|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

香港證券及期貨事務監察委員會(證監會)有條件批准比特幣和以太幣現貨交易所交易基金(ETF),使其成為第一個授權此類產品的全球金融中心。這些ETF旨在吸引中國大陸投資者250億美元的資金,並吸引尋求美國帳戶替代品的地區投資者。繼美國證券交易委員會 (SEC) 於 2024 年 1 月批准現貨比特幣 ETF 後,香港證監會批准了比特幣 ETF,該 ETF 交易量龐大,並推高了比特幣價格。

Hong Kong Embraces Crypto Innovation with Bitcoin and Ether Spot ETFs

香港透過比特幣和以太幣現貨 ETF 擁抱加密貨幣創新

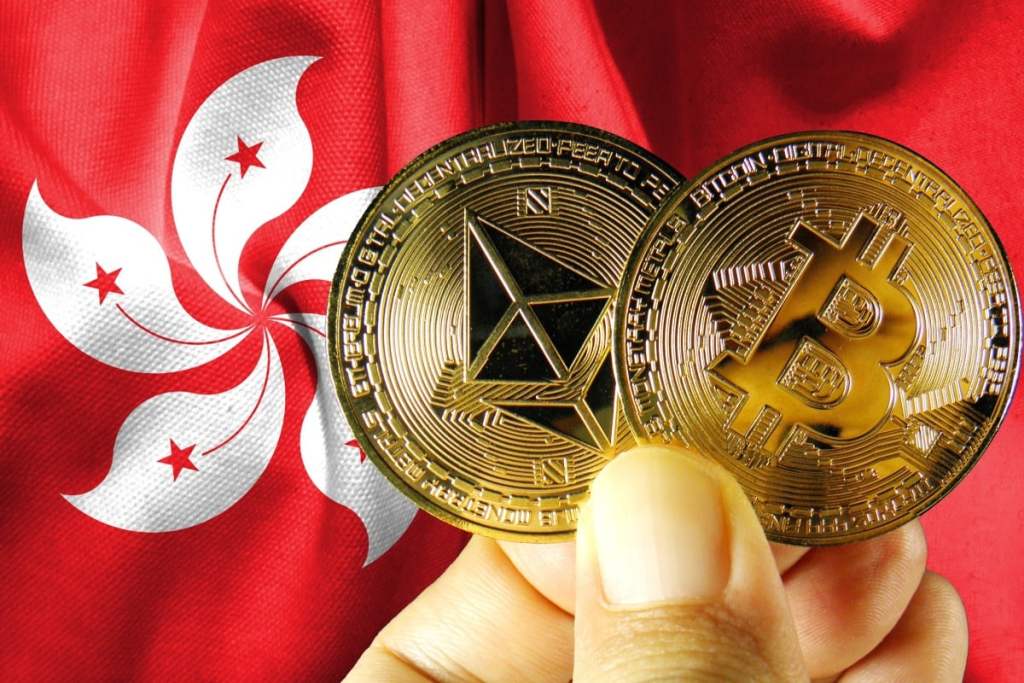

In a groundbreaking move, the Hong Kong Securities and Futures Commission (SFC) has granted conditional approval for Bitcoin and Ether spot exchange-traded funds (ETFs), solidifying the city's ambition to become a regional crypto hub. This momentous decision marks Hong Kong as the first market in Asia and the first global financial hub to authorize such products.

香港證券及期貨事務監察委員會(證監會)有條件批准比特幣和以太幣現貨交易所交易基金(ETF),這是一項突破性舉措,鞏固了香港成為區域加密貨幣中心的雄心。這項重大決定標誌著香港成為亞洲第一個授權此類產品的市場,也是第一個全球金融中心。

Unveiling the Potential of Spot ETFs

發掘現貨 ETF 的潛力

Spot ETFs, which track the live prices of underlying assets, offer investors a straightforward entry point into the cryptocurrency market. Unlike futures-based ETFs, which track the price of a futures contract, spot ETFs provide a more direct exposure to the asset's current value. This accessibility is expected to attract significant interest from both local and international investors.

