|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2021 年 2 月,馬斯克 (Elon Musk) 在特斯拉購買了總計 43,200 枚比特幣後,宣布首次進入加密貨幣世界。

The value of Tesla’s crypto holdings has now exceeded 1 billion dollars, following the recent bullish price action recorded by Bitcoin.

在比特幣最近出現看漲價格走勢之後,特斯拉持有的加密貨幣價值現已超過 10 億美元。

In February 2021, Tesla had purchased Bitcoin for 1.5 billion dollars, but later sold a part of it. The company is now in profit by about 495 million dollars.

2021年2月,特斯拉以15億美元購買了比特幣,但後來又出售了一部分。該公司目前獲利約4.95億美元。

Back in February 2021 Elon Musk announces his first entry into the crypto world after purchasing a total of 43,200 Bitcoin with Tesla.

早在 2021 年 2 月,馬斯克 (Elon Musk) 在特斯拉購買了總計 43,200 個比特幣後,宣布首次進入加密貨幣世界。

The investment by the car manufacturer, amounting to 1.5 billion dollars according to the quotations of the time, was intended to maximize the returns of the company’s liquid cash.

根據當時的報價,汽車製造商的投資金額為15億美元,目的是使公司的流動現金回報最大化。

In parallel, Tesla would have started accepting payments in Bitcoin for the purchase of electric vehicles, supporting a phase of public acceptance of the cryptocurrency.

同時,特斯拉將開始接受比特幣支付購買電動車,支持大眾接受加密貨幣的階段。

The news fueled part of the bull run of 2021, bringing Bitcoin above 60,000 dollars in the first quarter.

這一消息推動了 2021 年牛市的部分發展,使比特幣在第一季突破了 60,000 美元。

A few months later, however, Elon Musk decided to backtrack on his previous decision to liberalize bull and bear trading in crypto.

然而幾個月後,馬斯克決定收回先前開放加密貨幣牛熊交易的決定。

With a totally unexpected news, in May Tesla announced the sale of 10% of its holdings in Bitcoin, halting support for the digital asset.

5 月,特斯拉發布了一個完全出乎意料的消息,宣佈出售其持有的 10% 比特幣,停止對這一數位資產的支持。

The reason for this choice reflects the way in which Bitcoin mining was powered at the time, with a large amount of CO2 emissions harmful to the environment.

這項選擇的原因反映了當時比特幣挖礦的供電方式,大量二氧化碳排放對環境有害。

In 2022, Tesla continued to progressively sell its Bitcoin holdings, liquidating approximately 400 million dollars in total.

2022年,特斯拉繼續逐步出售持有的比特幣,總共變現約4億美元。

In the second quarter, it liquidated 75% of the reserves at a loss when the price of the crypto was 24,000 dollars, obtaining 218 million dollars.

第二季度,當加密貨幣價格為 24,000 美元時,它虧損清算了 75% 的儲備,獲得了 2.18 億美元。

In the fourth quarter, it further lightened the load by selling at a price of 21,000 dollars, for a total of 218 million dollars.

第四季進一步減輕負擔,以2.1萬美元的價格出售,總計2.18億美元。

From that moment on, Tesla has not executed any more operations in Bitcoin, leaving its holdings at a total of 11,500 coin.

從那時起,特斯拉就沒有再進行任何比特幣操作,其持有總量為 11,500 個比特幣。

The latest news talks about Tesla’s Bitcoin balance, which after the latest bull rise in cryptocurrency prices has risen to 1 billion dollars.

最新消息談到特斯拉的比特幣餘額,在加密貨幣價格最近一次牛市上漲後,其比特幣餘額已升至 10 億美元。

At the end of 2022, when the value of the currency was just 17,000 dollars, the company’s crypto haul amounted to only 195 million dollars.

2022 年底,當貨幣價值僅 17,000 美元時,該公司的加密貨幣收入僅為 1.95 億美元。

Compared to then, prices have increased by over 400%, bringing the multi-billionaire Elon Musk and his automotive company back into profit.

與當時相比,價格上漲了 400% 以上,使億萬富翁伊隆馬斯克和他的汽車公司重新獲利。

Compared to the original price of 2021 at which these Bitcoin were initially purchased, we count an unrealized profit of 495 million dollars.

與 2021 年最初購買這些比特幣的原價相比,我們算出未實現利潤為 4.95 億美元。

By also considering all the operations closed in losses, we can state that if Tesla were to sell the last 11,500 Bitcoin now, it would close the entire investment with a profit of approximately 200 million dollars.

