|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BlackRock's Crypto Playbook: A Selective Focus in a Vast Ocean

貝萊德的加密貨幣手冊:浩瀚海洋中的選擇性焦點

Is BlackRock Playing It Too Safe in Crypto?

貝萊德在加密領域玩得太安全了嗎?

BlackRock, the asset management behemoth, is making waves in the cryptocurrency waters, but it's doing so with a selective compass. The digital asset landscape is a vast and volatile expanse, with Bitcoin and Ethereum dominating the market and capturing the lion's share of attention. However, Robert Mitchnick, BlackRock's Head of Digital Assets, recently unveiled the company's strategic focus within this burgeoning sector.

資產管理巨頭貝萊德正在加密貨幣領域掀起波瀾,但它的做法是有選擇性的。數位資產格局廣闊且不穩定,比特幣和以太坊主導市場並吸引了大部分注意力。然而,貝萊德數位資產主管羅伯特·米奇尼克最近宣布了該公司在這一新興領域的戰略重點。

According to Mitchnick, while the crypto community craves a diverse menu of products, BlackRock's gaze remains primarily fixed on Bitcoin, with a modest nod towards Ethereum and barely a glance at the rest. This selective approach has raised questions among industry observers, who wonder if BlackRock is missing out on the potential of other promising cryptocurrencies.

米奇尼克表示,雖然加密貨幣社群渴望多樣化的產品,但貝萊德的目光仍主要集中在比特幣上,對以太坊略有點頭,幾乎不看其他產品。這種選擇性方法引起了行業觀察人士的質疑,他們想知道貝萊德是否錯過了其他有前途的加密貨幣的潛力。

BlackRock's Cautious Journey into Crypto's Depths

貝萊德在加密貨幣領域的謹慎之旅

BlackRock's foray into the cryptocurrency realm is not a sudden whim. It's a calculated journey that began as early as 2016, when the digital currency space was still in its infancy. Mitchnick's narrative highlights a dynamic strategy that has evolved in tandem with the crypto ecosystem's growth over the years. This evolution reflects BlackRock's approach to becoming a stalwart in the space, balancing innovation with caution.

貝萊德進軍加密貨幣領域並不是一時興起。這是一個精心策劃的旅程,早在 2016 年就開始了,當時數位貨幣領域還處於起步階段。米奇尼克的敘述強調了多年來隨著加密生態系統的發展而演變的動態策略。這種演變反映了貝萊德成為該領域中堅力量的方法,謹慎地平衡創新。

Demystifying Crypto for Investors: BlackRock's Educational Mission

為投資人揭秘加密貨幣:貝萊德的教育使命

The dialogue around cryptocurrency at BlackRock is not confined to mere speculation. It's a comprehensive discourse that spans the spectrum of client sophistication. From seasoned investors to novices, the conversations traverse the basics of blockchain technology to intricate market dynamics and portfolio considerations. This educational endeavor by BlackRock signifies a broader commitment to demystifying the crypto space for its clientele, ensuring they're well-informed to make prudent investment decisions.

貝萊德圍繞加密貨幣的對話不僅限於猜測。這是一個涵蓋客戶複雜程度範圍的全面論述。從經驗豐富的投資者到新手,對話涵蓋了區塊鏈技術的基礎知識、複雜的市場動態和投資組合考慮。貝萊德的這項教育活動標誌著其更廣泛的承諾,即為其客戶揭開加密貨幣領域的神秘面紗,確保他們充分了解情況以做出審慎的投資決策。

The Investors' Compass: Navigating through Bitcoin and Beyond

投資者的指南針:穿越比特幣及其他領域

The pivot towards Bitcoin, particularly through the lens of BlackRock's IBIT offering, underscores a significant trend. Investors, both new and those reevaluating their crypto holdings, are increasingly gravitating towards Bitcoin. This shift isn't just about diversification. It's a quest for understanding the inherent risks and potential rewards, aiming to integrate these digital assets into a broader, well-rounded portfolio.

