|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maker(MKR)是一種獨特的加密貨幣,可作為Makerdao的治理令牌(領先的分散融資(DEFI)平台Makerdao的治理令牌。

Maker (MKR) is a unique cryptocurrency that serves as the governance token for MakerDAO, a leading decentralized finance (DeFi) platform. Unlike traditional cryptocurrencies like Bitcoin, which primarily function as payment methods, MKR offers users the ability to participate in the governance of the Maker ecosystem.

Maker(MKR)是一種獨特的加密貨幣,是Makerdao的治理令牌,Makerdao是領先的分散融資(DEFI)平台。與主要用作支付方法的傳統加密貨幣(例如比特幣)不同,MKR為用戶提供了參與製造商生態系統治理的能力。

Launched in November 2017, Maker allows users to generate the stablecoin DAI through its platform, Oasis.app. The high demand for DAI and the overall growth of the DeFi space have significantly contributed to MKR’s appeal as an investment, positioning it favorably within the cryptocurrency market.

Maker於2017年11月推出,允許用戶通過其平台Oasis.App生成Stablecoin Dai。對DAI的高需求和Defi領域的總體增長極大地促進了MKR作為一項投資的吸引力,從而在加密貨幣市場中有利地定位了它。

As of January 2025, MKR ranks among the top cryptocurrencies, boasting an impressive total value locked (TVL) in the DeFi ecosystem. While MKR may lack major everyday utility outside governance, its potential in the crypto market keeps it in the spotlight.

截至2025年1月,MKR在最高的加密貨幣中佔有一席之地,在Defi生態系統中擁有令人印象深刻的總價值(TVL)。儘管MKR可能缺乏政府之外的主要日常公用事業,但其在加密貨幣市場中的潛力使其成為人們關注的焦點。

For those looking to trade MKR, Coincheck, a prominent exchange in Japan, is highly recommended due to its user-friendly interface and extensive features, including access via mobile devices.

對於那些希望交易MKR的人,由於其用戶友好的界面和廣泛的功能(包括通過移動設備訪問),因此強烈建議在日本進行著名交流。

With the continuous growth of the DeFi market and the expanding use of DAI, MKR has established itself as an attractive prospect for investors seeking to capitalize on the evolving landscape of decentralized finance. As regulations around stablecoins continue to develop, MKR's future trajectory remains an area of keen interest.

隨著Defi市場的持續增長和DAI的不斷擴大,MKR已確立了自己的誘人前景,對於試圖利用分散財務不斷發展的景觀的投資者。隨著Stablecoins周圍的法規繼續發展,MKR的未來軌跡仍然是濃厚的興趣領域。

The Rise of Maker (MKR) in Decentralized Finance

分散財務中的製造商(MKR)的興起

Understanding Maker (MKR)

了解製造商(MKR)

Maker (MKR) is a unique cryptocurrency that operates as the governance token for MakerDAO, a leading decentralized finance (DeFi) platform. Serving primarily as a governance tool, MKR allows users to participate in decision-making processes that shape the future of the Maker ecosystem.

Maker(MKR)是一種獨特的加密貨幣,可作為Makerdao的治理令牌(領先的分散融資(DEFI)平台Makerdao的治理令牌。 MKR主要用作治理工具,允許用戶參與塑造製造商生態系統未來的決策過程。

Key Features of Maker (MKR)

製造商(MKR)的主要特徵

1. Governance Role: MKR holders have the power to vote on changes to the Maker Protocol, including risk parameters, new collateral types, and improvements to the Dai stablecoin system.

1。治理角色:MKR持有人有權對製造商協議的更改進行投票,包括風險參數,新的附帶類型以及對Dai Stablecoin系統的改進。

2. Stablecoin DAI: Maker enables users to generate DAI, one of the most utilized decentralized stablecoins, which is pegged to the US dollar. DAI is vital for various DeFi applications due to its price stability and liquidity.

2. Stablecoin Dai:製造商使用戶能夠生成Dai,Dai是使用最多的去中心化穩定的穩定劑之一,該固定蛋白與美元掛鉤。由於價格穩定性和流動性,DAI對於各種Defi應用至關重要。

3. Total Value Locked (TVL): As of January 2025, Maker boasts a substantial total value locked (TVL), indicating the amount of cryptocurrency collateralized in the platform, which reflects its reliability and user trust within the DeFi space.

3.總價值鎖定(TVL):截至2025年1月,製造商擁有大量的總價值鎖定(TVL),表明平台中對加密貨幣抵押品的量,這反映了其在Defi空間內的可靠性和用戶信任。

Pros and Cons of Maker (MKR)

製造商的優缺點(MKR)

# Pros:

#優點:

- Strong Governance Model: MKR holders contribute directly to protocol improvements, ensuring a decentralized management approach.

- 強大的治理模型:MKR持有人直接為協議改進做出了貢獻,從而確保了分散的管理方法。

- Growing Adoption: The increasing use of DAI across DeFi applications has sparked investor interest in MKR, further driving its market value.

- 越來越多的採用:在DEFI應用程序中使用DAI的日益增長引起了投資者對MKR的興趣,進一步推動了其市場價值。

- Robust Ecosystem: Maker’s integration with various decentralized applications enhances its utility and attractiveness for traders and investors.

