|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在快速發展的數位環境中,Chainlink 在現實世界資產 (RWA) 中的作用和監管審查為其未來帶來了不確定性。專家預計,在其穩健的質押結構的推動下,LINK Coin 可能會復甦,而狗狗幣在保持勢頭方面面臨挑戰。在 ETF 樂觀情緒和不斷增長的機構興趣的推動下,比特幣繼續看漲,為加密貨幣市場充滿活力的 4 月奠定了基礎。

Chainlink's Prominence in Real-World Assets Amid Regulatory Scrutiny: A Comprehensive Analysis for April 2024

Chainlink 在監管審查中在現實世界資產中的突出地位:2024 年 4 月的綜合分析

Introduction:

The digital landscape is in a continuous state of flux, with key players such as Chainlink attracting increasing attention regarding the potential impact of regulations. Renowned figures like the CEO of BlackRock are actively engaging in discussions surrounding Real World Assets (RWA), highlighting the significance of cryptocurrencies in the broader financial ecosystem. Chainlink, with its robust staking structure and utility of the LINK token, stands out as a formidable contender in this arena. However, looming questions regarding the classification of staking services as investment contracts, a topic exemplified by recent events at Coinbase, cast a shadow of uncertainty on Chainlink's future trajectory.

簡介:數位格局處於不斷變化的狀態,Chainlink 等關鍵參與者越來越多地關注法規的潛在影響。貝萊德執行長等知名人士正在積極參與圍繞現實世界資產(RWA)的討論,強調了加密貨幣在更廣泛的金融生態系統中的重要性。 Chainlink 憑藉其強大的質押結構和 LINK 代幣的實用性,成為這一領域的強大競爭者。然而,關於將質押服務分類為投資合約的迫在眉睫的問題(Coinbase 最近發生的事件就是一個例子)給 Chainlink 的未來軌跡蒙上了不確定性的陰影。

Chainlink's Role in Real World Assets and Regulatory Scrutiny:

In the realm of real-world assets (RWAs), Chainlink has emerged as a prominent player, with industry leaders like the CEO of BlackRock acknowledging its significance. The utility of the LINK token has been underscored by its staking structure, further solidifying its position in the market. However, amidst the optimism lies a looming concern – the potential impact of regulatory scrutiny on Chainlink's staking services. Recent events, such as the interpretation of staking services as investment contracts by platforms like Coinbase, have sparked debates about the regulatory risks facing Chainlink in the coming months. As we navigate through April, industry experts will closely monitor developments in this space to gauge the impact on Chainlink's trajectory.

Chainlink 在現實世界資產和監管審查中的作用:在現實世界資產 (RWA) 領域,Chainlink 已成為重要參與者,貝萊德 (BlackRock) 首席執行官等行業領導者都承認其重要性。 LINK 代幣的實用性透過其質押結構得到了強調,進一步鞏固了其在市場中的地位。然而,樂觀情緒背後卻隱藏著一個迫在眉睫的擔憂——監管審查對 Chainlink 質押服務的潛在影響。最近發生的事件,例如 Coinbase 等平台將質押服務解釋為投資合同,引發了有關 Chainlink 在未來幾個月面臨的監管風險的爭論。在 4 月份,行業專家將密切關注該領域的發展,以評估對 Chainlink 發展軌蹟的影響。

