|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

本週,看漲的加密貨幣陣容由 TURBO (TURBO) 領銜,位居第一,其次是 NEOPIN (NPT) 和 DEGEN (DEGEN)。

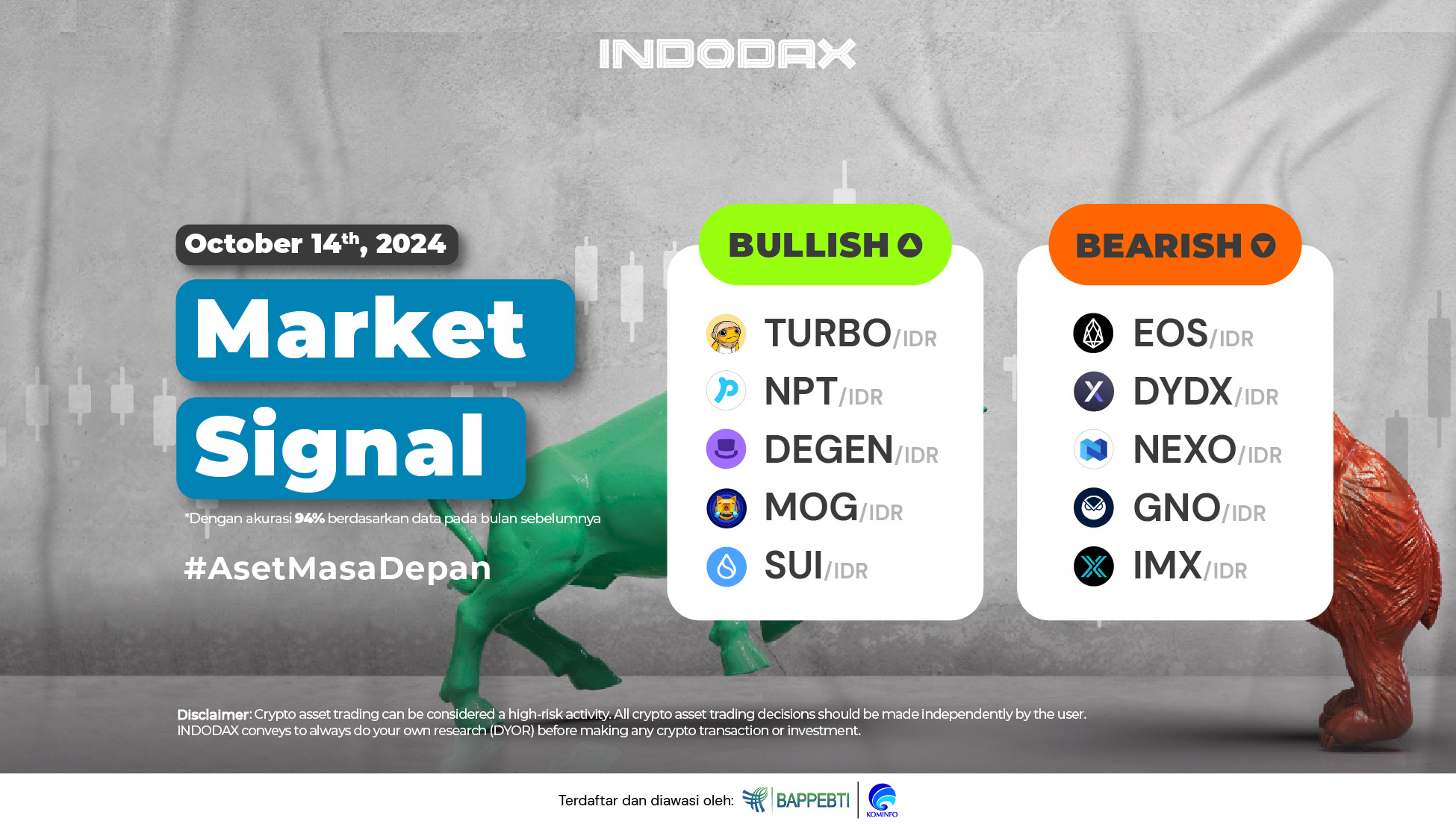

Crypto assets are still experiencing a downturn in the market. However, some crypto assets managed to strengthen and experience a price increase. This time, Indodax will present 5 crypto assets that are experiencing a bullish trend and 5 crypto assets that are experiencing a bearish trend.

