个人在做出任何财务承诺之前应进行彻底的研究。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

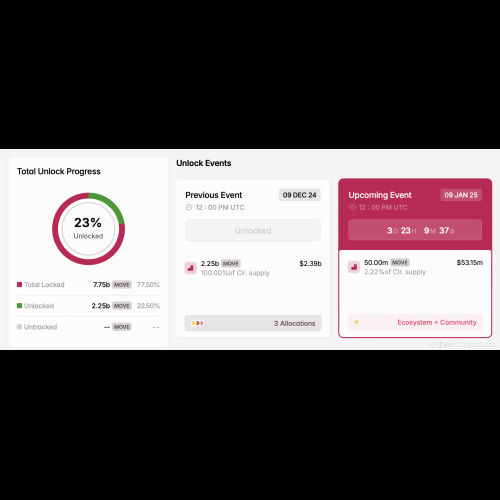

- 这 5 个项目下周将解锁数百万代币

- 2025-01-06 03:15:18

- 项目战略性地安排这些活动,以限制市场压力并稳定价格。

-

-

- PEPE 币:深入探讨 Meme 币市场竞争者

- 2025-01-06 03:10:18

- 佩佩币在市场上已经确立了强有力的竞争者的地位,最近其价格再次飙升引起了人们的关注,激起了投资者的好奇心。

-

-

- 比特币创世区块:区块链技术未来的历史锚点和蓝图

- 2025-01-06 03:10:18

- 在不断发展的加密货币领域,比特币创世块继续吸引着爱好者和开发人员。

-

- 狗狗币(DOGE)鲸鱼积累了 1.08B 代币,表明投资者信心不断增强

- 2025-01-06 03:10:18

- 顶级模因加密货币狗狗币(DOGE)经历了小幅短期波动,链上数据表明投资者对该代币的信心不断增强。

-

- XRP 显示实力,目标上涨 33%

- 2025-01-06 03:10:18

- Ripple 的 XRP 显示出非凡的实力,尽管市场波动,但仍保持其关键支撑位。经过最近的看涨飙升后,该代币触及 2.90 美元的高位

-