|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

星期三,金牌代幣的市值膨脹到不到20億美元,在過去的24小時內增長了5.7%

Amid the broader cryptocurrency market struggles linked to U.S. tariff uncertainties, tokenized gold once again performed well as risk assets come under pressure, according to a report by digital asset platform CEX.IO.

根據數字資產平台Cex.io的報告,在與美國關稅不確定性相關的更廣泛的加密貨幣市場鬥爭中,由於風險資產承受壓力,因此,象徵性的黃金再次表現良好。

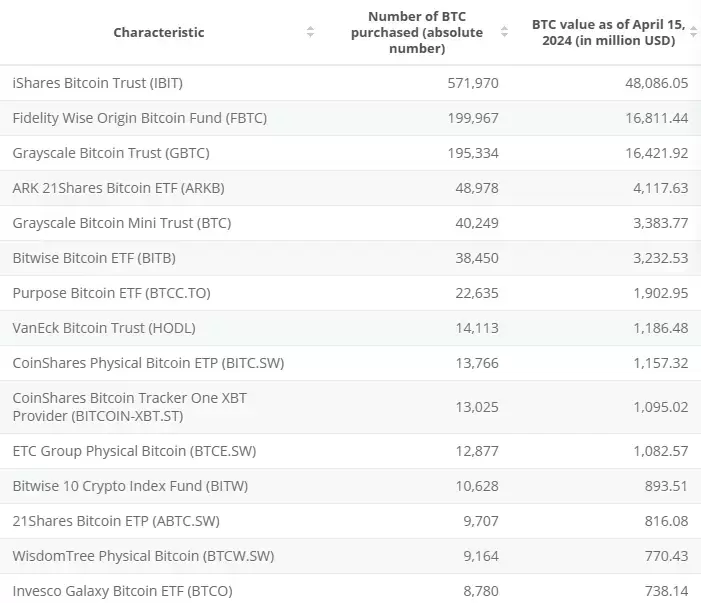

The market capitalization of gold-backed tokens swelled to just under $2 billion on Thursday, up 5.7% over the past 24 hours, according to CoinGecko data. The rise coincided with the yellow metal briefly touching a fresh all-time above $3,170/oz, TradingView shows.

根據Coingecko數據,在過去24小時內,黃金支持的代幣的市值膨脹到不到20億美元,增長了5.7%。 TradingView顯示,崛起與黃色金屬短暫觸及了3,170美元以上的新鮮時期。

Alongside the price rally, gold tokens experienced a frenzy of activity and demand over the past weeks, fueled by the broader market turmoil. Weekly tokenized gold trading volume surpassed $1 billion, the highest since the U.S. banking turmoil of March 2023, according to CEX.IO.

除了價格集會外,在更廣泛的市場動蕩的推動下,黃金代幣在過去幾周中經歷了狂熱的活動和需求。根據Cex.io的數據,每週標記的黃金交易量超過10億美元,這是自2023年3月的美國銀行動盪以來最高的。

The two largest tokens, Paxos Gold (PAXG), Tether Gold (XAUT), making up the bulk of the tokenized gold market, saw their weekly trading volumes surging over 900% and 300%, respectively, since January 20, the report said, citing CoinGecko data. PAXG also experienced continuous inflows totalling $63 million during this period, DefiLlama data shows.

報告說,自1月20日以來,他們的每週交易量分別飆升了900%和300%,這是兩個最大的代幣,Paxos Gold(Paxg),Tether Gold(XAUT),自1月20日以來,他們的每週交易量分別飆升了900%和300%。 DeFillama數據顯示,在此期間,PAXG還經歷了總計6300萬美元的連續流入。

The rally tracks the broader gains in physical gold, which posted double-digit increases in 2025 amid inflation concerns. However, even gold wasn’t spared during the market-wide sell-off triggered by U.S. tariffs, with prices briefly dropping 6% before quickly recovering to record highs.

集會跟踪實物黃金的更廣泛的收益,在通貨膨脹方面,2025年的兩位數增加了兩位數。但是,即使是在美國關稅觸發的整個市場售罄期間,也沒有倖免的黃金,價格短暫下降了6%,然後迅速恢復以創紀錄。

Since Trump’s inauguration, tokenized gold has been one of crypto’s top performing sectors, with its market cap up 21%, the report noted. By contrast, stablecoins gained a more modest 8% in market cap, while bitcoin declined 19% and the total crypto market lost 26%.

