|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

美國現貨比特幣ETF(交易所交易基金)昨天錄得8,136萬美元淨流出,結束連續兩天的正流量

US spot Bitcoin ETFs (exchange-traded funds) recorded $81.36 million net outflows yesterday, putting an end to a two-day positive flow streak as Bitwise says around 66% of institutional investors either increased or maintained their BTC ETF positions in Q2.

美國現貨比特幣ETF(交易所交易基金)昨天錄得8,136 萬美元淨流出,結束了連續兩天的正資金流,Bitwise 表示,約66% 的機構投資者在第二季度增加或維持了BTC ETF頭寸。

Only two funds, BlackRock’s IBIT and Franklin’s EZBC, recorded net inflows on Aug. 14. IBIT saw its reserves grow by $2.68 million, while EZBC saw net inflows of $3.42 million, according to data from SosoValue.

只有貝萊德的 IBIT 和富蘭克林的 EZBC 這兩隻基金在 8 月 14 日錄得淨流入。

Grayscale’s Bitcoin ETF suffers another blow, records largest outflows

灰階比特幣ETF再遭打擊,創最大資金流出紀錄

Grayscale’s GBTC took another hit and suffered $56.87 million outflows yesterday. Fidelity’s FBTC registered the second largest outflows for the day after $18.05 million left the fund. During the same trading session, Ark and 21Shares’ ARKB and Bitwise’s BITB also saw outflows of $6.77 million and $5.78 million, respectively. The remaining 6 funds recorded no flows.

灰階旗下的GBTC再次遭受打擊,昨天遭受了5,687萬美元的資金流出。富達 (Fidelity) 旗下的 FBTC 資金流出量位居當日第二位,該基金流出 1,805 萬美元。在同一交易日,Ark 和 21Shares 的 ARKB 以及 Bitwise 的 BITB 也分別出現 677 萬美元和 578 萬美元的資金流出。其餘6檔基金無資金流入。

Trading volume for spot Bitcoin ETFs reached $1.3 billion yesterday. This was a slight uptick compared to the $1.18 billion trading activity recorded the day before.

昨天,比特幣 ETF 現貨交易達到 13 億美元。與前一天記錄的 11.8 億美元交易活動相比,略有上升。

Bitcoin had a volatile trading session with regards to price. After managing to break above $61K and reach an intraday high of $61,687.76 yesterday, BTC saw its price plunge 3% in an hour to below $57K. It has since recovered slightly to trade at $58,144.79 as of 2:45 a.m. EST.

比特幣的價格波動較大。昨天,BTC 成功突破 61,000 美元並觸及盤中高點 61,687.76 美元後,一小時內暴跌 3%,跌破 57,000 美元。此後,截至美國東部時間凌晨 2:45,該價格略有回升,交易價格為 58,144.79 美元。

Institutional investors increase BTC ETF holdings

機構投資人增持BTC ETF

Around 66% of institutional investors either held or increased their exposure to spot Bitcoin ETFs, Bitwise found. “Institutional investors continued to adopt bitcoin ETFs in Q2. The trend is intact,” Bitwise Chief Investment Officer Matt Hougan said in an Aug. 15 X post.

Bitwise 發現,約 66% 的機構投資者持有或增加了對現貨比特幣 ETF 的投資。 「機構投資者在第二季繼續採用比特幣 ETF。這一趨勢完好無損。

A few initial thoughts after reviewing the Q2 Bitcoin 13-F filings:

查看第二季度比特幣 13-F 檔案後的一些初步想法:

1) The Institutions Are Still Coming; Total Filings Are Up: I count 1,924 holder<>ETF pairs across all 10 ETFs, up from 1,479 in Q1. That's a 30% increase; not bad considering prices fell in Q2.

