|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

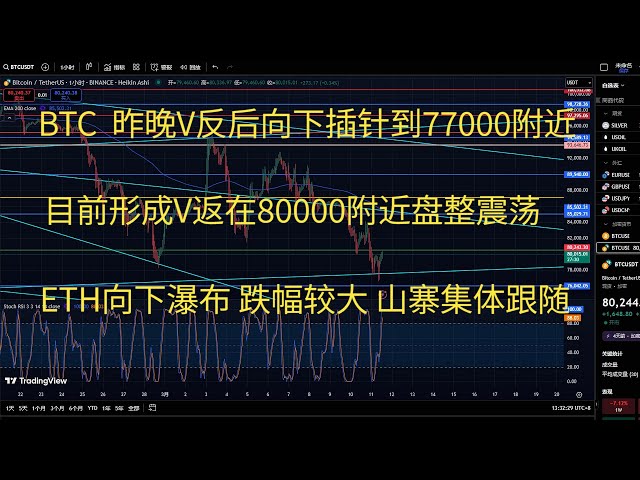

比特幣在3月11日滑行至11月10日以來最低,約為77,000美元。

Risk assets like crypto were hit on March 11 amid anxiety that US President Donald Trump’s tariffs and government firings will torpedo growth in the world’s largest economy.

諸如加密貨幣之類的風險資產於3月11日遭到襲擊,因為焦慮於美國總統唐納德·特朗普的關稅和政府解僱將在世界上最大的經濟體中捕撈。

US equities slid and Treasuries rallied as investors sought a refuge.

隨著投資者尋求避難所,美國股票滑行和國庫會集會。

“While Trump’s strategic crypto reserve announcement initially drove optimism, the rally quickly unraveled amid aggressive selling linked to worsening macro conditions,” said Nikolay Karpenko, director at crypto firm B2C2.

加密公司B2C2公司董事Nikolay Karpenko說:“儘管特朗普的戰略加密儲備公告最初引起了樂觀的興趣,但由於與宏觀條件惡化有關的積極銷售,這次集會很快就揭露了。”

Bitcoin slid to its lowest since November 10, reaching around US$77,000.

比特幣滑至11月10日以來最低,達到77,000美元。

Solana, Cardano and XRP, all tokens that Trump had mentioned as possible candidates for a digital asset stockpile but were not cited in his executive order, each slumped even more.

索拉納(Solana),卡爾達諾(Cardano)和XRP,特朗普(Trump)都提到的所有代幣都作為數字資產庫存的候選人,但並未以其行政命令引用,每個人都跌倒了。

Crypto-linked stocks such as Coinbase Global posted its biggest decline since July 2022, while entrepreneur Michael Saylor’s heavily leveraged Bitcoin proxy Strategy also fell.

Coinbase Global等與加密貨幣相關的股票自2022年7月以來的最大下降,而企業家Michael Saylor的大量利用比特幣代理策略也下降了。

Trump’s crypto-friendly stance, including an order to create a US Bitcoin reserve and a separate stockpile of other tokens, along with a high-profile summit with industry executives in Washington last week, has done little to lift market sentiment.

特朗普對加密貨幣友好的立場,包括建立美國比特幣儲備和其他代幣的單獨庫存的命令,以及上週與華盛頓的行業高管進行的備受矚目的峰會對提升市場情緒的影響很少。

While the administration pledged to capitalise the reserve with crypto seized in legal proceedings, the absence of fresh capital commitments disappointed investors.

儘管政府承諾在法律程序中抓住了加密貨幣,但沒有新的資本承諾使投資者失望。

“The market perceived the summit as underwhelming and top cryptocurrencies dropped after it was revealed that the widely anticipated crypto reserve would hold only existing government holdings,” said Jeff Mei, chief operating officer at crypto exchange BTSE.

