|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

貝萊德的比特幣 ETF(IBIT)自 1 月以來已吸引了 150 億美元資金,60 家實體合計持有 0.4% 的股份。儘管出現這種成長,但大多數持股規模相對較小,超過三分之二的實體持有價值不到 100 萬美元的 IBIT 股票。這表明比特幣被用作投資組合的小額補充,而不是重要的配置。

BlackRock's Bitcoin ETF Witnesses $15 Billion Inflow Amidst Limited Institutional Participation

貝萊德比特幣 ETF 在機構參與有限的情況下流入 150 億美元

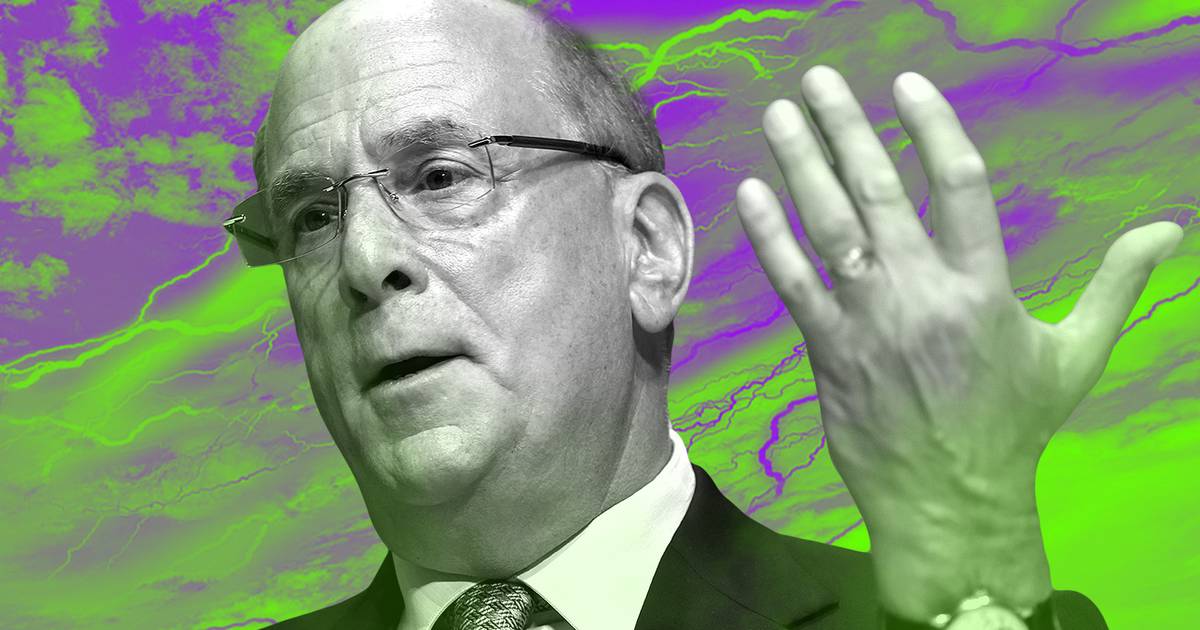

BlackRock's iShares Bitcoin Trust (IBIT), the first spot Bitcoin ETF approved by the Securities and Exchange Commission (SEC), has experienced a significant surge in assets under management since its inception in January 2023. As of the latest quarterly statements, IBIT has garnered over $15 billion in investor inflows.

貝萊德旗下 iShares 比特幣信託 (IBIT) 是美國證券交易委員會 (SEC) 批准的首隻現貨比特幣 ETF,自 2023 年 1 月成立以來,管理資產大幅飆升。 150億美元的投資者流入。

However, a recent analysis by Bloomberg Intelligence analyst Eric Balchunas reveals a nuanced picture of the ETF's investor base. While the ETF has undoubtedly attracted a wide range of investors, its ownership remains concentrated among a relatively small number of entities.

然而,彭博資訊 (Bloomberg Intelligence) 分析師 Eric Balchunas 最近的一項分析揭示了 ETF 投資者基礎的微妙情況。儘管該 ETF 無疑吸引了廣泛的投資者,但其所有權仍然集中在相對少數的實體手中。

According to Balchunas' analysis of 13F filings, which disclose institutional holdings, approximately 60 entities account for a mere 0.4% of IBIT's outstanding shares. Notably, the majority of these entities, roughly two-thirds, own less than $1 million worth of IBIT shares.