轉向比特幣,尤其是透過貝萊德 IBIT 產品的視角,凸顯了一個重要趨勢。投資者,無論是新投資者還是重新評估其持有的加密貨幣的投資者,都越來越傾向於比特幣。這種轉變不僅僅是多元化。這是對固有風險和潛在回報的探索,旨在將這些數位資產整合到更廣泛、更全面的投資組合中。

However, the discourse isn't solely fixated on Bitcoin. Ethereum gets its share of the spotlight, albeit to a lesser extent, reflecting a cautious yet open-minded approach to portfolio expansion within the crypto domain. As the conversation around cryptocurrency matures, the next big milestones for Bitcoin and its digital counterparts remain a topic of fervent speculation.

然而,討論不僅僅集中在比特幣上。以太坊也受到了人們的關注,儘管程度較小,這反映出加密領域內投資組合擴張的謹慎而開放的態度。隨著圍繞加密貨幣的討論日趨成熟,比特幣及其數位貨幣的下一個重大里程碑仍然是人們熱切猜測的話題。

What's the Next Big Moment for Crypto?

加密貨幣的下一個重要時刻是什麼?

Mitchnick, however, steers away from pinpointing a singular event or development as the pivotal moment for the industry. Instead, he suggests a gradual, yet inevitable, progression fueled by increasing institutional comfort and sophistication, alongside a deepening collective understanding of the asset class.

然而,米奇尼克並沒有將單一事件或發展確定為行業的關鍵時刻。相反,他建議透過不斷提高制度舒適性和複雜性以及加深對資產類別的集體理解來推動漸進但不可避免的進步。

BlackRock's Calculated Strategy: Focus on Bitcoin, Eye Ethereum

貝萊德深思熟慮的策略:關注比特幣、關注以太坊

The scene at the bustling Bitcoin Investor Day in New York, as recounted by Mitchnick, is just a glimpse into the broader journey BlackRock is embarking on within the crypto industry. Amidst a packed schedule and the anticipation of further insights on stage, the firm's strategy appears both clear and calculated: Focus on Bitcoin, eye Ethereum, and proceed with caution as the crypto universe expands.

正如米奇尼克所描述的那樣,紐約熙熙攘攘的比特幣投資者日的場景只是貝萊德在加密行業中開啟的更廣泛旅程的一瞥。在排得滿滿的日程和舞台上進一步見解的預期中,該公司的戰略顯得既清晰又經過深思熟慮:專注於比特幣,關注以太坊,並隨著加密貨幣宇宙的擴張而謹慎行事。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- 狗狗幣 (DOGE) 價格預測:分析師預計 2025 年將大幅上漲

- 2024-12-28 12:25:02

- 分析師對 2025 年狗狗幣大幅上漲的可能性感到興奮,有些人認為它將遠遠超過 2021 年的巨大漲幅。

-

-

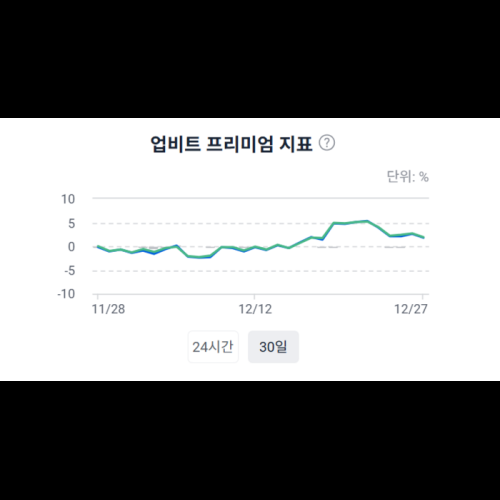

- 境內外交易所價差擴大,比特幣溢價指數創一個月新高

- 2024-12-28 12:25:02

- 比特幣價格上漲過程中發現,國內外交易所市價差不斷拉大,近期突破1.5億韓元。

-

-

-

- 本週最值得購買的 3 種新 Meme 硬幣

- 2024-12-28 12:25:02

- 隨著過去幾年的流行,模因幣已經從小眾笑話變成了合法的市場推動者。

-

-

-

- 狗狗幣 (DOGE) 在 TD Sequential 和鯨魚供應方面看到了積極信號

- 2024-12-28 10:55:01

- 一位分析師指出,狗狗幣最近觀察到的兩個指標模式可能對其價格有利。