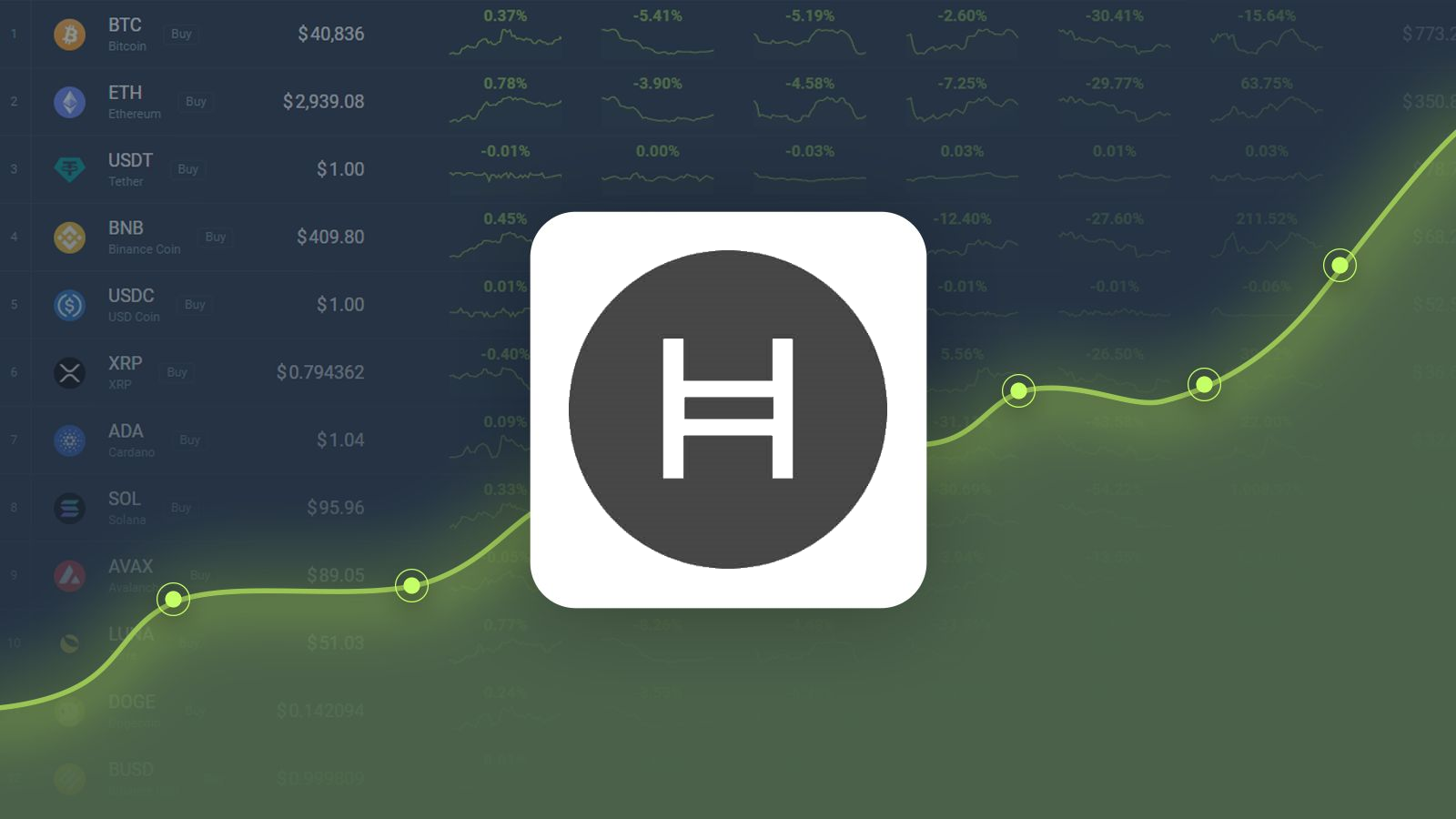

Performance Analysis of LINK Coin and Dogecoin:

Turning our gaze to specific cryptocurrencies, the performance of LINK Coin and Dogecoin has been a topic of keen interest among market observers. Despite LINK Coin experiencing a temporary setback, with its price dipping below $19 after hitting highs above $20.7, analysts remain optimistic about its potential for resurgence in the coming months. Should April unfold as anticipated, LINK Coin could aim for a retest of its $23 peak, with further gains potentially propelling it towards the $28.9 and $34 regions. Meanwhile, Dogecoin, while exhibiting positive divergence, faces challenges in maintaining momentum, with prices hovering around the $0.217 mark. However, buoyed by potential rebounds, analysts foresee a climb towards the $0.3 target, following intermediate hurdles at $0.23 and $0.27.

LINK Coin和Dogecoin的表現分析:將目光轉向具體的加密貨幣,LINK Coin和Dogecoin的表現一直是市場觀察人士熱衷的話題。儘管 LINK Coin 經歷了暫時的挫折,其價格在觸及 20.7 美元以上的高點後跌至 19 美元以下,但分析師仍對其未來幾個月的復甦潛力持樂觀態度。如果 4 月如預期展開,LINK Coin 可能會重新測試 23 美元的峰值,進一步上漲可能會推動其 28.9 美元和 34 美元區域。與此同時,狗狗幣雖然表現出正背離,但在保持勢頭方面面臨挑戰,價格徘徊在 0.217 美元大關附近。然而,在潛在反彈的推動下,分析師預計金價將在 0.23 美元和 0.27 美元的中間阻力位之後攀升至 0.3 美元的目標。

Bitcoin's Remarkable Journey and Market Outlook:

The year commenced on a remarkable note for Bitcoin, the pioneer cryptocurrency, as it surged to an all-time high of $73,777. This unprecedented milestone comes on the heels of growing optimism surrounding the approval of Exchange-Traded Funds (ETFs) for cryptocurrencies. While many anticipated a sell-off following the introduction of spot Bitcoin ETFs, the market witnessed a deceptive dip before rallying to new heights. With institutional interest continuing to soar and mainstream adoption on the rise, the outlook for Bitcoin remains bullish as we move forward into April.

