|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特幣週五早些時候再次受到打擊,下降到80,000美元以下,並使2月下降到20%以上。這刺激了更廣泛的加密貨幣市場

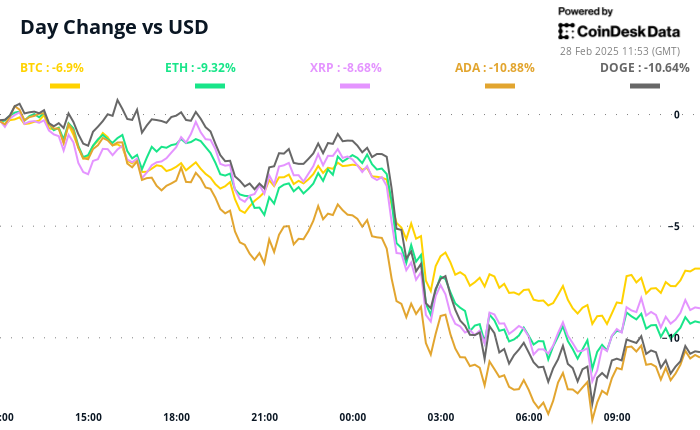

It's the dip that keeps on dipping. Bitcoin took another hit early Friday, falling below $80,000 and falling over 20% for February. And that sparked a bloodbath in the broader crypto market, with ether sliding below $2,100, a level it last saw in August.

這是不斷浸入的蘸料。比特幣週五早些時候再次受到打擊,跌至80,000美元以下,2月下降了20%。這引起了更廣泛的加密貨幣市場的血液浴,以太滑行低於2,100美元,這是8月上次看到的水平。

Increased volatility in cryptocurrencies mirrors trends in traditional markets. Compare the 10% jump in the Volmex BVIV, which tracks the 30-day implied volatility in bitcoin, with the equal increase in the MOVE index, which measures the implied volatility of U.S. Treasury notes. The VIX, Wall Street's so-called fear gauge, has risen by 14%.

加密貨幣的波動性增加反映了傳統市場的趨勢。比較Volmex BVIV中的10%跳躍,該跳躍跟踪比特幣中的30天隱含波動率,以及移動指數的同等增加,該指數衡量了美國財政部註釋的隱含波動性。華爾街所謂的恐懼量表的VIX增長了14%。

These movements, coupled with a sell-off in growth-sensitive commodity currencies like the Australian, New Zealand and Canadian dollars, are indicative of jitters in the macroeconomy, primarily driven by renewed concerns over potential Trump tariffs, prompting a rotation towards less volatile assets.

這些運動,再加上澳大利亞,新西蘭和加拿大美元等增長敏感的商品貨幣的拋售,表明了宏觀經濟的抖動,這主要是由於對特朗普的潛在關稅的重新擔憂,促使人們轉向降低波動率較小的資產。

"U.S. domestic policies have become unstable, and the White House seems happy to take advantage of this instability," said Griffin Ardern, head of options trading and research at crypto financial platform BloFin. "Given the challenges investors face in obtaining accurate forward-looking guidance, many are more inclined to hold low-volatility assets ... Traders need to liquidate positions to reduce their exposure to specific assets before transitioning to other markets, which explains the decline across almost all asset classes, including cryptocurrencies."

Crypto Financial Platform Blofin的期權交易和研究主管Griffin Ardern說:“美國國內政策變得不穩定,白宮似乎很樂意利用這種不穩定。” “鑑於投資者在獲得準確的前瞻性指導方面面臨的挑戰,許多人更傾向於持有低揮發性資產……交易者需要清算頭寸以減少其在過渡到其他市場之前對特定資產的接觸,這解釋了幾乎所有資產類別的下降,包括所有資產類別,包括加密貨幣。”

Volatility looks set to remain heightened, with President Donald Trump reportedly scheduled to speak later on Friday. In the meantime, those hoping for a significant rebound in risk assets based on personal consumption data may be disappointed because anticipated soft readings could be overshadowed by tariff concerns and rising forward-looking inflation metrics.

據報導,唐納德·特朗普總統定於週五晚些時候講話,波動性似乎將保持增強。同時,那些希望基於個人消費數據獲得大量風險資產反彈的人可能會感到失望,因為預期的軟讀數可能會因關稅問題和前瞻性通貨膨脹指標而被掩蓋。

But there were more positive developments on the regulatory front this week, with the SEC dropping charges against Uniswap, one of the leading decentralized exchanges, and mulling the same regarding its issues with Consensys.

但是,本週的監管方面有更多的積極發展,SEC對Uniswap的指控(是領先的分散交易所之一)的指控,並就其與Consensys的問題進行了同樣的考慮。

As Evgeny Gaevoy, CEO of leading market maker Wintermute, pointed out at Consensus Hong Kong last week, many are overlooking the evolving attitude of the SEC, and this is a factor the market has yet to fully price in.

正如領先的市政公司Wintermute的首席執行官Evgeny Gaevoy上週指出了香港共識,許多人忽略了SEC的不斷發展的態度,這是市場尚未完全代價的一個因素。

Plus, the decline in the basis in the CME bitcoin and ether futures, a sign of weakening demand, has stalled and from a technical analysis perspective, bitcoin is fast closing toward a potential demand zone. So, stay alert!

另外,CME比特幣和以太期貨的基礎下降(需求削弱的標誌)已經停滯不前,從技術分析的角度來看,比特幣正迅速邁向潛在需求區域。所以,請保持警惕!

Token Events

令牌事件

No events in the last 24 hours

過去24小時沒有事件

Conferences

會議

Token Talk

代幣談話

By Shaurya Malwa

Shaurya Malwa

ALERT: LAZARUS LAUNDERING THROUGH THORCHAIN - MINIMUM $240M SO FAROver $240M of ETH has been sent through Thorchain by Lazarus-tagged wallets according to Arkham.These funds have mainly been swapped for native BTC.

