|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在哥倫比亞法學院的一次演講中,SEC 主席加里·詹斯勒 (Gary Gensler) 批評加密貨幣行業逃避註冊要求並阻礙透明度。他強調需要強制揭露以保護投資者和消毒市場。 Gensler 的言論反映了 SEC 和加密產業之間持續的緊張關係,加密產業在加強執法行動的同時尋求更明確的監管。

SEC Chair Urges Crypto Industry to Embrace Transparency and Compliance

SEC 主席敦促加密產業擁抱透明度和合規性

In a comprehensive critique of the cryptocurrency market, Gary Gensler, Chairman of the United States Securities and Exchange Commission (SEC), has taken aim at the evasion of regulatory registration requirements by certain crypto market participants. Delivering a keynote address at Columbia Law School on March 22, Gensler painted a stark picture of an industry that has not fully embraced the principles of transparency and mandatory disclosure.

美國證券交易委員會(SEC)主席加里·根斯勒(Gary Gensler)對加密貨幣市場進行了全面批評,矛頭直指某些加密貨幣市場參與者規避監管註冊要求的行為。 3 月 22 日,Gensler 在哥倫比亞法學院發表主題演講時,描繪了一個尚未完全接受透明度和強制披露原則的行業的嚴峻景象。

Avoidance of Registration Undermines Market Integrity

迴避註冊破壞市場誠信

Gensler highlighted the troubling practice of some crypto entities seeking to skirt the SEC's registration requirements, thereby avoiding the mandatory disclosure obligations that come with it. This avoidance, he argued, directly undermines the integrity and transparency of the market, leaving investors exposed to potential harm.

Gensler 強調了一些加密貨幣實體試圖規避 SEC 註冊要求,從而避免隨之而來的強制揭露義務的令人不安的做法。他認為,這種迴避直接破壞了市場的完整性和透明度,使投資者面臨潛在的傷害。

"These crypto intermediaries do not want to register. They do not want transparency. They do not want investor protection,"Gensler said. "But what these crypto intermediaries want doesn't matter."

「這些加密貨幣中介機構不想註冊。他們不想要透明度。他們不想要投資者保護,」Gensler 說。 “但這些加密貨幣中介想要什麼並不重要。”

Gensler's remarks underscore the ongoing tension between the SEC and the crypto industry, which has been marked by calls for clearer regulations and the SEC's firm stance on enforcement.

Gensler 的言論凸顯了 SEC 與加密貨幣行業之間持續的緊張關係,其特點是要求更明確的監管以及 SEC 對執法的堅定立場。

Transparency as a Market Disinfectant

透明度作為市場消毒劑

Echoing the words of Supreme Court Justice Louis Brandeis, Gensler asserted that "sunlight is said to be the best of disinfectants," emphasizing the importance of mandatory disclosure practices within the crypto market.

Gensler 呼應最高法院法官 Louis Brandeis 的說法,聲稱“陽光被認為是最好的消毒劑”,並強調了加密貨幣市場中強制披露做法的重要性。

"I believe that mandatory disclosure would be a disinfectant for this market," Gensler said. "It would give investors the information they need to make informed decisions."

「我相信強制揭露將成為這個市場的消毒劑,」詹斯勒說。 “它將為投資者提供做出明智決策所需的資訊。”

This stance comes against the backdrop of the SEC's increased enforcement actions against major crypto firms, such as Kraken, Binance, Ripple, and Coinbase, all of which have heightened the demand for more definitive regulatory guidelines.

這一立場是在 SEC 對 Kraken、Binance、Ripple 和 Coinbase 等主要加密貨幣公司加強執法行動的背景下提出的,所有這些都增加了對更明確的監管指南的需求。

Regulatory Actions and Industry Response

監管行動和產業反應

The SEC's aggressive regulatory approach, which has included efforts to potentially classify Ethereum (Ether) as a security, has sparked a significant reaction from the crypto community. Advocacy groups and crypto companies have pressed the SEC for clearer "rules of the road" to foster innovation within the United States.

美國證券交易委員會激進的監管方法,其中包括可能將以太坊(Ether)歸類為證券的努力,引起了加密貨幣社群的強烈反應。倡導團體和加密貨幣公司已向美國證券交易委員會施壓,要求其製定更明確的“道路規則”,以促進美國境內的創新。

Meanwhile, the SEC has continued to expand its reach into the crypto space, approving several crypto-tied exchange-traded products, including those linked to Ether (ETH) and Bitcoin futures, as well as the first spot Bitcoin (BTC) exchange-traded funds in January.

