使用斐波那契擴展和艾略特波浪理論等技術指標,加密貨幣分析師確定了出售比特幣的理想“最佳點”

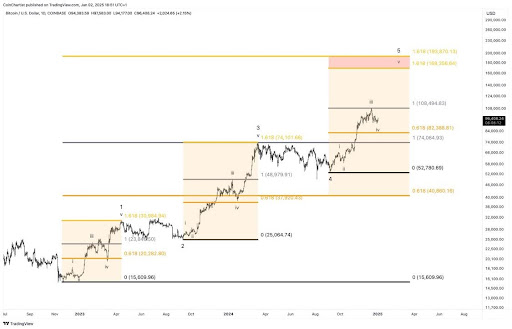

A crypto analyst has pinpointed an ideal “sweet spot” for selling Bitcoin (BTC) using technical indicators like Fibonacci extensions and the Elliott Wave Theory. According to the analysis, specific price zones have been identified as target BTC sell areas that investors and traders could use to exit positions strategically ahead of possible downtrend.

一位加密貨幣分析師使用斐波那契擴展和艾略特波浪理論等技術指標確定了出售比特幣(BTC)的理想「最佳點」。根據分析,特定的價格區域已被確定為比特幣的目標賣出區域,投資者和交易者可以利用這些區域在可能的下跌趨勢之前策略性地退出頭寸。

Analyst Sets $169,000 And $194,000 As BTC Sell ZonesIn an X (formerly Twitter) post, crypto analyst Tony Severino revealed that BTC is currently in Wave 5, experiencing the final push of its bullish Elliott Wave cycle. In previous cycles, the BTC price has consistently terminated near the 1.618 Fibonacci extension of subwaves i through iii. Severino's analysis suggests that BTC could reach new all-time highs (ATH) within a price range.Severino’s Bitcoin chart shows that its price action is segmented into five distinctive waves. Wave 1 represents the initial bullish movement, followed by Wave 2, a corrective pullback. Wave 3 stands out as the most powerful and extended wave, while Wave 4 introduces another corrective phase. Finally, Wave 5, where BTC currently trades within, signals a possible final bullish push upwards.Each wave in the BTC chart has triggered a price increase to different levels, whether to new highs or lows. For Wave 5, however, Severino has proposed an ambitious price target that would act as an important sell zone for investors and traders.The analyst questioned whether BTC could repeat historical trends and terminate again at the 1.618 Fibonacci extension of Waves 1 through 3 combined. This points to a price range between $169,366 and $194,000. According to Severino, these price levels, marked in the red zone on the chart, are called a “sweet spot.” He identified these price areas as a significant sell zone for BTC.Currently, BTC is trading at $96,341, meaning Severino expects the leading cryptocurrency to surge 75.31% and 101.24% to reach the projected target range between $169,000 and $194,000, respectively. The analyst asserts that his bullish projections are reasonable price targets for BTC, underscoring his confidence that the cryptocurrency could hit these new ATHs.

分析師設定BTC 賣出區域為169,000 美元和194,000 美元在X(以前稱為Twitter)帖子中,加密貨幣分析師Tony Severino 透露,BTC 目前處於第5 波,正在經歷看漲的艾略特波浪週期的最後推動力。在先前的週期中,BTC 價格始終終止於子波 i 至 iii 的 1.618 斐波那契延伸線附近。 Severino 的分析表明,BTC 可能在某個價格範圍內達到新的歷史高點 (ATH)。波浪 1 代表最初的看漲走勢,隨後是波浪 2,即修正性回調。第 3 浪是最強勁、最延伸的波浪,而第 4 浪則引入了另一個調整階段。最後,比特幣當前交易的第 5 浪,預示著可能最終看漲向上推動。然而,對於第5 波,Severino 提出了一個雄心勃勃的價格目標,該目標將作為投資者和交易者的重要賣出區域。 3 波組合的1.618 斐波那契擴展位。這意味著價格範圍在 169,366 美元到 194,000 美元之間。根據塞維裡諾的說法,這些價格水平標記在圖表上的紅色區域中,被稱為「最佳點」。他將這些價格區域視為BTC 的重要賣出區域。之間的預計目標範圍。這位分析師聲稱,他的看漲預測是 BTC 的合理價格目標,這突顯了他對加密貨幣可能觸及這些新 ATH 的信心。

For traders and investors, a sell zone is an ideal exit point to potentially lock in profits and prevent financial loss before a trend reversal. Whether or not Severino’s projected “sweet spot” holds, his analysis provides valuable insights into BTC’s potential price movements and potential sell targets for investors.

對於交易者和投資者來說,賣出區域是一個理想的退出點,可以在趨勢逆轉之前鎖定利潤並防止財務損失。無論 Severino 預測的「最佳點」是否成立,他的分析都為投資者提供了有關 BTC 潛在價格走勢和潛在賣出目標的寶貴見解。

Bitcoin Market Top Expected In 2025Prominent crypto analyst Trader Tardigrade took to X to declare that the Bitcoin 4-year cycle is still in play. The analyst's projections suggest that 2025 could still be on the horizon for BTC market peaks, giving traders another chance to capitalize on the cryptocurrency's price surges.Trader Tardigrade predicts that BTC will hit a market peak in 2025, presenting another prime opportunity for investors who may have missed out on its ATH in 2024. However, investors who overlook this window of opportunity in 2025 may have to wait until 2029, after the next halving event, for BTC's next market peak.Sharing a price chart, Trader Tardigrade highlighted BTC's price performance during each four-year cycle. The analyst noted that during each halving cycle from 2011 to 2023, BTC rose to a peak the following year after the halving event. If this historical trend holds, BTC could experience another final surge to new heights in 2025.

比特幣市場預計在 2025 年見頂著名加密貨幣分析師 Trader Tardigrade 在 X 上宣布比特幣 4 年周期仍在發揮作用。分析師的預測表明,2025 年BTC 市場仍可能達到峰值,這為交易者提供了另一個利用加密貨幣價格飆升的機會。另一個絕佳機會。交易員Tardigrade 分享了價格圖表,強調了BTC 的價格表現在每個四年周期內。該分析師指出,在2011年至2023年的每個減半週期中,BTC在減半事件後的次年上漲至高峰。如果這一歷史趨勢持續下去,比特幣可能會在 2025 年再次最終飆升至新的高度。

![super Mario World Koopa Troopa 100%96⭐️ +硬幣[AO Vivo] super Mario World Koopa Troopa 100%96⭐️ +硬幣[AO Vivo]](/uploads/2025/04/10/cryptocurrencies-news/videos/super-mario-koopa-troopa-coin-ao-vivo/image-1.webp)