|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

華爾街專家 Jim Cramer 出乎意料地建議投資比特幣和以太坊,而不是 Marathon Digital。由於地緣政治緊張局勢造成的市場不確定性,Marathon Digital 的股價暴跌,Cramer 建議直接購買比特幣和以太坊以獲得短期收益,而不是投資 Marathon Digital。

Renowned Market Analyst Jim Cramer Advocates Bitcoin and Ethereum as Preferable Investments to Marathon Digital

著名市場分析師 Jim Cramer 主張比特幣和以太坊作為 Marathon Digital 的首選投資

In a recent interview with CNBC, Jim Cramer, the esteemed financial expert and former hedge fund manager, has advised investors to consider Bitcoin and Ethereum as more favorable investment options compared to Marathon Digital.

在最近接受 CNBC 採訪時,受人尊敬的金融專家、前對沖基金經理 Jim Cramer 建議投資者將比特幣和以太坊視為比 Marathon Digital 更有利的投資選擇。

Cramer acknowledged the ongoing market volatility impacting the cryptocurrency industry, particularly in light of geopolitical tensions in the Middle East. The significant decline in Marathon Digital's stock price, dropping over 20% within the past month, has prompted Cramer to recommend direct investments in Bitcoin and Ethereum instead.

克萊默承認持續的市場波動影響加密貨幣產業,特別是考慮到中東地緣政治緊張局勢。 Marathon Digital 股價大幅下跌,過去一個月下跌超過 20%,促使 Cramer 建議直接投資比特幣和以太幣。

"If you want to own Marathon Digital, just go buy either Ethereum or buy Bitcoin," said Cramer during the CNBC segment. "Let's not fool around."

克萊默在 CNBC 節目中表示:“如果你想擁有 Marathon Digital,只需購買以太幣或購買比特幣。” “咱們別胡鬧了。”

Volatility in Cryptocurrency Markets

加密貨幣市場的波動性

Cramer's recommendation stems from the inherent volatility of cryptocurrency trading prices. The recent downturn in the value of Marathon Digital's stock highlights the potential risks associated with indirect investments in the cryptocurrency market through companies like Marathon Digital, which primarily focus on Bitcoin mining.

克萊默的建議源自於加密貨幣交易價格固有的波動性。 Marathon Digital 股票價值最近的下跌凸顯了透過 Marathon Digital 等主要專注於比特幣挖礦的公司間接投資加密貨幣市場的潛在風險。

Cramer's analysis suggests that investors seeking exposure to the cryptocurrency market may be better served by investing directly in Bitcoin and Ethereum, the two largest and most established digital assets. These assets offer a more direct and transparent way to participate in the market's performance, without the added risk associated with intermediary companies.

克萊默的分析表明,直接投資比特幣和以太坊這兩種最大、最成熟的數位資產可能會更好地滿足尋求進入加密貨幣市場的投資者的需求。這些資產提供了一種更直接、更透明的參與市場表現的方式,而不會增加與中介公司相關的風險。

Analyst Commentary on Bitcoin's Price Movement

分析師對比特幣價格走勢的評論

Meanwhile, a prominent cryptocurrency analyst has shared insights on Bitcoin's price trajectory. The analyst identified $62,000 as a crucial support level for Bitcoin, noting that a drop below this level could result in a shift towards the next significant support level at approximately $51,500.

同時,一位著名的加密貨幣分析師分享了對比特幣價格軌蹟的見解。該分析師認為 62,000 美元是比特幣的關鍵支撐位,並指出,跌破該水平可能會導致比特幣轉向下一個重要支撐位(約 51,500 美元)。

Conversely, the analyst highlighted that Bitcoin's rise above $66,250 could reinvigorate the bull market. However, it's important to note that Bitcoin's price has since fallen below the $60,000 threshold, sparking speculation about the potential for further downward movement.

相反,分析師強調,比特幣升至 66,250 美元以上可能會重振牛市。然而,值得注意的是,比特幣的價格此後已跌破 6 萬美元的門檻,引發了有關進一步下跌潛力的猜測。

War Tensions Impact on Cryptocurrency Market

戰爭緊張局勢對加密貨幣市場的影響

The market volatility in the cryptocurrency sector can be attributed to a complex interplay of factors, including macroeconomic conditions, geopolitical tensions, and evolving regulatory landscapes. The recent escalation of tensions between Israel and Iran has further exacerbated market uncertainty, creating both opportunities and risks for investors.

加密貨幣產業的市場波動可歸因於多種因素的複雜交互作用,包括宏觀經濟狀況、地緣政治緊張局勢和不斷變化的監管環境。近期以色列和伊朗緊張局勢升級,進一步加劇了市場的不確定性,為投資者創造了機會,也帶來了風險。

As geopolitical dynamics unfold, investors are closely monitoring the impact on cryptocurrency prices and adjusting their strategies accordingly. The evolving situation underscores the need for prudent decision-making and careful consideration of both short-term and long-term investment goals.

隨著地緣政治動態的展開,投資人正密切關注其對加密貨幣價格的影響,並相應調整策略。不斷變化的情況凸顯了審慎決策和仔細考慮短期和長期投資目標的必要性。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- 以太坊(ETH)在下一次推動之前測試流動性

- 2024-12-28 07:05:01

- 以太坊在 2024 年表現平平,全年表現低於比特幣和許多頂級山寨幣。

-

-

- BWB-BGB合併宣布後BGT代幣價格飆漲

- 2024-12-28 06:55:02

- 著名的加密貨幣交易所 Bitget 最近宣布計劃整合 Bitget 錢包代幣(BWB)和 Bitget 代幣(BGB)

-

-

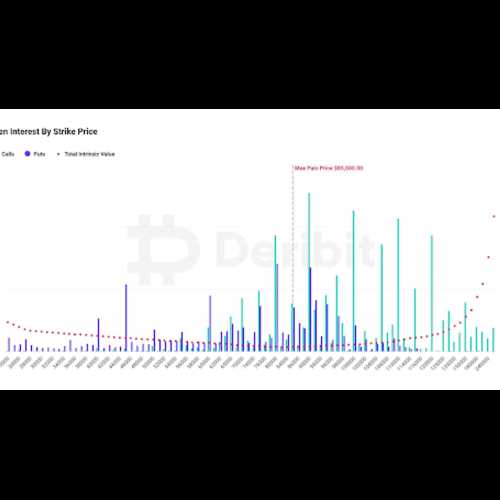

- 比特幣面臨 2024 年 12 月期權到期

- 2024-12-28 06:55:02

- 儘管 2024 年 12 月期權到期,比特幣價格最近表現出顯著的彈性,可能會大幅回調至 85,000 美元以下。