現貨 ETF 追蹤標的資產的即時價格,為投資者提供了進入加密貨幣市場的直接切入點。與追蹤期貨合約價格的期貨 ETF 不同,現貨 ETF 提供了更直接的資產當前價值風險。這種便利性預計將吸引本地和國際投資者的濃厚興趣。

China's Potential Role

中國的潛在作用

The approval of spot ETFs is particularly significant for mainland Chinese investors, who have been eagerly awaiting access to such products. Through the Southbound Connect program, which facilitates cross-border trading between Hong Kong and China, qualified mainland investors can now participate in the Hong Kong ETF market. Analysts estimate that these investors could contribute up to $25 billion to the new ETF offerings.

現貨ETF的批准對於一直熱切等待此類產品的中國大陸投資者來說尤其重要。透過南向通計劃促進香港和內地之間的跨境交易,合格的內地投資者現在可以參與香港ETF市場。分析師估計,這些投資者可能會為新的 ETF 產品貢獻高達 250 億美元。

US-Hong Kong Comparison

美國與香港比較

While Hong Kong has made significant strides in embracing crypto innovation, it remains behind the United States in terms of the overall market size and regulatory framework. The US Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs in January 2024, resulting in an influx of investor interest and a surge in trading volume. However, the SEC has yet to approve similar products for Ether.

儘管香港在擁抱加密貨幣創新方面取得了重大進展,但在整體市場規模和監管框架方面仍落後於美國。美國證券交易委員會 (SEC) 於 2024 年 1 月批准了現貨比特幣 ETF,導致投資者興趣湧入,交易量激增。然而,美國證券交易委員會尚未批准以太坊的類似產品。

A Positive Outlook for Bitcoin

比特幣前景樂觀

The approval of spot ETFs in Hong Kong is undoubtedly positive news for Bitcoin, opening up new avenues for investment and potentially driving up its price. While the long-term impact of these ETFs on the crypto market remains to be seen, they represent a significant step towards mainstream adoption and legitimization of digital assets.

香港現貨ETF的批准對於比特幣來說無疑是一個利好消息,為比特幣的投資開闢了新的途徑,並有可能推高比特幣的價格。雖然這些 ETF 對加密貨幣市場的長期影響仍有待觀察,但它們代表了數位資產主流採用和合法化的重要一步。

Conditional Approval and Next Steps

有條件批准和後續步驟

It's important to note that the SFC's approval is conditional, granting applicants permission to prepare for offering the ETFs. The funds must still apply to the Hong Kong Exchanges and Clearing (HKEX) for listing on the local stock exchange. Once all necessary approvals are obtained, the ETFs will be available to investors.

值得注意的是,證監會的批准是有條件的,即授予申請人準備發行 ETF 的許可。該資金仍須向香港交易及結算所(HKEX)申請在當地證券交易所上市。一旦獲得所有必要的批准,ETF 將可供投資者使用。

Hong Kong's Global Ambitions

香港的全球抱負

With this latest development, Hong Kong has taken a bold step towards establishing itself as a leading center for crypto innovation. The city's robust financial infrastructure, coupled with its proximity to mainland China, positions it as an ideal gateway for crypto adoption in Asia.

憑藉這一最新發展,香港朝著成為領先的加密貨幣創新中心邁出了大膽的一步。該市強大的金融基礎設施,加上毗鄰中國大陸,使其成為亞洲採用加密貨幣的理想門戶。

Disclaimer

免責聲明

The information provided in this article is for informational purposes only and should not be considered financial advice. Individuals should consult with qualified professionals before making any investment decisions.

本文提供的資訊僅供參考,不應被視為財務建議。個人在做出任何投資決定之前應諮詢合格的專業人士。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

- 羅伯特清崎表示是時候購買更多比特幣了,而不是為價格下跌而哭泣

- 2024-12-25 01:25:56

- 暢銷書《富爸爸窮爸爸》的著名作者並不擔心最近比特幣價格的下跌。

-

-

-

- 狗狗幣(DOGE)價格分析與預測:陷入盤整,接近關鍵斐波那契水平

- 2024-12-25 01:25:01

- 狗狗幣(DOGE)似乎一直停留在當前水平,並處於長期盤整階段。更廣泛的加密市場情緒也隨之而來