- 強大的生態系統:製造商與各種分散應用程序的集成增強了其對貿易商和投資者的吸引力。

# Cons:

#cons:

- Market Volatility: Like other cryptocurrencies, MKR is subject to significant price fluctuations, which may deter risk-averse investors.

- 市場波動:與其他加密貨幣一樣,MKR也會發生重大價格波動,這可能會阻止規避風險的投資者。

- Limited Utility Outside Governance: MKR’s primary function is governance-related, making it less versatile compared to payment-oriented cryptocurrencies.

- 政府外部有限的公用事業:MKR的主要功能與治理相關,與面向付款的加密貨幣相比,它的用途較低。

- Regulatory Risks: As regulations surrounding stablecoins evolve, MKR could face challenges that affect its market dynamics.

- 法規風險:隨著圍繞穩定幣的法規的發展,MKR可能面臨影響其市場動態的挑戰。

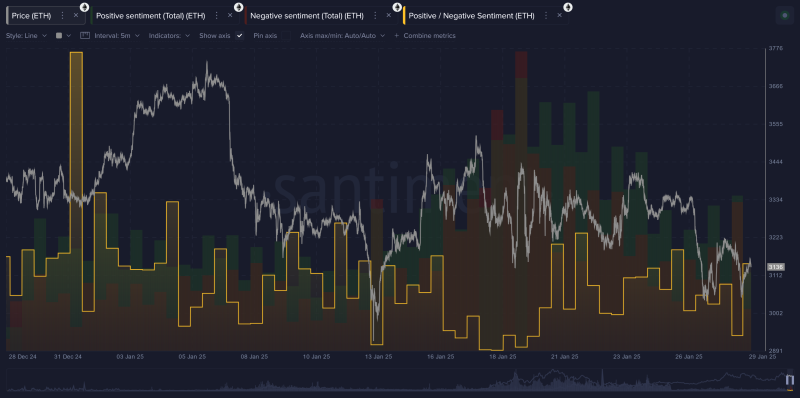

Price Trends and Insights

價格趨勢和見解

Recent trends indicate that the demand for DAI continues to rise, leading to a resurgence in interest for MKR. Market analysts predict that as the DeFi landscape matures, MKR’s role in governance could enhance its value, especially if it can successfully navigate regulatory challenges. The stability offered by DAI is expected to drive more users towards Maker’s ecosystem, further bolstering MKR’s position.

最近的趨勢表明,對DAI的需求繼續增加,導致MKR的興趣復興。市場分析師預測,隨著Defi景觀的成熟,MKR在治理中的作用可能會提高其價值,尤其是如果它可以成功地應對監管挑戰。 DAI提供的穩定性有望推動更多用戶進入Maker的生態系統,從而進一步加強了MKR的位置。

Security Aspects

安全方面

Security remains a top priority for MakerDAO, which undergoes regular audits and employs robust risk management strategies. The decentralized nature of the platform adds an additional layer of security, making it less susceptible to centralized failures.

安全仍然是Makerdao的重中之重,後者經過定期審核並採用強大的風險管理策略。該平台的分散性質增加了一層安全性,使其不太容易受到集中式失敗的影響。

Use Cases and Compatibility

用例和兼容性

MKR serves various use cases, primarily focused on governance. It is compatible with major cryptocurrency wallets and widely accepted on numerous exchanges, including Coincheck in Japan, which is praised for its seamless trading experience.

MKR服務於各種用例,主要側重於治理。它與主要的加密貨幣錢包兼容,並在包括日本的Coincheck在內的眾多交易所被廣泛接受,這是因為其無縫的交易經驗而受到讚揚。

Conclusion

結論

As a pioneer in the DeFi space, Maker (MKR) continues to capture attention due to its unique governance model and the widespread adoption of its stablecoin, DAI. With increasing regulatory clarity and a steadily growing decentralized finance ecosystem, MKR is poised for a promising future.

作為Defi Space的先驅,Maker(MKR)由於其獨特的治理模型以及廣泛採用其Stablecoin Dai而繼續引起關注。隨著法規清晰度的越來越大,並穩定增長的分散金融生態系統,MKR有望實現有希望的未來。

For more information about MKR and its ecosystem, visit MakerDAO.

有關MKR及其生態系統的更多信息,請訪問Makerdao。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- Ripple的未來重新定義:SEC領導力轉移如何影響加密貨幣法律

- 2025-01-30 03:55:51

- Ripple的首席法律官Stuart Alderoty表示希望對加密貨幣法規進行轉變,並預期的變化

-

- Qubetics,Bitcoin和Ethereum:現在投資的最佳加密貨幣

- 2025-01-30 03:55:51

- 加密貨幣景觀正在迅速發展,碼頭,比特幣和以太坊引起了指控。這些項目中的每一個都提供了獨特的優勢

-

-

- Robinhood推出了比特幣和以太坊的期貨交易

- 2025-01-30 03:55:51

- 流行的交易應用程序Robinhood正在擴展到期貨交易。在過去的幾個月中,該公司已大量多樣化其產品。

-

- 霍華德·盧特尼克(Howard Lutnick):繫繩的大支持者

- 2025-01-30 03:55:51

- 霍華德·盧特尼克(Howard Lutnick

-

- 華盛頓的數字資產庫存大戰揭示了加密貨幣過渡到主流金融的根本張力

- 2025-01-30 03:50:51

- 在美國的數字資產儲備上進行的戰鬥揭示了加密貨幣向主流金融的過渡中的根本張力。

-

-