Crypto Exchange BTSE首席運營官Jeff Mei表示:“市場認為,眾多加密貨幣的競選活動被揭示出了廣泛的加密貨幣,這一峰會被揭示出了廣泛預期的加密貨幣儲備只能持有現有的政府持股。”

The US currently owns about US$17 billion worth of Bitcoin and about US$400 million worth of several other tokens, largely attributable to asset forfeitures related to civil and criminal cases.

美國目前擁有價值約170億美元的比特幣和約4億美元的其他幾個代幣,這在很大程度上歸因於與民事和刑事案件有關的資產沒收。

Investors are rationally more bullish on crypto given recent developments like the reduced US Securities and Exchange Commission (SEC) enforcement, but other factors are more nuanced or even negative, said Ari Paul, co-founder of BlockTower Capital.

Blocktower Capital的聯合創始人Ari Paul說,鑑於美國證券交易委員會(SEC)的執法減少,但其他因素更加細微甚至是負面,投資者對加密貨幣的看法更為看好。

“The apparent capricious favouritism in the administration’s selection of assets for the strategic reserve – especially after the launching of Trump and Melania coins – is a strong deterrent to investors,” Paul said in a message.

保羅在一份消息中說:“在政府選擇戰略儲備的資產中,尤其是在特朗普和梅拉尼亞硬幣推出後,顯然具有反复無常的偏愛是對投資者的強烈威懾力。”

“It’s created the impression that the Trump administration is engaged in lobbying-based selection and promotion of ‘insider’ assets, and that the cryptocurrency market today is largely a short-term trading casino.”

“這給人留下了這樣的印象,即特朗普政府從事基於遊說的選擇和促進'Insider'資產的選擇,而當今的加密貨幣市場在很大程度上是一個短期的交易賭場。”

Since February, investors have withdrawn a net US$4.4 billion from the group of US Bitcoin ETFs, which played a key role in the token’s record run in 2024.

自2月以來,投資者已從美國比特幣ETF中撤回了44億美元的淨淨資金,該公司在2024年的代幣紀錄中發揮了關鍵作用。

The largest crypto asset is currently down about 28 per cent from its record high of US$109,241 and the broader crypto market has lost over US$1 trillion in market capitalisation from its peak, according to CoinGecko.

根據Coingecko的說法,最大的加密資產目前比其創紀錄的109,241美元的創紀錄高度下降了約28%,而更廣泛的加密貨幣市場從高峰起就損失了超過1萬億美元的市值。

“Bitcoin could very well drop to the US$70,000-$80,000 range in the coming week. Only when this tariff war ends and the Fed resumes cutting rates will top cryptocurrencies resume trending towards previous all-time highs,” added Mei.

“在下週,比特幣很可能會跌至70,000美元至80,000美元。只有當這場關稅戰爭結束並且美聯儲恢復削減速度時,最高加密貨幣才能恢復以前的歷史高潮的趨勢。” MEI補充說。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 病毒視頻顯示了恒河水從河岸消退後如何發掘金,銀和硬幣

- 2025-03-12 03:10:49

- 病毒式視頻顯示了恒河水從河岸消退後如何發掘金,銀和硬幣。

-

-

- LEDGITY收益率和連鎖鏈接實驗室宣布擁有獨家X空間

- 2025-03-12 03:10:49

- RWA代表在區塊鏈上具有標誌性的有形資產(房地產,債券,商品)。它們提高了投資的流動性,可及性和透明度

-

-

-

- 雷的硬幣和郵票 - 硬幣收集的遺產

- 2025-03-12 03:10:49

- 2024年11月22日,我收到了有關硬幣文章的第一封信。發送這封信的善良紳士給了我我收藏中最古老的硬幣。

-

- 加密鯨累積樂觀(OP),運動(移動)和瑪瑙幣(XCN)

- 2025-03-12 03:10:49

- 加密鯨一直在積累樂觀(OP),移動(移動)和Onyxcoin(XCN),儘管最近的市場進行了糾正,但仍有信號。

-

-