比特幣的非凡歷程和市場前景:作為加密貨幣的先驅,比特幣在這一年伊始便迎來了輝煌的一年,其價格飆升至 73,777 美元的歷史新高。這一前所未有的里程碑是在人們對加密貨幣交易所交易基金(ETF)獲得批准的樂觀情緒不斷增長之後出現的。儘管許多人預計現貨比特幣 ETF 推出後會出現拋售,但市場在反彈至新高之前經歷了欺騙性的下跌。隨著機構興趣持續飆升以及主流採用率的上升,隨著進入 4 月份,比特幣的前景仍然看漲。

Dogecoin's Trajectory and Market Dynamics:

In the ever-volatile world of cryptocurrencies, Dogecoin has captivated investors with its unpredictable trajectory. Despite experiencing significant divergence in recent weeks, Dogecoin faces challenges in sustaining momentum as it hovers around key support levels. With price predictions ranging from bullish targets of $0.3 to cautious retracements, the future of Dogecoin remains uncertain as it seeks to find equilibrium amidst market fluctuations. As April unfolds, traders and enthusiasts will closely monitor price movements and market dynamics to gauge Dogecoin's resilience in the face of uncertainty.

狗狗幣的軌跡和市場動態:在不斷波動的加密貨幣世界中,狗狗幣以其不可預測的軌跡吸引了投資者。儘管最近幾週出現了明顯的分歧,但狗狗幣在維持關鍵支撐位附近的勢頭方面面臨著挑戰。由於價格預測範圍從 0.3 美元的看漲目標到謹慎的回調,狗狗幣的未來仍然不確定,因為它尋求在市場波動中找到平衡。隨著四月的到來,交易者和愛好者將密切關注價格走勢和市場動態,以衡量狗狗幣在面對不確定性時的彈性。

Looking Ahead: Insights and Predictions for April 2024

As we embark on a new month in the cryptocurrency market, the landscape is ripe with opportunities and challenges. With Bitcoin leading the charge to new highs, Chainlink navigating regulatory headwinds, and Dogecoin grappling with market dynamics, April promises to be a pivotal period for digital assets. Whether it's institutional adoption, regulatory clarity, or market sentiment driving price movements, one thing remains certain – the cryptocurrency market continues to captivate the imagination of investors worldwide.

展望未來:2024 年 4 月的見解和預測當我們進入加密貨幣市場的新月份時,機會與挑戰並存。隨著比特幣引領新高、Chainlink 應對監管逆風、狗狗幣努力應對市場動態,四月有望成為數位資產的關鍵時期。無論是機構採用、監管清晰度或推動價格變動的市場情緒,有一點是確定的:加密貨幣市場持續吸引全球投資者的想像。

Conclusion:

The cryptocurrency market's trajectory in 2024 is a testament to the ever-evolving nature of digital finance. With each milestone reached and hurdle overcome, the landscape continues to mature, presenting both opportunities and challenges for participants. As investors navigate the intricate web of market dynamics and regulatory landscapes, one thing remains certain: the digital currency revolution is far from over, with countless chapters yet to be written.

結論:2024 年加密貨幣市場的軌跡證明了數位金融不斷發展的本質。隨著每個里程碑的實現和障礙的克服,格局不斷成熟,為參與者帶來了機會和挑戰。當投資者在錯綜複雜的市場動態和監管環境網絡中航行時,有一件事仍然是確定的:數位貨幣革命還遠未結束,還有無數的篇章有待書寫。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

- 比特幣 (BTC) 升至 75,000 美元以上的歷史新高,山寨幣也加入其中

- 2024-11-07 10:35:01

- 領先的加密貨幣對唐納德·川普的總統勝利豎起大拇指,期待白宮更加友好。

-

-

-

- 唐納德·川普在美國大選中擊敗卡馬拉·哈里斯,實現最偉大的政治逆轉

- 2024-11-07 10:20:02

- 這本應是一場刀鋒上的美國大選,一場勢均力敵、難以預測的競爭。

-

-

-