|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在比特币减半后价值飙升的预期中,美国的 ETF 投资于 4 月 19 日转为正值,停止了五天的资金流出,流入资金达 5970 万美元。在 FBTC 收益 5480 万美元的带动下,这一积极趋势与之前的资金流出形成鲜明对比,之前资金流出主要来自灰度比特币信托 ETF (GBTC),原因是 SEC 批准了现货比特币 ETF。

Bitcoin ETF Investments Surge Amidst Halving Speculation

比特币 ETF 投资在减半投机中激增

Washington, DC - Bitcoin exchange-traded fund (ETF) investments in the United States have registered a notable upswing, marking a departure from the recent trend of outflows. This reversal is attributed to the anticipation of a significant value surge following Bitcoin's upcoming halving event, scheduled for April 20.

华盛顿特区 - 美国的比特币交易所交易基金(ETF)投资出现显着上升,标志着与近期资金外流趋势的背离。这一逆转归因于预计 4 月 20 日比特币即将迎来减半事件,价值将大幅飙升。

According to data provided by Farside Investors, Bitcoin ETFs experienced a positive net inflow of $59.7 million on April 19. This influx was primarily driven by FBTC, which accounted for $54.8 million of the total inflows. The positive trend contrasts with the recent pattern of outflows, which were mainly attributed to the Securities and Exchange Commission (SEC) approvals for spot Bitcoin ETFs and the resulting impact on the Grayscale Bitcoin Trust ETF (GBTC).

根据 Farside Investors 提供的数据,4 月 19 日,比特币 ETF 净流入 5970 万美元。这一流入主要由 FBTC 推动,占总流入量的 5480 万美元。这一积极趋势与近期的资金流出模式形成鲜明对比,后者主要归因于美国证券交易委员会 (SEC) 对现货比特币 ETF 的批准以及由此对灰度比特币信托 ETF (GBTC) 的影响。

Other Bitcoin ETFs that contributed to the inflows include Bitwise Bitcoin ETF (BITB), ARK 21Shares Bitcoin ETF (ARKB), Invesco Galaxy Bitcoin ETF (BTCO), and Franklin Bitcoin ETF (EZBC).

其他促成资金流入的比特币 ETF 包括 Bitwise 比特币 ETF (BITB)、ARK 21Shares 比特币 ETF (ARKB)、Invesco Galaxy 比特币 ETF (BTCO) 和 Franklin 比特币 ETF (EZBC)。

The approaching Bitcoin halving, which will mark the fourth such event in the cryptocurrency's history, has spurred increased activity on the Bitcoin network. Block number 840,000, the halving block, has witnessed a sharp rise in network fees, with users spending a total of 37.7 BTC (over $2.4 million) to secure transaction space.

即将到来的比特币减半将标志着加密货币历史上第四次此类事件,刺激了比特币网络上的活动增加。减半区块 840,000 号区块的网络费用大幅上涨,用户总共花费了 37.7 BTC(超过 240 万美元)来确保交易空间。

Following the previous halving in 2020, Bitcoin's value embarked on a remarkable trajectory, rising from $8,500 to approximately $65,000 within a span of four years. The current surge in ETF investments suggests a similar bullish sentiment in the market post-halving, reflecting investor optimism regarding Bitcoin's growth potential.

继 2020 年减半之后,比特币的价值走上了一条非凡的轨迹,在四年内从 8,500 美元上涨至约 65,000 美元。目前 ETF 投资的激增表明市场在减半后也出现了类似的看涨情绪,反映出投资者对比特币增长潜力的乐观态度。

"The increased investment in Bitcoin ETFs is a testament to the growing confidence in the post-halving prospects of Bitcoin," said Max Cressman, CIO of Bitwise Asset Management. "Investors recognize Bitcoin's unique value proposition and are positioning themselves to capitalize on its expected value appreciation."

Bitwise 资产管理公司首席信息官 Max Cressman 表示:“比特币 ETF 投资的增加证明了人们对比特币减半后前景的信心不断增强。” “投资者认识到比特币独特的价值主张,并正在利用其预期的升值机会。”

As the Bitcoin halving approaches, the crypto community anticipates a significant market shift. The event is expected to reduce the supply of new Bitcoins entering the market, which may lead to increased scarcity and potentially higher prices.

随着比特币减半的临近,加密社区预计市场将发生重大转变。预计该事件将减少进入市场的新比特币供应,这可能会导致稀缺性增加并可能导致价格上涨。

The positive trend in Bitcoin ETF investments is a clear indication of the market's bullish outlook and reflects the growing adoption of Bitcoin as a mainstream investment vehicle. Investors are eager to tap into the potential growth of the cryptocurrency, and ETF investments provide a convenient and accessible way for them to do so.

比特币 ETF 投资的积极趋势清楚地表明了市场的看涨前景,并反映出比特币作为主流投资工具的日益普及。投资者渴望利用加密货币的潜在增长,而 ETF 投资为他们提供了一种便捷且可行的方式。

As the halving event draws closer, the crypto community remains enthralled with the potential consequences. Bitcoin's trajectory following the halving will be closely monitored by investors, analysts, and enthusiasts alike, as it may have profound implications for the cryptocurrency's future.

随着减半事件的临近,加密货币社区仍然对其潜在后果着迷。比特币减半后的轨迹将受到投资者、分析师和爱好者的密切关注,因为它可能对加密货币的未来产生深远的影响。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- 以太坊(ETH)在下一次推动之前测试流动性

- 2024-12-28 07:05:01

- 以太坊在 2024 年表现平平,全年表现低于比特币和许多顶级山寨币。

-

-

- BWB-BGB合并宣布后BGT代币价格飙升

- 2024-12-28 06:55:02

- 著名的加密货币交易所 Bitget 最近宣布计划整合 Bitget 钱包代币(BWB)和 Bitget 代币(BGB)

-

-

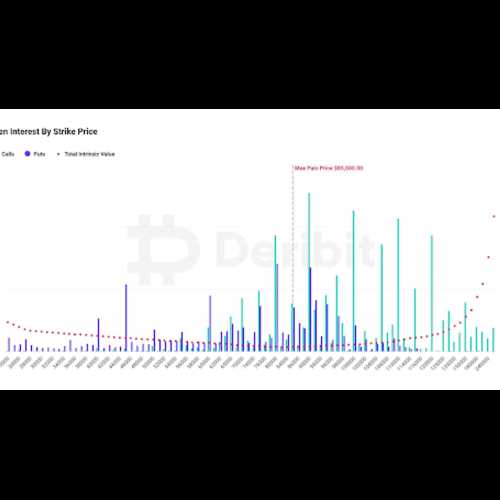

- 比特币面临 2024 年 12 月期权到期

- 2024-12-28 06:55:02

- 尽管 2024 年 12 月期权到期,比特币价格最近表现出显着的弹性,可能会大幅回调至 85,000 美元以下。