|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 月下旬,比特币经历了“减半”,这是一项降低新币产量的技术变革。这一事件引发了对其对加密货币价格影响的猜测。随着新比特币发行放缓,比特币的通货紧缩性质被强调,可能会吸引需求增加和价格上涨。不过,短线交易者应保持谨慎,因为减半的预期可能已经影响了其价格。比特币的价值仅由需求驱动,因为它缺乏基本面的支持。长期投资者应监控资产的流入和流出,同时认识到其所有权所涉及的重大风险。

Bitcoin Halving: A Deep Dive into Its Impact on the Cryptocurrency's Price and Investment Implications

比特币减半:深入探讨其对加密货币价格和投资影响的影响

In the ever-evolving world of cryptocurrencies, Bitcoin stands as a towering figure. Its upcoming technical change, known as the "halving," has ignited a flurry of speculation and anticipation among traders and investors alike. Understanding the halving's potential impact on Bitcoin's price and its implications for investment decisions is crucial for navigating this dynamic market.

在不断发展的加密货币世界中,比特币是一个高耸的人物。即将到来的技术变革,即所谓的“减半”,引发了交易员和投资者的一系列猜测和期待。了解减半对比特币价格的潜在影响及其对投资决策的影响对于驾驭这个充满活力的市场至关重要。

Decoding the Bitcoin Halving

解读比特币减半

Bitcoin, a digital currency devoid of physical form, operates through a decentralized network of computers responsible for managing, tracking, and issuing the cryptocurrency. These computers, known as miners, utilize high-powered computational resources to solve complex mathematical puzzles as a means of verifying transactions and maintaining the integrity of the system. In return for their efforts, miners receive newly minted Bitcoins.

比特币是一种没有物理形式的数字货币,通过负责管理、跟踪和发行加密货币的去中心化计算机网络运行。这些计算机(称为“矿工”)利用高性能计算资源来解决复杂的数学难题,作为验证交易和维护系统完整性的手段。作为他们努力的回报,矿工们会收到新铸造的比特币。

A distinctive feature of Bitcoin's monetary policy is the halving, a predetermined event that occurs every four years. During a halving, the reward for successfully solving the aforementioned mathematical problems is halved, effectively reducing the rate at which new Bitcoins enter circulation. This scarcity-inducing mechanism is designed to maintain Bitcoin's finite issuance, capped at 21 million coins.

比特币货币政策的一个显着特征是减半,这是每四年发生一次的预定事件。在减半期间,成功解决上述数学问题的奖励减半,有效降低了新比特币进入流通的速度。这种稀缺诱导机制旨在维持比特币的有限发行量,上限为 2100 万枚。

Halving's Impact on Bitcoin's Price

减半对比特币价格的影响

The halving's primary effect on Bitcoin's price stems from the principle of supply and demand. By reducing the issuance of new coins, the halving artificially constrains the supply of Bitcoin. In contrast, demand for the cryptocurrency has consistently risen over time, fueled by its increasing adoption and perceived value as a store of value. This imbalance between supply and demand creates upward pressure on Bitcoin's price.

减半对比特币价格的主要影响源于供需原理。通过减少新币的发行,减半人为地限制了比特币的供应。相比之下,随着时间的推移,由于加密货币的采用率不断提高以及人们对加密货币作为价值储存手段的认知价值的推动,对加密货币的需求持续上升。这种供需之间的不平衡给比特币的价格造成了上行压力。

Historically, Bitcoin's halvings have been associated with substantial price rallies. The first halving, which took place in 2012, witnessed a surge in Bitcoin's price from around $12 to over $1,200. Subsequent halvings in 2016 and 2020 were also followed by significant price increases.

从历史上看,比特币减半与价格大幅上涨有关。第一次减半发生在 2012 年,比特币的价格从 12 美元左右飙升至 1,200 美元以上。随后的 2016 年和 2020 年减半之后也出现了价格大幅上涨。

Implications for Traders and Investors

对交易者和投资者的影响

For traders seeking to capitalize on the potential price increase associated with the halving, timing is of the essence. The market often anticipates such events, leading to a pricing in of the expected impact well ahead of time. As a result, traders may face challenges in profiting from short-term price movements.

