|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MakerDAO(MKR)持續飆升,維持上升趨勢,大幅成長 358%。該協議的市值飆升 40.9% 至 30.7 億美元,而 TVL 則成長 10.1% 至 70.5 億美元。即將推出的投票措施旨在提高平台為利害關係人帶來的利益,包括改變費率體係以調整費用和利率。

Blockchain protocol MakerDAO (MKR) continues to see significant gains, maintaining a strong upward trend throughout the year. MKR has seen significant growth of over 358%, accompanied by positive metrics reflecting increased adoption and usage of the protocol.

區塊鏈協議 MakerDAO (MKR) 繼續取得顯著收益,全年保持強勁的上升趨勢。 MKR 的顯著增長超過 358%,同時積極的指標反映協議的採用和使用增加。

In addition, upcoming voting initiatives aim to further increase the platform’s benefits for its stakeholders.

此外,即將推出的投票措施旨在進一步增加平台為其利害關係人帶來的利益。

MakerDAO Announces Plans For Rate System Changes

MakerDAO 宣布費率系統變更計劃

In a recent announcement, MakerDAO stated that it closely monitors developments in the cryptocurrency market and has gained a better understanding of the impact of recent proposals.

MakerDAO 在最近的聲明中表示,它密切關注加密貨幣市場的發展,並對最近提案的影響有了更好的了解。

As a result, the protocol is recommending the next set of changes to its rate system. MakerDAO emphasized that further adjustments will likely be introduced shortly, contingent upon market dynamics, such as prices, leverage demand, and the external rate environment encompassing centralized finance (CeFi) funding rates and decentralized (DeFi) effective borrowing rates.

因此,該協議建議對其費率系統進行下一組變更。 MakerDAO 強調,短期內可能會根據市場動態(例如價格、槓桿需求以及包括中心化金融(CeFi)融資利率和去中心化(DeFi)有效借款利率在內的外部利率環境)進行進一步調整。

The protocol further noted that the Maker rate system will be adjusted accordingly if the external rate environment continues to exhibit signs of decline.

協議進一步指出,如果外部利率環境持續呈現下降跡象,Maker利率體系將進行相應調整。

Efforts are underway to update the rate system language within the Stability Scope, including developing a new iteration of the Exposure model. These updates aim to ensure that the system can adjust rates more gradually and effectively in the future.

目前正在努力更新穩定性範圍內的費率系統語言,包括開發新的風險模型迭代。這些更新旨在確保系統未來能夠更逐步、更有效地調整費率。

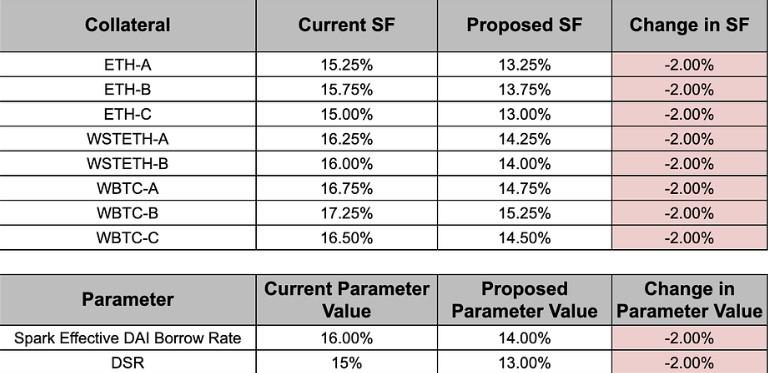

Based on recommendations from BA Labs, a blockchain infrastructure provider, the Stability Facilitator proposes various parameter changes to the Maker Rate system, which will be subject to an upcoming Executive vote.

根據區塊鏈基礎設施提供者 BA Labs 的建議,穩定性促進者提議對 Maker Rate 系統進行各種參數更改,並將接受即將舉行的執行投票。

As shown in the table above, the proposed changes include reducing the Stability Fee by 2 percentage points for various collateral types such as ETH-A, ETH-B, ETH-C, WSTETH-A, WSTETH-B, WBTC-A, WBTC-B, WBTC-C. In addition, the Dai Savings Rate (DSR) and the Effective DAI Borrowing Rate for Spark will also be reduced by 2 percentage points.

NewsBTC如上表所示,建議的變更包括將各種抵押品類型(例如ETH-A、ETH-B、ETH-C、WSTETH-A、WSTETH-B、WBTC-A、WBTC)的穩定費降低2個百分點-B,WBTC-C。此外,Spark 的 Dai 儲蓄率(DSR)和有效 DAI 借款利率也將降低 2 個百分點。

However, one active protocol user offered an alternative viewpoint, suggesting using the demand shock opportunity to expand the net interest margin. While agreeing with the proposed 2% interest rate reduction for borrowers, the user advocates for a larger 4% reduction in the DSR, which he believes will further benefit MakerDAO’s net interest margin.

