|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密貨幣格局正在迅速發展,而以太坊作為這個宇宙的支柱,也不能倖免於劇變。第 2 層 (L2) 解決方案正在經歷爆炸性增長,總鎖定價值 (TVL) 達到 515 億美元。

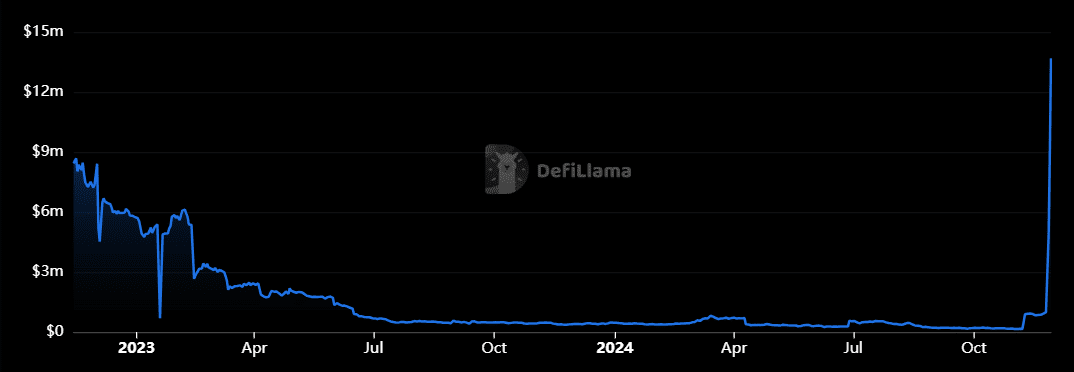

As the crypto landscape undergoes rapid transformations, Layer 2 (L2) solutions are experiencing explosive growth, reaching a total value locked (TVL) of $51.5 billion. These innovations are fundamentally altering the Ethereum ecosystem, posing both opportunities and challenges for Ether (ETH).

隨著加密貨幣格局經歷快速變革,第 2 層 (L2) 解決方案正在經歷爆炸性增長,鎖定總價值 (TVL) 達到 515 億美元。這些創新從根本上改變了以太坊生態系統,為以太坊(ETH)帶來了機會和挑戰。

L2 solutions, such as Arbitrum and Base, are designed to enhance Ethereum's scalability by enabling transactions to be processed on secondary chains, reducing fees and wait times on the main crypto network. This has led to a 205% increase in TVL within a year, rising from $16.6 billion in November 2023 to over $51 billion today.

L2 解決方案(例如 Arbitrum 和 Base)旨在透過使交易能夠在二級鏈上處理、減少主加密網路上的費用和等待時間來增強以太坊的可擴展性。這導致 TVL 在一年內成長了 205%,從 2023 年 11 月的 166 億美元增加到如今的超過 510 億美元。

Arbitrum holds a dominant 35% share of the total L2 TVL, amounting to $18.3 billion. Base follows with an impressive 22% share, largely attributed to record-breaking transactions per second (TPS) and a surge in interest around memecoins. These figures highlight the enthusiasm among investors for L2 solutions, which are widely regarded as essential for the future of Ethereum.

Arbitrum 佔 L2 TVL 總額 35% 的主導份額,達 183 億美元。 Base 緊隨其後,佔據了令人印象深刻的 22% 份額,這主要歸功於破紀錄的每秒交易量 (TPS) 以及人們對 memecoin 的興趣激增。這些數字突顯了投資者對 L2 解決方案的熱情,人們普遍認為 L2 解決方案對以太坊的未來至關重要。

However, this rise is not without its consequences. Recent upgrades, such as Dencun, have stabilized transaction fees on L2, making these solutions even more attractive. But this optimization could potentially divert a portion of the revenues from the main network, posing a strategic question: to what extent can L2 solutions coexist with Ether crypto without impacting its value?

然而,這種崛起並非沒有後果。最近的升級(例如 Dencun)穩定了 L2 上的交易費用,使這些解決方案更具吸引力。但這種優化可能會從主網路轉移部分收入,從而提出一個策略問題:L2 解決方案可以在多大程度上與以太加密共存而不影響其價值?

Some experts view L2 solutions as potential "cannibals" within the Ethereum ecosystem. By concentrating activities on secondary chains, these solutions could potentially weaken the main network and, by extension, compromise the valuation of ETH crypto.

一些專家將 L2 解決方案視為以太坊生態系統中潛在的「食人者」。透過將活動集中在二級鏈上,這些解決方案可能會削弱主網絡,進而損害 ETH 加密貨幣的估值。

Currently, Ether remains the central engine of Ethereum, being used for transactions and fees on the main network. However, as L2 solutions continue to gain traction, ETH crypto could lose some of its appeal, especially in terms of demand. This scenario presents a strategic dilemma for developers, who must decide whether to prioritize large-scale adoption of L2 solutions at the expense of Ether's price.

目前,以太幣仍然是以太坊的核心引擎,用於主網路上的交易和費用。然而,隨著 L2 解決方案繼續受到關注,ETH 加密貨幣可能會失去一些吸引力,特別是在需求方面。這種情況為開發人員帶來了戰略困境,他們必須決定是否以犧牲以太幣價格為代價來優先大規模採用 L2 解決方案。

Recent data reveals a fragile balance, as the TVL of L2 skyrockets while the price of Ether remains stagnant, failing to keep up with this dynamic. This divergence raises a crucial question: could the popularity of L2 solutions lead to a sustainable decoupling between Ethereum and its native token?

最近的數據顯示出一種脆弱的平衡,L2 的 TVL 飆升,而 ETH 的價格停滯不前,未能跟上這種動態。這種分歧提出了一個關鍵問題:L2 解決方案的流行能否導致以太坊與其原生代幣之間可持續的脫鉤?

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。