報告指出,自特朗普就職以來,令牌化的黃金一直是加密貨幣表現最佳的領域之一,其市值增長了21%。相比之下,Stablecoins的市值增長了8%,而比特幣下降了19%,總加密貨幣市場損失了26%。

“Tokenized gold is emerging as one of the key diversification strategies among crypto-native users, alongside bitcoin," said Alexandr Kerya, VP of product management at CEX.IO. "It provides a safer and more stable approach to portfolio management, enabling users to stay within the crypto ecosystem while benefiting from the value and stability of the underlying physical asset.”

Cex.io產品管理副總裁Alexandr Kerya說:“象徵性黃金正在成為加密本地用戶的主要多元化策略之一。” “它為投資組合管理提供了一種更安全,更穩定的方法,使用戶能夠留在加密生態系統中,同時受益於基礎物理資產的價值和穩定性。”

"At the same time, the broader RWA narrative helps make gold exposure more accessible and intuitive for users who may not have considered it before," Kerya added.

Kerya補充說:“與此同時,更廣泛的RWA敘述有助於使可能以前從未考慮過的用戶更容易獲得黃金曝光。”

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

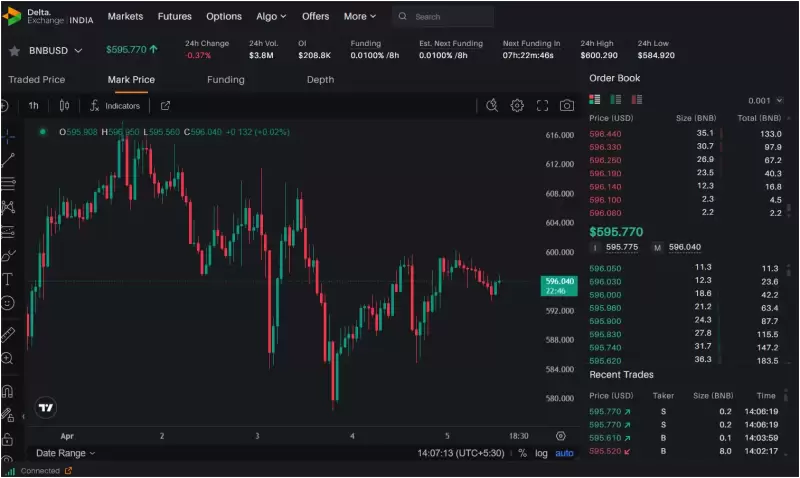

- 比特幣(BTC)的價格會從這個臨時校正階段中斷嗎?

- 2025-04-18 18:35:14

- 比特幣價格(BTC)的最新價格變動已變得很大。現在,投資者推測市場是否會從這個臨時更正階段恢復並進行重大突破。

-

-

- 鎳可以使您富裕500萬美元

- 2025-04-18 18:30:13

- 這種“自由”硬幣可以使您變得高達500萬美元,因此,在您扔掉舊鎳之前,請先驗證您的錢幣學以查看您是否有這種稀有硬幣。

-

-

- Pyth網絡(PYTH)以10.1%的浪潮領先

- 2025-04-18 18:25:14

- 金融市場本周處於壓力下,標準普爾500指數下跌1.5%至5282.70,反映了四月份的低迷5.9%,年至今的下降10%。

-

- XRP價格預測:XRP加密貨幣可以飆升至$ 10或$ 20嗎?

- 2025-04-18 18:25:14

- XRP再次成為頭條新聞,在1.61美元的彈跳後僅一周就經歷了15%的增長。

-

- 比特幣ETF的興起永遠改變了加密貨幣市場

- 2025-04-18 18:20:12

- 比特幣ETF的興起或交易所貿易資金的興起已經改變了加密貨幣市場和整個財務世界。

-

- PI硬幣(PI)價格預測:由於令牌供應的增加,可能會下跌35%至50%

- 2025-04-18 18:20:12

- 僅本月,就會發布超過1億個新的PI代幣,從而導致價格壓力進一步下降。

-

- XRP最近的價格行動引起了市場的關注

- 2025-04-18 18:15:13

- XRP最近的價格行動引發了市場上的關注,分析師表明,可能會重新測試1.6美元左右。