根據 Balchunas 對揭露機構持股的 13F 文件的分析,約 60 家實體僅佔 IBIT 流通股的 0.4%。值得注意的是,這些實體中的大多數(大約三分之二)擁有價值不到 100 萬美元的 IBIT 股票。

"Shows that most of the bites are nibbles but there are a lot of fish," Balchunas remarked, underscoring the presence of numerous small-scale investors within the ETF's investor base.

巴爾丘納斯表示:「這表明大部分咬傷都是小口咬的,但也有很多魚。」他強調了 ETF 投資者群體中存在眾多小規模投資者。

The findings suggest that while IBIT has successfully introduced Bitcoin to a broader audience, institutional adoption remains relatively limited. Instead, the ETF appears to be utilized by many investors as a complementary asset to their existing portfolios, much like "hot sauce" added to enhance flavor.

調查結果表明,雖然 IBIT 已成功將比特幣介紹給更廣泛的受眾,但機構採用仍然相對有限。相反,許多投資者似乎將 ETF 作為其現有投資組合的補充資產,就像添加“辣醬”來增強風味。

Quattro Advisors, a Pittsburgh-based registered investment company, represents the largest investor in IBIT with approximately $19 million worth of shares, accounting for roughly 5% of its total holdings. The firm's substantial investment in Bitcoin highlights the growing acceptance of the cryptocurrency among a subset of financial professionals.

Quattro Advisors 是一家總部位於匹茲堡的註冊投資公司,是 IBIT 的最大投資者,擁有價值約 1,900 萬美元的股票,約佔其總持股的 5%。該公司對比特幣的大量投資凸顯了部分金融專業人士對加密貨幣的接受程度不斷提高。

Balchunas notes that IBIT's investor profile aligns with the widespread use of the 60/40 investment strategy, where a portfolio consists of approximately 60% stocks and 40% bonds. Many investors are seeking to allocate a small portion of their portfolios to Bitcoin as a potential diversifier and source of return enhancement.

Balchunas 指出,IBIT 的投資者概況與廣泛使用的 60/40 投資策略一致,該策略的投資組合由大約 60% 的股票和 40% 的債券組成。許多投資者正在尋求將其投資組合的一小部分分配給比特幣,作為潛在的多元化工具和回報增強的來源。

The launch of IBIT has been a transformative moment for the Bitcoin market, providing investors with a regulated and convenient way to access the cryptocurrency. However, the ETF's investor composition reveals that institutional adoption remains in its nascent stages. As the market evolves, it remains to be seen whether IBIT will attract larger institutional investors, ultimately leading to a broader embrace of Bitcoin within traditional financial institutions.

IBIT 的推出是比特幣市場的變革時刻,為投資者提供了一種受監管且便捷的方式來獲取加密貨幣。然而,該 ETF 的投資者組成表明,機構採用仍處於初級階段。隨著市場的發展,IBIT是否會吸引更大的機構投資者,最終導致傳統金融機構更廣泛地接受比特幣,還有待觀察。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- Bitget將BGB應用擴展到鏈上生態系統

- 2024-12-27 01:30:02

- 為了為用戶創建一個功能性生態系統,Bitget 公開宣布將其代幣 BWB 與不斷增長的 BGB 代幣整合。

-

-

-

-

-

-

-

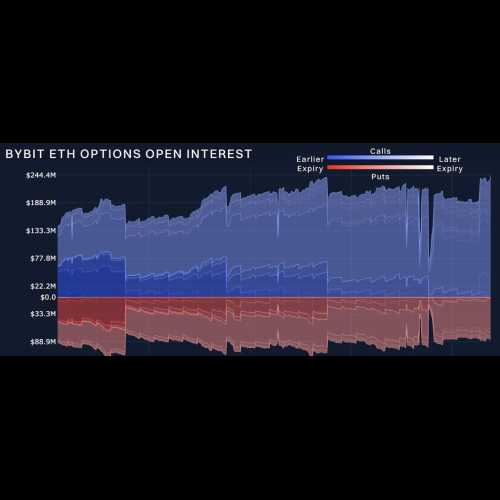

- 市場在年底選擇權到期前表現出彈性:Bybit x Block Scholes 加密衍生性商品報告

- 2024-12-27 01:05:02

-