再考慮到所有以虧損結束的業務,我們可以說,如果特斯拉現在出售最後 11,500 個比特幣,它將結束整個投資,並獲得約 2 億美元的利潤。

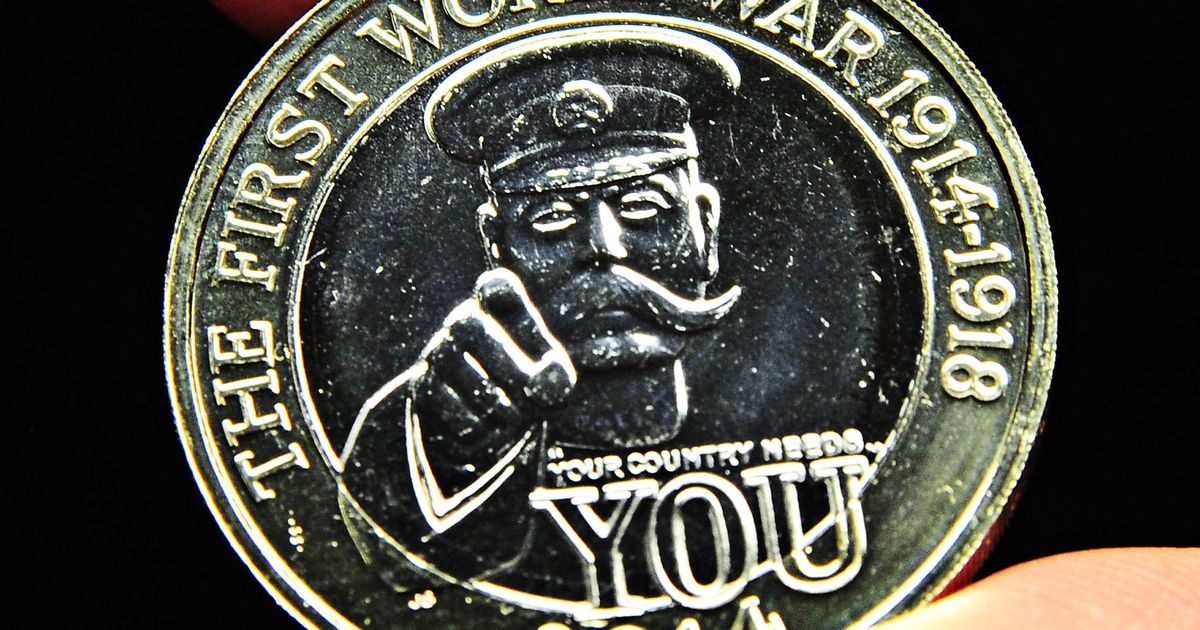

The dashboard of the Arkham Intelligence platform shows the current crypto assets of the company.

Arkham Intelligence 平台的儀表板顯示了該公司目前的加密資產。

In November, the news emerged that Tesla was moving its entire stack of Bitcoin to a new address for cryptocurrencies.

去年 11 月,有消息指出特斯拉正在將其全部比特幣轉移到新的加密貨幣地址。

We do not know the reason for this shift, but we might be close to Elon Musk’s next unexpected move.

我們不知道這種轉變的原因,但我們可能很快就會看到伊隆馬斯克的下一個意想不到的舉動。

It is unlikely that these coins will be sold now, given Musk’s support for Trump’s election campaign, with the new president fully supporting the crypto.

鑑於馬斯克對川普競選活動的支持,以及新總統完全支持加密貨幣,這些代幣現在不太可能被出售。

We might instead expect a new purchase, capable of triggering a new wave of FOMO in 2021 style.

相反,我們可能會期待新的購買,能夠引發 2021 年風格的新一輪 FOMO 浪潮。

Elon Musk had indeed stated that he would resume embracing Bitcoin if mining became sustainable with 50% renewable energy.

伊隆馬斯克確實曾表示,如果礦業能夠利用 50% 的再生能源實現永續發展,他將重新擁抱比特幣。

According to the data from the Bitcoin Mining Council, it has already surpassed that green mining threshold for some time.

根據比特幣礦業委員會的數據,它已經超過綠色礦業門檻一段時間了。

After the latest news on the front of the USA elections, the price of Bitcoin soared, registering several continuous all-time highs in the market.

美國大選最新消息傳出後,比特幣價格飆升,連續創下市場歷史新高。

Tesla or not, in this round of bull market the currency is advancing towards new horizons following the narrative of mainstream adoption.

無論特斯拉如何,在這一輪牛市中,隨著主流採用的敘述,該貨幣正在邁向新的視野。

First with the launch of the ETFs in January, then with the presidential support of Donald Trump in November, Bitcoin goes its way breaking every record.

首先是 1 月份 ETF 的推出,然後是 11 月份唐納德·特朗普總統的支持,比特幣一路打破了所有記錄。

Prices yesterday increased up to briefly reaching the 90,000 dollar mark, only to then make way for a brief retracement by the bear.

昨天價格上漲並短暫觸及 9 萬美元大關,然後為空頭的短暫回調讓路。

Various publicly traded companies are celebrating their entry into the world of crypto, placing BTC as a strategic reserve of their finances

多家上市公司正在慶祝他們進入加密貨幣世界,將比特幣作為其財務的策略儲備

Enthusiasm and FOMO for speculations are returning, accompanied by an increase in searches for the query “Bitcoin” on Google Trends.

隨著谷歌趨勢上「比特幣」搜尋量的增加,投機熱情和 FOMO 正在回歸。

Both institutional with ETFs and retail with exchanges have returned to lead the cyclical four-year phase of the Bitcoin mania.

擁有 ETF 的機構機構和擁有交易所的零售機構都已重新引領比特幣狂熱的四年週期性階段。

This bullish phase on Bitcoin is also pushing up the price of those company stocks that base their business on the cryptographic sector.

比特幣的看漲階段也推高了那些以加密貨幣領域為基礎的公司股票的價格。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

-

-

- 比特幣(BTC)價格預測:漲勢會持續嗎?

- 2024-11-15 00:20:02

- 11 月 14 日星期四,比特幣 (BTC) 交易價格為 91,200 美元,今年迄今漲幅達 115%。

-

-

-

-