|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

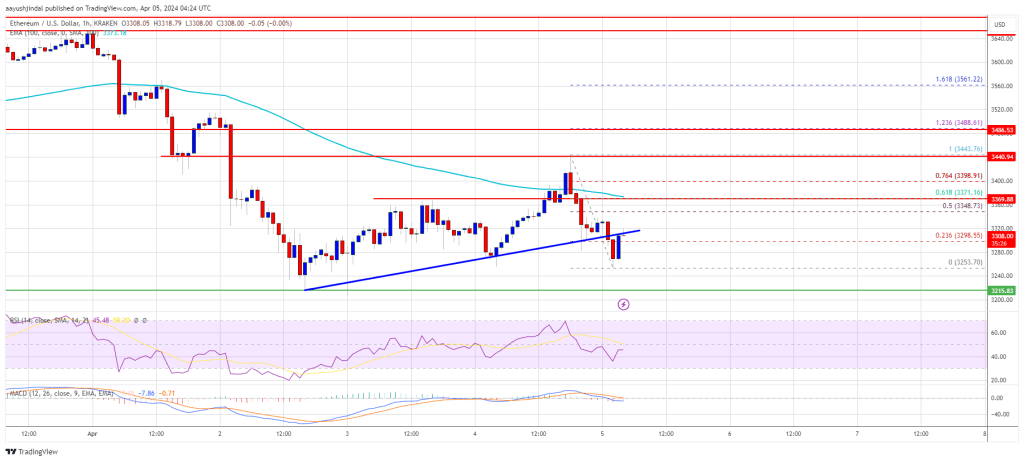

以太坊的上漲已停止,價格難以突破 3,440 美元的阻力位。目前交易價格低於 3,380 美元,以太坊在試圖維持 3,250 美元的支撐位時面臨嚴峻的考驗。跌破該水準可能會導致進一步下跌,可能將損失擴大至 3,120 美元。

Ethereum Price Faces Critical Juncture: Can $3,250 Hold Firm Amidst Mounting Pressure?

以太坊價格面臨關鍵時刻:3,250美元能否在不斷增加的壓力下堅守?

Ethereum, the second-largest cryptocurrency by market capitalization, is facing a pivotal test as it grapples with significant resistance at the $3,440 mark. The cryptocurrency has struggled to regain its footing above this crucial level, and a potential breach of the $3,250 support could trigger further declines.

以市值計算的第二大加密貨幣以太坊正面臨關鍵考驗,它正在努力應對 3,440 美元關卡的重大阻力。該加密貨幣一直難以在這一關鍵水平之上重新站穩腳跟,如果突破 3,250 美元的支撐位,可能會引發進一步下跌。

Recovery Attempts Falter

恢復嘗試步履蹣跚

Earlier attempts by Ethereum to mount a recovery above the $3,300 and $3,320 levels proved futile. Bears emerged at the $3,440 resistance zone, driving the price lower. This resulted in a break below a bullish trend line with support at $3,300 on the hourly chart.

以太坊早些時候試圖恢復至 3,300 美元和 3,320 美元上方的嘗試被證明是徒勞的。 3,440 美元阻力區出現空頭,推動價格走低。這導致其跌破小時圖上支撐位為 3,300 美元的看漲趨勢線。

The price has since consolidated losses, hovering just above the 23.6% Fibonacci retracement level of the recent downward wave from $3,443 to $3,253. However, Ethereum remains below the $3,380 level and the 100-hourly Simple Moving Average.

此後,該價格一直盤整跌勢,徘徊在近期下跌趨勢的 23.6% 斐波那契回檔位(從 3,443 美元至 3,253 美元)之上。然而,以太坊仍低於 3,380 美元水平和 100 小時簡單移動平均線。

Immediate Resistance and Support Levels

即時阻力位和支撐位

Immediate resistance for Ethereum lies near the $3,320 level, followed by the significant $3,350 level. The latter represents the 50% Fibonacci retracement level of the downward wave mentioned earlier. A突破 above $3,440 could pave the way for a test of $3,500.

以太坊的直接阻力位於 3,320 美元附近,其次是 3,350 美元的重要水平。後者代表了前面提到的下行波浪的 50% 斐波那契回檔位。突破 3,440 美元可能為測試 3,500 美元鋪平道路。

On the downside, initial support is situated at the $3,250 level. If this support fails to hold, the next major support zone lies between $3,220 and $3,200. A decisive break below $3,200 could lead to further losses towards $3,120 and even $3,040.

下檔方面,初步支撐位於 3,250 美元水準。如果該支撐位未能守住,下一個主要支撐位將位於 3,220 美元至 3,200 美元之間。果斷跌破 3,200 美元可能會導致進一步跌向 3,120 美元,甚至 3,040 美元。

Technical Indicators Signal Bearish Momentum

技術指標顯示看跌勢頭

Technical indicators on the hourly chart reinforce the bearish sentiment surrounding Ethereum. The MACD and RSI indicators both indicate a shift in momentum towards the bears. The MACD is gaining momentum in the bearish zone, while the RSI has dipped below the 50 level.

小時圖上的技術指標強化了圍繞以太坊的看跌情緒。 MACD 和 RSI 指標均顯示勢頭轉向空頭。 MACD 在看跌區域中獲得動力,而 RSI 已跌破 50 水平。

Implications for Ethereum

對以太坊的影響

A failure to overcome the $3,350 resistance could lead to a continuation of the downward trend, potentially triggering further losses towards the $3,250 and $3,220 support levels. However, if Ethereum can reclaim and hold above $3,350, it could regain some of its recent losses and challenge the $3,440 resistance once more.

如果未能克服 3,350 美元的阻力位,可能會導致下跌趨勢的持續,並可能引發進一步跌向 3,250 美元和 3,220 美元支撐位的損失。然而,如果以太坊能夠收復並保持在 3,350 美元上方,它可能會收復近期的部分失地,並再次挑戰 3,440 美元的阻力位。

The broader market sentiment remains a key factor influencing Ethereum's price action. If Bitcoin, the dominant cryptocurrency, continues to trade sideways or experience further declines, it could weigh on Ethereum's recovery efforts.

更廣泛的市場情緒仍然是影響以太坊價格走勢的關鍵因素。如果主導的加密貨幣比特幣繼續橫盤整理或進一步下跌,可能會影響以太坊的復甦努力。

Traders and investors should closely monitor the price action around the $3,250 and $3,350 levels to gauge the strength of the current trend and identify potential trading opportunities.

交易者和投資者應密切關注 3,250 美元和 3,350 美元水平附近的價格走勢,以衡量當前趨勢的強度並識別潛在的交易機會。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- RCO Finance:將先進人工智慧技術融入其平台的潛在“狗狗幣殺手”

- 2024-11-18 12:10:02

- 隨著長期持有者享受萊特幣價格回升帶來的利潤,一些投資者已轉向潛在的狗狗幣殺手。

-

- ETFSwap (ETFS):ETF 支援的加密貨幣的未來

- 2024-11-18 12:10:02

- 隨著柴犬(SHIB)在更廣泛的市場反彈中繼續獲得動力,加密市場充滿了期待。隨著柴犬價格的突破

-

-

-

-

- 塑造比特幣未來的隱藏力量:真正的利害關係是什麼?

- 2024-11-18 12:10:02

- 隨著比特幣到 2025 年可能實現突破性的轉變,表面之下有更多的東西正在深刻地影響個人、社區和整個國家。

-

-

-