对于寻求利用与减半相关的潜在价格上涨的交易者来说,时机至关重要。市场通常会预测此类事件,从而提前对预期影响进行定价。因此,交易者可能面临从短期价格波动中获利的挑战。

Investors with a longer-term perspective, however, should pay close attention to factors that may influence money flows into Bitcoin and related assets. An increase in institutional investment, for instance, could provide a significant boost to Bitcoin's price, irrespective of the halving's direct impact.

然而,具有长远眼光的投资者应密切关注可能影响资金流入比特币及相关资产的因素。例如,无论减半的直接影响如何,机构投资的增加都可能显着推高比特币的价格。

Bitcoin's Intrinsic Value: A Question of Perspective

比特币的内在价值:视角问题

Unlike traditional assets like stocks, which represent fractional ownership in businesses, Bitcoin lacks an underlying entity with assets or cash flow. Consequently, it possesses no fundamental value in the traditional sense. Bitcoin's price is solely driven by the collective perception of its worth among traders and investors.

与股票等代表企业部分所有权的传统资产不同,比特币缺乏具有资产或现金流的基础实体。因此,它不具有传统意义上的基本价值。比特币的价格完全取决于交易者和投资者对其价值的集体看法。

The halving, therefore, cannot directly affect Bitcoin's fundamental value. However, it may serve as a catalyst for increased recognition of Bitcoin's scarcity, potentially attracting new investors and boosting its perceived value.

因此,减半不会直接影响比特币的基本价值。然而,它可能会成为提高人们对比特币稀缺性的认识的催化剂,有可能吸引新的投资者并提高其感知价值。

Conclusion

结论

The Bitcoin halving is a significant event that has historically influenced the cryptocurrency's price trajectory. While short-term traders may face difficulties navigating the market's anticipatory nature, long-term investors should focus on monitoring money flows into Bitcoin and related assets. Ultimately, Bitcoin's value remains subject to the fickle whims of sentiment, highlighting the inherent risks associated with investing in this highly volatile asset class.

比特币减半是历史上影响加密货币价格轨迹的重大事件。虽然短期交易者可能在应对市场的预期性质方面面临困难,但长期投资者应重点监控流入比特币和相关资产的资金。最终,比特币的价值仍然受到情绪变化无常的影响,凸显了投资这种高度波动的资产类别所固有的风险。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

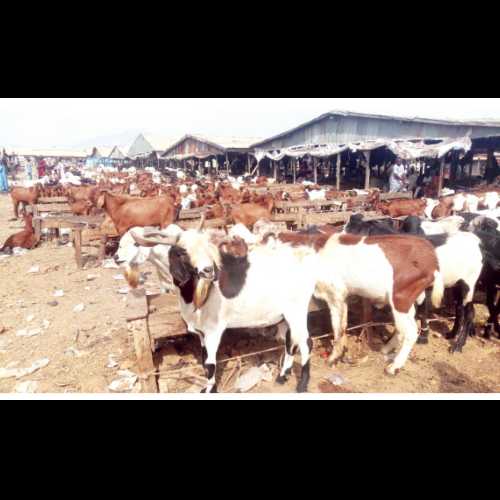

- 阿布贾牲畜市场助理投入额外时间照顾小山羊

- 2024-12-27 16:25:02

- Bashir Rabiu 在阿布贾牲畜市场(位于 FCT 的 Die-Dei 地区)担任动物贸易商及其买家的助理。

-

-

- 2024年币安用户调查:AI代币有望引领市场新趋势

- 2024-12-27 16:25:02

- 许多用户认为,未来一年,加密行业将变得更加成熟,更加贴近现实生活。

-

-

-

- 基于模因的加密货币:一波创新占领市场

- 2024-12-27 16:25:02

- 随着加密货币市场进入 2025 年,一波基于 meme 的代币正在吸引社区和投资者的想象力。

-

-

-