1)機構仍在到來;申請總數增加:我計算出所有 10 隻 ETF 中共有 1,924 個持有人 <>ETF 對,高於第一季的 1,479 個。增加了 30%;考慮到第二季價格下跌,這還不錯。

Of course, this…

當然,這…

— Matt Hougan (@Matt_Hougan) August 14, 2024

— 馬特·豪根 (@Matt_Hougan) 2024 年 8 月 14 日

He added that large corporations have mostly “diamond hands.”

他補充說,大公司大多擁有「鑽石手」。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 比特幣再次超過90,000美元的交易

- 2025-04-24 05:30:12

- 比特幣再次超過90000美元的交易,儘管持續的全球不確定性,但公牛隊增長了動力,這表明了增強實力。

-

- 小額$ 173的投資將巨額$ 224,390的利潤變成了巨魔模因硬幣

- 2025-04-24 05:30:12

- 交易者在2024年12月中旬進行了購買,當時硬幣的總市場價值僅為6,510美元。

-

-

- Coinbase高管說,錯過了黃金集會的投資者可能會湧入比特幣(BTC)

- 2025-04-24 05:25:13

- 一位頂級共同行政主管說,錯過了黃金大規模集會的投資者可能會開始湧入比特幣(BTC)。

-

-

![AI代理AI16Z [AI16Z]令牌創建了其對稱的三角突破 AI代理AI16Z [AI16Z]令牌創建了其對稱的三角突破](/assets/pc/images/moren/280_160.png)

- AI代理AI16Z [AI16Z]令牌創建了其對稱的三角突破

- 2025-04-24 05:20:13

- AI代理AI16Z [AI16Z]令牌在較低的時間範圍內創建了其對稱的三角形突破

-

- SEC指控的PGI Global創始人欺騙了近2億美元的投資者

- 2025-04-24 05:15:12

- 美國證券交易委員會(SEC)負責現已停產的加密貨幣和外匯投資公司PGI Global的創始人,違反了聯邦

-

-

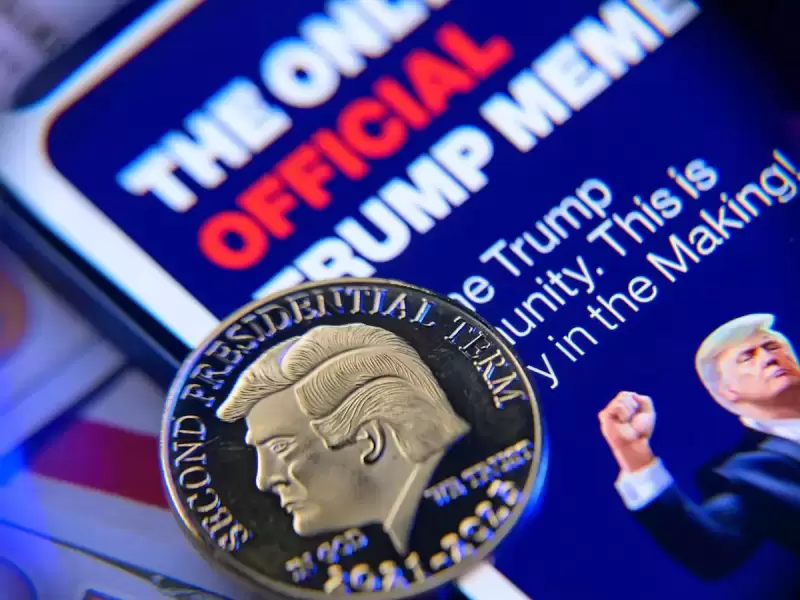

- 在宣布與總統進行投資者晚宴的計劃後,特朗普硬幣飆升了多達71%。

- 2025-04-24 05:10:13

- 計劃於5月22日在華盛頓特區舉行的前220個代幣持有人的晚餐

![AI代理AI16Z [AI16Z]令牌創建了其對稱的三角突破 AI代理AI16Z [AI16Z]令牌創建了其對稱的三角突破](/uploads/2025/04/24/cryptocurrencies-news/articles/ai-agent-aiz-aiz-token-created-symmetrical-triangle-breakout/middle_800_480.webp)