然而,一位活躍的協議用戶提出了另一種觀點,建議利用需求衝擊機會擴大淨利差。該用戶在同意借款人利率降低 2% 的同時,主張 DSR 進一步降低 4%,他認為這將進一步有利於 MakerDAO 的淨利差。

Ultimately, the outcome of the voting process will determine whether these proposed changes are implemented and benefit the stakeholders of MakerDAO. Further decisions regarding rates and fees will be made based on the results.

最終,投票過程的結果將決定這些建議的變更是否已實施並讓 MakerDAO 的利害關係人受益。有關費率和費用的進一步決定將根據結果做出。

Market Cap Skyrockets

市值飆升

According to data from Token Terminal, MakerDAO has demonstrated significant growth and positive performance across various key metrics over the past 30 days.

根據 Token Terminal 的數據,過去 30 天內,MakerDAO 在各種關鍵指標上都展現了顯著的成長和正面的表現。

In terms of market capitalization, MakerDAO’s fully diluted market cap has reached approximately $3.07 billion, reflecting a notable increase of 40.9% over the past 30 days. The circulating market cap is around $2.82 billion, showing a similar growth rate of 41.1%.

從市值來看,MakerDAO 的完全稀釋後市值已達到約 30.7 億美元,過去 30 天顯著成長 40.9%。流通市值約28.2億美元,成長率類似,為41.1%。

On another note, the total value locked (TVL) in MakerDAO has increased by 10.1% over the past 30 days to approximately $7.05 billion.

另一方面,MakerDAO 的鎖定總價值 (TVL) 在過去 30 天內增加了 10.1%,達到約 70.5 億美元。

The token trading volume for MakerDAO has surged 126.6% over the past month, reaching approximately $4.35 billion. This increase in trading volume suggests heightened market activity and interest in the protocol.

過去一個月,MakerDAO 的代幣交易量激增 126.6%,達到約 43.5 億美元。交易量的增加表明市場活動和對該協議的興趣增強。

In terms of user activity, MakerDAO has seen an increase in daily active users, with an increase of 32.2% to 193 users. On the other hand, weekly active users decreased by 22.6% to 783 users. However, monthly active users have shown a positive growth rate of 10.0%, reaching 2.88k users. Short-Term Outlook For MKR

用戶活躍度方面,MakerDAO 日活躍用戶數增加,成長 32.2% 至 193 名用戶。另一方面,每週活躍用戶減少 22.6% 至 783 名。不過,月活躍用戶卻呈現 10.0% 的正成長,達到 288,000 名用戶。 MKR 的短期前景

Regarding price action, MKR is currently trading at $3,158, reflecting a 4.8% growth in the past 24 hours, 10% in the past seven days, and an impressive 49% increase in the past fourteen and thirty-day time frames.

就價格走勢而言,MKR 目前的交易價格為 3,158 美元,過去 24 小時內增長了 4.8%,過去 7 天增長了 10%,過去 14 和 30 天時間範圍內增長了 49%,令人印象深刻。

The token has encountered a support wall for the short term at $3,048. This support level is significant for the token’s growth prospects. Another key support level is at $2,884, which further contributes to the token’s short-term stability and potential growth.

該代幣在短期內遇到了 3,048 美元的支撐牆。這一支持水準對於代幣的成長前景至關重要。另一個關鍵支撐位是 2,884 美元,這進一步有助於該代幣的短期穩定性和潛在成長。

On the other hand, the nearest resistance level is observed at its 28-month high of $3,321. This level represents the highest point reached by the token since November 2021.

另一方面,最近的阻力位是 28 個月高點 3,321 美元。該水準代表了該代幣自 2021 年 11 月以來達到的最高點。

Featured image from Shutterstock, chart from TradingView.com

精選圖片來自 Shutterstock,圖表來自 TradingView.com

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- 加密貨幣市場今天目睹了穩固的看漲逆轉

- 2025-05-09 17:20:13

- 隨著比特幣的激增,超過100,000美元的潮流使模因硬幣中的瘋狂重點。領導指控,佩佩(Pepe)猛增了28%

-

- PI Network的(PI)令牌在更廣泛的市場實力上飆升10%

- 2025-05-09 17:15:13

- PI Network的Pi令牌經歷了巨大的激增,在過去24小時內攀升10%,以0.6872美元的價格交易

-

-

- Stablecoins正在破壞跨境支付

- 2025-05-09 17:10:13

- 在當今越來越相互聯繫的全球經濟中,企業不斷尋求更快,更具成本效益的方式來進行跨境支付。

-

- 狗狗幣要去月球嗎?當加密貨幣市場看到巨大的收益時,問題再次成為巡迴賽。

- 2025-05-09 17:10:13

- 在(Doge)價格預測中:模因硬幣會達到$ 1嗎?

-

-

-

- SpacePay旨在改善我們的發送和接收方式,針對日常用戶

- 2025-05-09 17:00:12

- 許多加密解決方案都試圖改善我們的寄出和收入方式,但是當涉及現實世界可用性時,大多數解決方案都缺乏。