同時,美國證券交易委員會繼續擴大其在加密貨幣領域的影響力,批准了幾種與加密貨幣相關的交易所交易產品,包括與以太坊(ETH)和比特幣期貨相關的產品,以及第一個現貨比特幣(BTC)交易所交易產品。一月份的資金。

Conclusion: A Critical Phase in Crypto Regulation

結論:加密貨幣監管的關鍵階段

Gary Gensler's call for enhanced transparency and adherence to regulatory standards in the crypto industry highlights a critical phase in the ongoing dialogue between regulators and the cryptocurrency sector. As the SEC maintains its rigorous oversight, the demand for clear and conducive regulatory frameworks grows, underscoring the complex relationship between innovation and regulation in the evolving digital asset landscape.

加里·詹斯勒 (Gary Gensler) 呼籲提高加密行業的透明度並遵守監管標準,這突顯了監管機構與加密貨幣行業之間正在進行的對話的關鍵階段。隨著 SEC 保持嚴格的監管,對清晰、有利的監管框架的需求不斷增長,突顯了不斷發展的數位資產格局中創新與監管之間的複雜關係。

"We need to see more transparency and more accountability," Gensler said. "We need to see more crypto markets come into compliance with the law."

「我們需要看到更多的透明度和更多的問責制,」詹斯勒說。 “我們需要看到更多的加密市場遵守法律。”

The SEC's determination to bring transparency and regulatory compliance to the crypto market is a significant development that will have far-reaching implications for the industry's future. It remains to be seen whether the crypto community will embrace these principles or continue to resist the regulatory embrace. However, one thing is clear: the era of unregulated crypto is drawing to a close.

美國證券交易委員會決心為加密貨幣市場帶來透明度和監管合規性,這是一項重大進展,將對產業的未來產生深遠影響。加密貨幣社群是否會接受這些原則或繼續抵制監管還有待觀察。然而,有一點是明確的:不受監管的加密貨幣時代即將結束。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

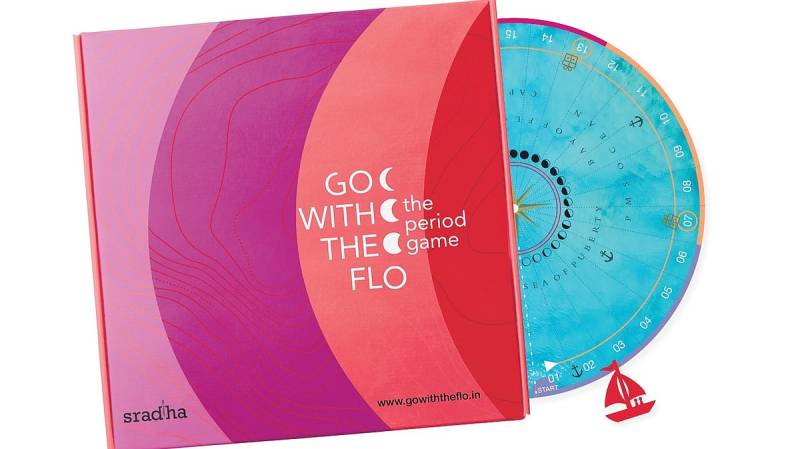

- “使用Flo”:一個簡化與月經有關的複雜主題的棋盤遊戲

- 2025-01-30 16:30:52

- 該遊戲具有超過60多個月經相關的術語,簡化了複雜的主題。 “最有意義的部分是看著我的兒子和他的同齡人在玩遊戲。

-

- 在黑客排幹他的幻影錢包之後

- 2025-01-30 16:30:52

- 禮物是在布蘭斯特特(Branstetter)的幻影錢包被黑客排幹兩天之後,以消滅660萬個UFD硬幣,價值約120萬美元

-

- 長期比特幣(BTC)持有人正在出售,這是看漲的標誌

- 2025-01-30 16:30:52

- 但是,根據觀察歷史趨勢的分析師的說法,敘述在加密貨幣市場上有所不同,在加密貨幣市場中,這種銷售表明了看漲。

-

-

-

- 比特幣在2024年的機構突破

- 2025-01-30 16:30:52

- 隨著機構採用的加速,比特幣去年達到了新的里程碑。現貨比特幣ETF的批准使主要財務參與者可以直接接觸BTC

-

-

- 硬幣Rush:Cred宣佈為期三天的獎勵節,成員可以在其中交換信用硬幣作為優質產品和經驗

- 2025-01-30 16:30:52

- 硬幣搶購使成員可以訪問硬幣的罕見和遙不可及的放縱。

-