警報:根據Arkham的說法,Lazarus通過Thorchain洗錢 - 至少2.4億美元通過Lazarus標記的錢包通過Thorchain發送了2.4億美元的ETH。這些資金主要換成本地BTC。

As the dust settles on the recent crypto market crash, new data from blockchain analytics firm Arkham reveals a massive money laundering operation unfolding in plain sight. According to Arkham, Lazarus-tagged wallets, notorious for their involvement in malicious activities, have been actively transferring enormous sums of ether through the Thorchain protocol.

隨著最近最近一次加密市場崩潰的塵埃落定,區塊鏈分析公司阿卡姆的新數據顯示出了一場大規模的洗錢業務。根據阿卡姆(Arkham)的說法,拉撒路(Lazarus)標記的錢包因參與惡意活動而臭名昭著,通過胸腔協議積極轉移了巨額資金。

In a series of tweets, Arkham highlights how these Lazarus wallets, linked to North Korea's cybercrime activities, systematically sent billions of won in KICP (the native token of the Korean cryptocurrency exchange) to ether and then utilized the Thorchain protocol to swap the ETH for BTC.

在一系列推文中,阿克漢姆(Arkham)強調了這些拉撒路錢包與朝鮮網絡犯罪活動有聯繫,系統地將數十億韓元(韓國加密貨幣交易所的本地託管)送給了以太,然後利用Thorchain協議將ETH交換為BTC。

"The AML [anti-money laundering] implications of this are significant. It appears that Lazarus is able to easily and quickly launder large amounts of crypto by leveraging DeFi protocols like Thorchain," stated Arkham.

Arkham說:“ AML [反洗錢]對此的影響很大。似乎Lazarus能夠通過利用Thorchain(例如Thorchain)的Defi協議輕鬆而迅速地洗錢。”

The scale of the operation is staggering. According to Arkham's analysis, at least $240 million in ETH has been laundered through Thorchain so far, with the true figure potentially even higher.

操作的規模令人驚嘆。根據阿卡姆(Arkham)的分析,到目前為止,通過索爾奇(Thorchain)洗了至少2.4億美元的ETH,真正的數字可能更高。

The majority of the laundered funds were later used to purchase bitcoin on the decentralized exchange protocol, highlighting the Lazarus group's preference for the flagship cryptocurrency.

後來,大多數洗錢資金用於在分散的交換協議上購買比特幣,突出了拉撒路集團對旗艦加密貨幣的偏愛。

The operation began in February 2023, with the KICP tokens being transferred to a specific address on the Huobi exchange. From there, the tokens were sold for USDT, which was subsequently used to purchase ether on FTX.

該操作始於2023年2月,KICP令牌被轉移到Huobi Exchange上的特定地址。從那裡,代幣被出售給USDT,後來用於在FTX上購買以太。

The stolen funds were then moved to a new wallet, eventually reaching a Lazarus-tagged address on March 9. After March 9, the same batch of ETH tokens was used to perform several swaps on Thorchain, enabling the seamless conversion of ether to bitcoin.

然後將被盜的資金移至新錢包,最終於3月9日到達了拉撒路標籤的地址。3月9日之後,相同批次的ETH代幣被用來對Thorchain進行多次交換,從而使Ether無縫轉換為Bitcoin。

Derivatives Positioning

衍生物定位

The aggregate bitcoin notional value across major centralized exchanges like Binance, Coinbase and Huobi fell by 9% over the past 24 hours to $97 billion, compared with a 7% increase in the aggregate ether notional value to $80 billion, according to CCData.

根據CCDATA的數據,諸如Binance,Coinbase和Huobi等主要集中式交易所的總比特幣概念價值在過去24小時內下降了9%,達到970億美元,而總概念價值增加了7%,達到800億美元。

The total notional value across all 10 cryptocurrencies followed by CCData also dropped by 6% to $147 billion, with bitcoin and ether

所有10個加密貨幣的總概念價值也下降了6%,至1.47億美元,比特幣和以太幣

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- CME集團確認Solana(Sol)期貨合約將於3月17日啟動

- 2025-03-01 02:25:34

- 芝加哥商業交易所(CME)集團已確認計劃於3月17日推出Solana(Sol)期貨,等待監管審查

-

- PI令牌的命運是否會被義務封印嗎?分解即將到來的決定

- 2025-03-01 02:25:34

- 加密貨幣發燒友在潛在突破的邊緣處pi doken teeters時充滿了沉迷。

-

-

-

- 當Pi網絡投資者觀看並等待時,一波期待遍布數字走廊

- 2025-03-01 02:25:34

- 他們的重點牢固地放在binance上,該公司最近與社區有關列出PI代幣的民意調查。將近295,000名參與者投票

-

- 誘人的戲劇在加密貨幣世界中展開

- 2025-03-01 02:25:34

- 當Pi網絡愛好者急切地觀看全球領先的交流之一,以列出他們心愛的代幣的潛在點頭

-

- PI硬幣(PI)價格,圖表和市值

- 2025-03-01 02:25:34

- 加密貨幣的世界正在不斷發展,Pi Coin是最新的參賽者,引起了人們對其進行分散和用戶參與的新方法的關注。

-

- 特朗普組織通過NFT交易平台大膽地進入元元。

- 2025-03-01 02:25:34

- 數字化轉型正在進行中,特朗普組織大膽地進入了虛擬世界和區塊鏈創新的領域。

-

- 2025年要購買的#1加密

- 2025-03-01 02:25:34

- 佩佩硬幣在過去一周中下降了9%以上,現在為0.000082美元,面臨0.000085美元的阻力,顯示了一些混合信號。