|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

自二月份强劲上涨以来,比特币呈现出牛市三角旗形态。横向走势可能会持续两周左右,如果该模式向上突破,则潜在目标为 105,000 美元。下行突破可能导致回撤至 51,000 美元,为那些寻求入场或增仓的人提供买入机会。无论短期市场波动如何,重点应该是持有比特币以实现长期升值。

Bitcoin Bull Pennant Signals Potential Explosive Move

比特币牛市三角旗预示着潜在的爆炸性走势

After a remarkable 76% surge from February to mid-March, Bitcoin has been trading sideways throughout April. This extended period of consolidation has raised anticipation for a substantial market movement once the pattern breaks.

比特币从 2 月到 3 月中旬大幅上涨 76% 后,整个 4 月一直在横盘整理。这种长时间的盘整引发了人们对一旦该模式被打破,市场将出现大幅波动的预期。

Technical analysis suggests that Bitcoin has formed a bull pennant on the daily time frame. This pattern typically indicates an impending upward breakout, bolstering the likelihood of a bullish continuation. Currently, Bitcoin's price has briefly dipped below the pennant's trendline but remains within its confines.

技术分析表明,比特币在每日时间框架内形成了牛市三角旗。这种模式通常表明即将出现向上突破,从而增强了看涨持续的可能性。目前,比特币的价格已短暂跌破三角旗趋势线,但仍处于其范围内。

A closer examination using the 4-hour chart reveals that Bitcoin is oscillating within the pennant's boundaries. Historical behavior suggests that Bitcoin tends to exit these patterns prematurely, indicating that the sideways movement could persist for approximately two weeks before a decisive breakout.

使用 4 小时图表进行仔细检查表明,比特币正在三角旗边界内振荡。历史行为表明,比特币往往会过早退出这些模式,这表明横盘运动可能会持续大约两周,然后才会出现决定性突破。

The target for Bitcoin's potential move is contingent on the starting point of the pennant's measured move. Assuming that the flagpole's base is established at $38,600 on January 23, the measured move culminates in a target of $105,000. This aligns with Fibonacci analysis, which suggests a similar target of $102,000.

比特币潜在走势的目标取决于三角旗测量走势的起点。假设旗杆底价于 1 月 23 日确定为 38,600 美元,则测得的波动最终目标为 105,000 美元。这与斐波那契分析一致,斐波那契分析建议类似的目标为 102,000 美元。

Conversely, a bearish breakout from the pennant would potentially retrace Bitcoin's price to $51,000, a level with strong historical support. While such a move could unsettle investors, it would ultimately serve as a healthy correction, establishing a more stable foundation for future upward momentum. Additionally, it would provide an opportunity for investors to accumulate Bitcoin at a reduced price.

相反,三角旗的看跌突破可能会使比特币的价格回撤至 51,000 美元,这是一个具有强大历史支撑的水平。虽然此举可能会让投资者感到不安,但它最终将成为一次健康的调整,为未来的上涨势头奠定更稳定的基础。此外,这将为投资者提供以低价积累比特币的机会。

While profit-taking is a crucial consideration in any asset class, it is paramount for Bitcoin investors to prioritize holding the cryptocurrency in self-custody. Bitcoin's long-term value proposition and potential for appreciation make it an essential asset for those who believe in its underlying fundamentals.

虽然获利回吐在任何资产类别中都是一个重要的考虑因素,但对于比特币投资者来说,优先持有自我托管的加密货币至关重要。比特币的长期价值主张和升值潜力使其成为那些相信其基本面的人的重要资产。

It is important to note that this analysis is based on technical indicators and historical patterns. Actual market conditions can be unpredictable, and investors should exercise caution and conduct thorough research before making any investment decisions.

值得注意的是,这种分析是基于技术指标和历史模式的。实际市场状况可能难以预测,投资者在做出任何投资决定之前应谨慎行事并进行彻底研究。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

-

-

-

-

-

-

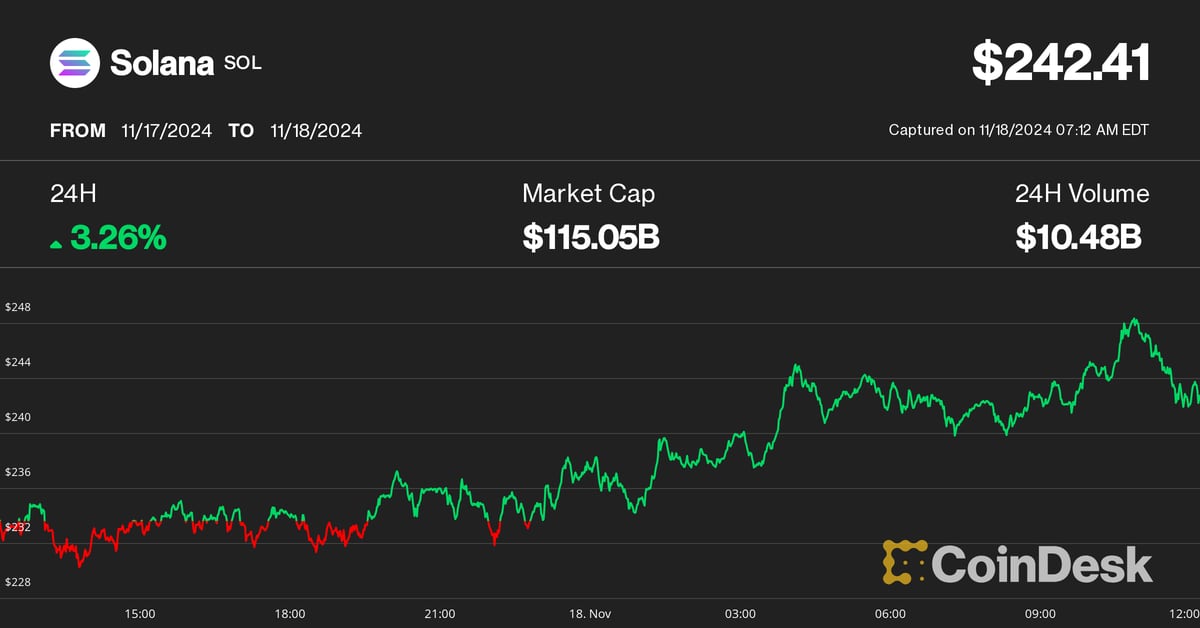

- Solana 突破周期新高

- 2024-11-19 00:25:01

- 2024 年 11 月 18 日加密货币市场的最新价格走势。