|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

儘管面臨市場波動和大幅下跌,Chainlink 的 LINK 代幣仍引起人們的關注,並出現了有望復甦的跡象。

Despite facing a volatile market and substantial declines, Chainlink's LINK token is showing promising signs of recovery on the horizon. The dramatic decrease in its price, once falling by 15% to slip below $25, did not deter the optimism surrounding its future prospects.

儘管面臨市場波動和大幅下跌,Chainlink 的 LINK 代幣仍顯示出即將復甦的良好跡象。其價格大幅下跌,一度下跌 15%,跌破 25 美元,但這並沒有阻止人們對其未來前景的樂觀情緒。

Recent activity highlighted major 'whale' actions within the cryptocurrency, as large holders withdrew 529,000 LINK tokens, valued at $15.5 million, from Binance. This substantial outflow decreased market liquidity, sparking speculation about the intentions behind these moves. However, analysts interpreted this as a strategic positioning rather than panic selling, considering the solid support level around $23 that has been repeatedly tested and remained intact.

最近的活動凸顯了加密貨幣中的重大「鯨魚」行為,大持有者從幣安撤回了 529,000 個 LINK 代幣,價值 1,550 萬美元。大量資金外流減少了市場流動性,引發了人們對這些舉措背後意圖的猜測。然而,考慮到 23 美元附近的堅實支撐位已被反覆測試並保持完好,分析師將此解讀為一種戰略定位,而不是恐慌性拋售。

Future Price Predictions and Market Signals

未來價格預測與市場訊號

Overall market sentiment for Chainlink remained positive. According to sources like CoinCodex, projections indicated that LINK could rebound to $40 by January and might reach an impressive $75 by mid-2025. The current price at approximately $23.26 reflected a decline of over 21% in the past week, yet analysts remained confident in a bullish trend.

Chainlink 的整體市場情緒依然樂觀。據 CoinCodex 等消息人士稱,預測表明 LINK 可能會在 1 月反彈至 40 美元,到 2025 年中期可能會達到令人印象深刻的 75 美元。目前價格約為 23.26 美元,過去一周下跌超過 21%,但分析師仍對看漲趨勢充滿信心。

Emphasizing Chainlink's resilience and the optimism surrounding its long-term potential, many predicted an average price of around $45 in the coming years, suggesting significant value growth from current levels. Despite recent setbacks, the expected 120% increase positioned Chainlink as a top-performing asset, with its functionality and adoption driving optimism.

許多人強調 Chainlink 的韌性和對其長期潛力的樂觀態度,預測未來幾年的平均價格將達到 45 美元左右,這表明價值將在當前水平上顯著增長。儘管最近遭遇挫折,但預計 120% 的成長使 Chainlink 成為表現最佳的資產,其功能和採用率令人樂觀。

Analysts remained hopeful, anticipating a recovery to $35 by January 2025, further highlighting Chainlink's resilience and long-term potential amidst market fluctuations.

分析師仍抱持希望,預計到 2025 年 1 月將回升至 35 美元,這進一步凸顯了 Chainlink 在市場波動中的韌性和長期潛力。

Strategies for Navigating the Cryptocurrency Market in 2025: Insights and Predictions

2025 年加密貨幣市場的策略:洞察與預測

As cryptocurrency markets continue their dynamic evolution, investors find themselves both excited and cautious about what the future holds. With immense volatility characterizing the digital assets landscape, particularly with tokens like Chainlink’s LINK, there’s a palpable buzz about its potential value by 2025.

隨著加密貨幣市場繼續動態發展,投資者發現自己對未來既興奮又謹慎。由於數位資產格局存在巨大的波動性,尤其是像 Chainlink 的 LINK 這樣的代幣,到 2025 年其潛在價值將受到明顯關注。

Cryptocurrency Rate Predictions for 2025Chainlink’s LINK token has been on a roller coaster ride, but market analysts are predicting bright days ahead. Forecasts by reputable sources like CoinCodex suggest that LINK might reach $75 by mid-2025, driven by strategic whale movements and a robust support level at $23. Such predictions have reinvigorated investor confidence, providing a compelling case for those considering long-term positions.

2025 年加密貨幣匯率預測Chainlink 的 LINK 代幣一直在坐雲霄飛車,但市場分析師預測未來的日子將會很光明。 CoinCodex 等知名來源的預測表明,在戰略鯨魚運動和 23 美元強勁支撐位的推動下,LINK 到 2025 年中期可能會達到 75 美元。這些預測重振了投資人的信心,為那些考慮長期持股的人提供了令人信服的理由。

Investment Risks and ConsiderationsInvesting in cryptocurrency, while potentially lucrative, is not without its risks. Price volatility, regulatory developments, and technological challenges all play significant roles in shaping the market. For Chainlink, the recent 21% decline underscores the unpredictability and vulnerabilities inherent in cryptocurrency investments.

投資風險和注意事項投資加密貨幣雖然可能有利可圖,但並非沒有風險。價格波動、監管發展和技術挑戰都在塑造市場方面發揮重要作用。對 Chainlink 來說,最近 21% 的下跌凸顯了加密貨幣投資固有的不可預測性和脆弱性。

Nevertheless, understanding these risks allows investors to strategize effectively—diversification and a balanced portfolio remain key. It is crucial for investors to keep abreast of market trends and sentiment to mitigate potential losses while maximizing gains.