加密資產市場仍在低迷。然而,一些加密資產成功走強並經歷了價格上漲。這次,Indodax 將展示 5 種正在經歷看漲趨勢的加密資產和 5 種正在經歷看跌趨勢的加密資產。

Here are 5 crypto assets that are experiencing a bullish trend:

以下是 5 種正在經歷看漲趨勢的加密資產:

1. TURBO (TURBO)

1. 渦輪增壓(渦輪增壓)

Recently, TURBO (TURBO) reached a high of around 148, marking its peak price since being listed on Indodax. This surge is largely attributed to a prevailing bullish trend that has influenced TURBO’s price movement. The strengthening trend briefly led the asset into an oversold area. If the price weakens, it will test the strength of the support levels, which are estimated to be in the range of 100 – 120.

近期,TURBO(TURBO)觸及148左右高位,創下Indodax上市以來的最高價格。這種飆升很大程度上歸因於影響 TURBO 價格走勢的普遍看漲趨勢。走強趨勢短暫導致該資產進入超賣區域。如果價格走弱,將測試支撐位的強度,預計支撐位在 100 – 120 範圍內。

2. NEOPIN (NPT)

2. 尼奧平 (NPT)

The recent strengthening of NEOPIN (NPT) began when the trend managed to break above the 4,000 level, followed by a significant price increase. This movement also triggered a transition in the trend from bearish to bullish. The upward momentum in NEOPIN (NPT) is likely to continue if a full-bodied candle can form above the price range of 28,000 – 30,000.

當趨勢成功突破 4,000 水準時,NEOPIN (NPT) 近期開始走強,隨後價格大幅上漲。這一走勢也引發了趨勢從看跌轉向看漲的轉變。如果 NEOPIN (NPT) 能夠在 28,000 – 30,000 的價格區間上方形成一根完整的蠟燭,那麼其上漲勢頭可能會持續下去。

3. Degen (DEGEN)

3. 麵團(麵團)

Using a 4-hour time frame, Degen (DEGEN) continues to show positive performance, with the trend failing to break below the EMA/200. This has resulted in a strengthening of the price.

使用 4 小時時間框架來看,德勁 (DEGEN) 繼續表現出正面的表現,但趨勢未能跌破 EMA/200。這導致價格走強。

4. Mog Coin (MOG)

4.莫格幣(MOG)

A positive trend movement is still indicated, as shown by the MACD indicator with both lines crossing upwards. The support area for Mog Coin (MOG) is formed around the price range of 0.0205 – 0.024. If this level is breached, the EMA/200 is likely to experience negative pressure.

如 MACD 指標所示,兩條線均向上交叉,仍顯示正向的趨勢運動。 Mog Coin (MOG) 的支撐區域形成於 0.0205 – 0.024 的價格範圍附近。如果突破該水平,EMA/200 可能會承受負壓。

5. Sui (SUI)

5. 隋(SUI)

On the 1-day chart, Sui (SUI) has been experiencing a steady price increase, with resistance levels being consistently broken, indicating that positive momentum is dominating the trend direction of Sui (SUI). This positive trend has allowed Sui (SUI) to reach new highs, while the support area is located around the price range of 27,500 – 31,500.

1日圖上,Sui (SUI)價格一直在穩步上漲,阻力位不斷被突破,顯示積極勢頭主導著Sui (SUI)的趨勢方向。這種正面的趨勢使Sui (SUI)創下新高,而支撐區域位於27,500 – 31,500的價格範圍附近。

Here are 5 crypto assets that are experiencing a bearish trend:

以下是 5 種正在經歷看跌趨勢的加密資產:

1. EOS (EOS)

1. EOS(EOS)

The price strengthening of EOS (EOS) is expected to take shape if a candle can hold above the WMA/85, with significant resistance for further strengthening available in the high range of 10,000 – 14,500. On the other hand, if the price weakens, the trend may attempt to form a candle below the level of 4,500 – 6,000.

