|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jump Trading 前員工James Hunsaker 在正在進行的Terraform Labs 案件中透露了一些信息,他向SEC 提交了一份投訴,內容涉及Do Kwon 在2022 年崩潰之前支持UST 穩定幣的努力。Hunsaker 聲稱,高頻交易公司Jump Trading與 Terraform Labs 達成了一項“實質協議”,以促進 UST 的採用,Jump Crypto 總裁 Kanav Kariya 促成了這一安排。

Terraform Labs Case: Former Jump Trading Employee Alleges SEC Appeal

Terraform Labs 案例:前 Jump Trading 員工指控 SEC 上訴

In the ongoing Securities and Exchange Commission (SEC) case against Terraform Labs (TFL) and its co-founder Do Kwon, a former employee of Jump Trading has provided significant testimony that sheds light on the company's involvement in the controversial algorithmic stablecoin UST.

在美國證券交易委員會(SEC) 正在審理的針對Terraform Labs (TFL) 及其聯合創始人Do Kwon 的案件中,Jump Trading 的前員工提供了重要證詞,揭示了該公司參與有爭議的演算法穩定幣UST的情況。

James Hunsaker, who previously worked at Jump Crypto, a subsidiary of Jump Trading, has filed an appeal to the SEC regarding Do Kwon's role in propping up UST prior to its catastrophic collapse in 2022. The appeal alleges that Jump Trading entered into a substantial agreement with TFL to drive UST adoption, committing hundreds of millions of dollars to saving the LUNA token a year before the actual collapse.

曾在 Jump Trading 子公司 Jump Crypto 工作的 James Hunsaker 已就 Do Kwon 在 2022 年 UST 災難性崩潰之前支撐 UST 的角色向 SEC 提出上訴。上訴稱,Jump Trading 達成了一項實質性協議與TFL 合作推動UST的採用,在實際崩潰前一年投入數億美元來拯救LUNA 代幣。

According to Hunsaker's statement, Jump Crypto President Kanav Kariya assured him that Kwon would provide tokens that would be unlocked later when UST moved away from its dollar peg in May 2021. Subsequently, Bill DiSoma, co-founder of Jump Trading, instructed investors to execute "aggressive trades" and accumulate USTs.

根據 Hunsaker 的聲明,Jump Crypto 總裁 Kanav Kariya 向他保證,Kwon 將提供代幣,這些代幣將在 2021 年 5 月 UST 取消與美元掛鉤時解鎖。隨後,Jump Trading 聯合創始人 Bill DiSoma 指示投資者執行「激進交易」並累積UST。

Hunsaker described DiSoma as the real authority on Jump Crypto and testified that, due to Terra's importance to Jump, DiSoma was willing to risk several hundred million dollars. Neither Kariya nor DiSoma responded to filings with the SEC regarding the Terraform Labs case.

Hunsaker 將 DiSoma 描述為 Jump Crypto 的真正權威,並作證說,由於 Terra 對 Jump 的重要性,DiSoma 願意冒數億美元的風險。 Kariya 和 DiSoma 都沒有回應向 SEC 提交的有關 Terraform Labs 案件的文件。

The SEC alleges that Jump made approximately $1 billion in profits from its dealings with TFL. A key aspect of the SEC's fraud case against TFL and Kwon is the claim that they concealed Jump's intervention in stabilizing UST during the May 2021 asset crisis, which preceded the actual collapse in 2022. Kwon claimed that UST was "automatically self-healing," a belief held by investors.

SEC 指控 Jump 從與 TFL 的交易中獲取了約 10 億美元的利潤。美國證券交易委員會針對TFL 和Kwon 的詐欺案的一個關鍵方面是,他們聲稱他們隱瞞了Jump 在2021 年5 月資產危機期間穩定UST 的干預行為,這場危機發生在2022 年實際崩潰之前。Kwon 聲稱UST “自動自我修復”,投資者所持有的信念。

Interestingly, Hunsaker himself invested $200,000 in UST to earn a return of approximately 20% from the Anchor protocol. Despite his doubts about UST's stability, he believed he could exit quickly if necessary. He liquidated his UST holdings on May 7 or 8, 2022, when the write-down began.

有趣的是,Hunsaker 本人向 UST 投資了 20 萬美元,從 Anchor 協議中獲得了約 20% 的回報。儘管他對科技大學的穩定性表示懷疑,但他相信如果有必要的話他可以迅速退出。他於 2022 年 5 月 7 日或 8 日開始減記時清算了所持 UST 股份。

The Terraform Labs case is a complex and ongoing investigation involving allegations of fraud and deception. The SEC's investigation into Jump Trading's involvement raises further questions about the stability of algorithmic stablecoins and the role of third-party actors in the cryptocurrency market.

Terraform Labs 案件是一項複雜且持續的調查,涉及欺詐和欺騙指控。美國證券交易委員會對 Jump Trading 的參與調查引發了有關演算法穩定幣的穩定性以及第三方參與者在加密貨幣市場中的作用的進一步問題。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

-

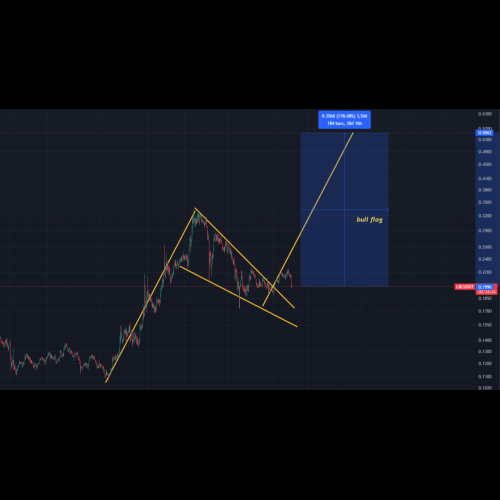

- #LRC/USDT 多頭訊號

- 2025-01-08 07:10:21

- 正如您所看到的,lrc 硬幣創建了一個巨大的看漲模式,稱為上升三角形。現在lrc持有巨大的成交量剖面支撐區和上升三角形支撐線。這是現貨的巨大買入機會。突破這個看漲模式後,技術上它將觸及 0.29,正如您在更長的時間範圍內看到的那樣,lrc 硬幣創建了一個巨大的牛市旗形,現在牛市旗形被打破。這樣我們就可以在現貨錢包中購買一些硬幣。在較長的時間範圍內,比特幣的主導地位是看跌的,因為比特幣的主導地位也打破了其牛旗支撐線。這就是為什麼lrc幣在較長時間範圍看跌中看漲usdt主導地位,因為在usdt.d大幅拋售之後創建了頭肩形態,所以我看跌usdt.d。當 usdt.d 拋售加密貨幣時,市場將產生嚴重的負相關性。

-

-