儘管如此,了解這些風險可以讓投資者有效地制定策略——多元化和平衡的投資組合仍然是關鍵。對於投資人來說,隨時了解市場趨勢和情緒,以減少潛在損失,同時最大化收益至關重要。

Pros and Cons of Investing in ChainlinkChainlink offers several advantages: its robust technology facilitates real-world applications, and its decentralized oracle network bridges the gap between blockchain and real-world data. This makes it a valuable asset for smart contracts, driving its adoption across numerous sectors.

投資 Chainlink 的利弊 Chainlink 具有多項優勢:其強大的技術促進了現實世界的應用,其去中心化的預言機網路彌合了區塊鏈和現實世界數據之間的差距。這使其成為智能合約的寶貴資產,推動其在眾多領域的採用。

However, market volatility and competitive pressure are tangible challenges. While Chainlink holds a leading position, rivalry from emerging projects could impact its market share. Additionally, blockchain technology’s rapid evolution demands constant innovation to maintain relevance.

然而,市場波動和競爭壓力是實際的挑戰。雖然 Chainlink 佔據領先地位,但新興項目的競爭可能會影響其市場份額。此外,區塊鏈技術的快速發展需要不斷創新以保持相關性。

Controversies and Market SpeculationThe movement of significant LINK tokens by large holders, often referred to as ‘whales’, raises questions about market manipulation and insider trading. Such actions, while sometimes strategic, can lead to liquidity challenges and speculative trading, affecting broader market dynamics.

爭議和市場投機大持有者(通常被稱為“鯨魚”)大量 LINK 代幣的流動引發了有關市場操縱和內幕交易的問題。此類行動雖然有時具有戰略意義,但可能會導致流動性挑戰和投機交易,從而影響更廣泛的市場動態。

Final ThoughtsSpeculation about Chainlink’s future remains, with predictions of significant growth offering a tantalizing opportunity for investors willing to navigate its complexities. As the cryptocurrency landscape continues to mature, maintaining informed and strategic investment decisions will be paramount.

最後的想法關於 Chainlink 未來的猜測依然存在,其顯著增長的預測為願意應對其複雜性的投資者提供了誘人的機會。隨著加密貨幣領域的不斷成熟,保持明智的策略投資決策將至關重要。

For continuous updates and insights into the dynamic world of cryptocurrency, investors can visit trusted resources such as CoinDesk and CoinTelegraph. By staying informed, investors can better navigate the intricate dance of risks and rewards in the cryptocurrency market.

為了持續更新和深入了解加密貨幣的動態世界,投資者可以存取 CoinDesk 和 CoinTelegraph 等值得信賴的資源。透過及時了解情況,投資者可以更好地駕馭加密貨幣市場中錯綜複雜的風險和回報。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- 2025年持有的最佳加密貨幣:碼頭,聲音,比特幣現金

- 2025-04-11 03:45:12

- 在快節奏的加密貨幣世界中,跟踪哪些資產在2025年的其餘部分至關重要。

-

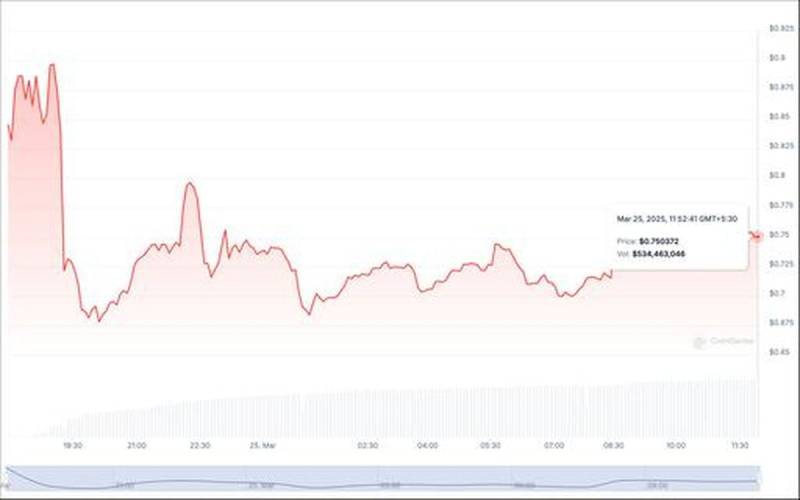

- 自2025年3月25日推出以來,NILLIN的NIL代幣的市值經歷了巨大的衰退。

- 2025-04-11 03:40:12

- 首次亮相後,代幣的價值在最初的24小時內暴跌了12%,這表明投資者對其潛力的早期懷疑。

-

-

-

-

- Shiba Inu(Shib)投資者有一個新的機會來積累令牌

- 2025-04-11 03:30:12

- 希伯的價格變動和當前的機會。儘管從ATH下降了,但有些人認為這是購買蘸醬的機會。

-

- USD1 Stablecoin推出針對機構投資者的目標

- 2025-04-11 03:30:12

- 與特朗普家族有關的加密項目世界自由金融公司(WLFI)宣布推出了一種新的稱為USD1的Stablecoin。

-

- REMITTIX(RMX)價格預測今天在十字路口

- 2025-04-11 03:25:13

- 據大多數人稱,Remittix是一個新的Defi代幣,可能是今年將您的錢投入的最佳加密貨幣之一。

![super Mario World Koopa Troopa 100%96⭐️ +硬幣[AO Vivo] super Mario World Koopa Troopa 100%96⭐️ +硬幣[AO Vivo]](/uploads/2025/04/10/cryptocurrencies-news/videos/super-mario-koopa-troopa-coin-ao-vivo/image-1.webp)