如果蠟燭能夠守住 WMA/85 上方,則 EOS (EOS) 的價格預計將走強,進一步走強的重大阻力位於 10,000 – 14,500 的高位。另一方面,如果價格走弱,趨勢可能會嘗試在 4,500 – 6,000 點下方形成蠟燭。

2. dYdX (DYDX)

2. dYdX (DYDX)

dYdX (DYDX) is experiencing negative pressure, as the candle has yet to strengthen beyond the WMA/75. This factor indirectly affects the movement confirmation of the MACD indicator, which remains narrow. If the price moves above the range of 16,500 – 24,000, it would result in a more positive movement for dYdX (DYDX).

dYdX (DYDX) 正承受負壓,因為蠟燭圖尚未走強至 WMA/75 上方。此因素間接影響MACD指標的走勢確認,目前MACD指標仍維持窄幅走勢。如果價格升至 16,500 – 24,000 的範圍之上,將導致 dYdX (DYDX) 出現更積極的趨勢。

3. Nexo (NEXO)

3. Nexus(NEXO)

The rate of change for Nexo (NEXO) is expected to be quite significant, with a price movement range around 14,000 – 19,000. The MACD indicator will confirm the direction of Nexo’s price movement, which will determine whether Nexo (NEXO) can hold above the 13,000 – 14,000 level or if the Bearish trend will increasingly dominate.

Nexo (NEXO) 的變化率預計將相當顯著,價格變動範圍約為 14,000 – 19,000。 MACD 指標將確認 Nexo 價格走勢的方向,這將決定 Nexo (NEXO) 能否守住 13,000 – 14,000 水平上方,或者看跌趨勢是否將日益佔據主導地位。

4. Gnosis (GNO)

4. 靈知(GNO)

On the 1-Day chart, the trend has been in a Bearish zone since August 9, 2024. Currently, the trend is moving positively with a price range around 2,000,000 – 3,500,000. The trend is expected to strengthen if a candle can form above the 4,000,000 level.

在 1 日圖表上,自 2024 年 8 月 9 日以來,趨勢一直處於看跌區域。如果蠟燭能夠在 4,000,000 水平之上形成,則預計趨勢將會加強。

5. Immutable X (IMX)

5. 不可變X(IMX)

The Bearish trend is at risk of failing if Immutable X (IMX) manages to break through a strong Resistance level at 28,000 – 36,000. If this Resistance is successfully breached, the likelihood of Immutable X (IMX) sustaining above the EMA/200 is high. Conversely, if it fails

如果 Immutable X (IMX) 成功突破 28,000 – 36,000 點的強勁阻力位,則看跌趨勢面臨失敗的風險。如果成功突破該阻力位,Immutable X (IMX) 維持在 EMA/200 上方的可能性很高。反之,如果失敗

NOTE: If the 5 EMA crosses the WMA 75, 85 and 200 EMA lines and

注意:如果 5 EMA 穿過 WMA 75、85 和 200 EMA 線並且

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 雪崩警報:Avax ETF嗡嗡聲和看漲圖表 - 月球?

- 2025-09-17 04:00:00

- 雪崩正在加熱!隨著潛在的Avax ETF即將到來,並且出現了看漲圖表模式,Avax會成為下一個爆炸的加密貨幣嗎?

-

- TRX,Pi Coin,BlockDag:導航加密貨幣的潮汐

- 2025-09-17 04:00:00

- 看看Tron的回購,Pi Coin的潛在陷阱和Blockdag有希望的TestNet發布。

-

- 錨協議的Defi Dream:從繁榮到胸圍以及超越

- 2025-09-17 03:54:43

- 看看錨協議在Defi世界中的崛起和下降,探討了ANC的關鍵要點和未來的前景。

-

- Google,Coinbase和Stablecoin AI:自動交易的新時代

- 2025-09-17 03:39:51

- 探索Google和Coinbase如何開創將穩定菌的整合到AI中,從而實現無縫和自主交易。

-

- PI網絡的潛在價格提升:鯨魚活動和協議升級

- 2025-09-17 03:33:17

- 在鯨魚積累和協議23升級的情況下,分析PI網絡的價格動態。地平線上的激增嗎?

-

-

- 導航Nexus:2025年的醫療技術,金融和全球合規性

- 2025-09-17 02:10:50

- 探索醫療技術,金融和全球合規性的融合,重點關注區塊鏈在醫療保健和分散的金融創新中的作用。

-

- 銳化劍和智慧:中世紀武器瑣事夜晚,免費飲料!

- 2025-09-17 02:09:30

- 在鳳凰城的瑣事之夜測試您對中世紀武器和酷刑設備的知識!您的門票可讓您獲得街機的訪問,免費飲料以及贏得獎品的機會。

-