|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency is currently experiencing a liquidity slump, with traders waiting for a breakout to trigger market activity. According to analysts, Bitcoin holders are sitting on the sidelines until a clearer market direction emerges.

加密貨幣目前正經歷流動性下滑,交易者等待突破以觸發市場活動。分析師表示,在出現更清晰的市場方向之前,比特幣持有者將採取觀望態度。

On Oct. 9, Glassnode head analyst James Check highlighted this point in an X post, stating, "Investors need a new price range to re-awaken supply." He also noted that Bitcoin's sell-side risk ratio is trading "deep into the low liquidity zone."

10 月 9 日,Glassnode 首席分析師 James Check 在 X 帖子中強調了這一點,他表示:“投資者需要一個新的價格範圍來重新喚醒供應。”他還指出,比特幣的賣方風險比率正在「深入低流動性區域」。

As Check further explained, "The vast majority of coins moving around onchain are NOT booking large profit, nor loss."

正如 Check 進一步解釋的那樣,“絕大多數在鏈上流通的代幣都沒有獲得巨額利潤,也沒有損失。”

In periods of Bitcoin price consolidation, experienced traders often prefer to sit out and wait for a stronger market signal before making a move, Cointelegraph reported.

根據 Cointelegraph 報道,在比特幣價格盤整期間,經驗豐富的交易者通常更願意觀望,等待更強勁的市場訊號,然後再採取行動。

"Best to wait for confirmation in times like these," Daan Crypto Trades noted on Oct. 9. Both scenarios are still possible, according to Check, who suggested that the market could be setting up "for either a الكبير sell-off event to create capitulation level fear, or a الكبير rally to restart the profit taking engines."

Daan Crypto Trades 於10 月9 日指出,「在這樣的時期,最好等待確認。」Check 表示,這兩種情況仍然有可能,他表示,市場可能正在準備「要么出現一場拋售事件,要么出現一場拋售事件」。製造投降等級的恐懼,或透過股市反彈來重啟獲利了結引擎。”

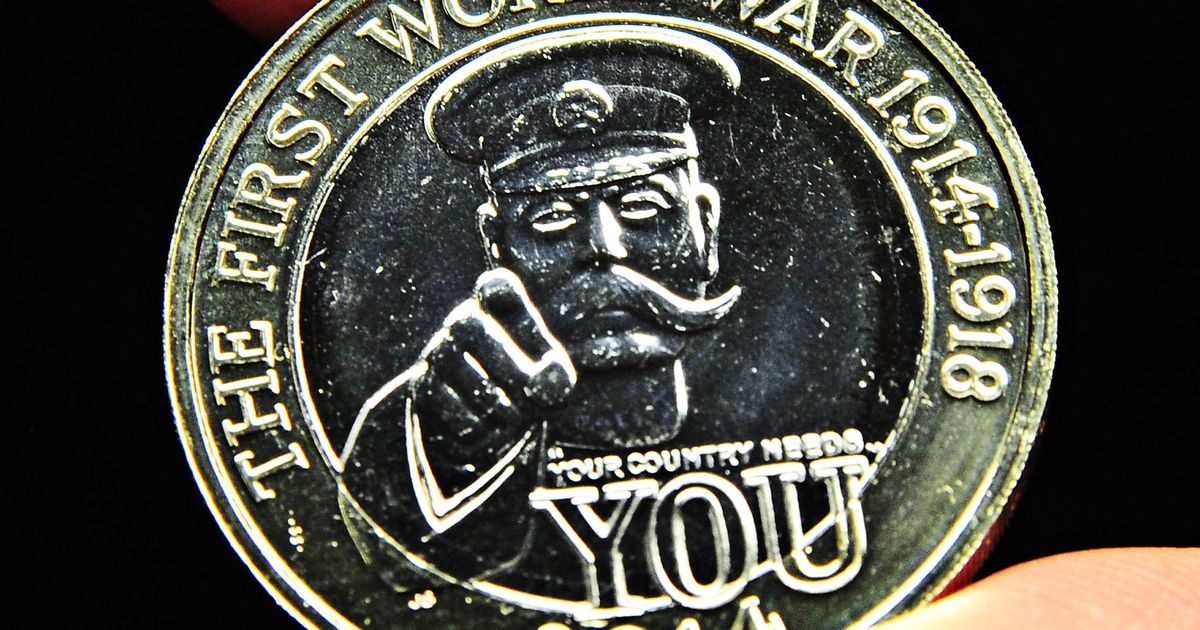

Meanwhile, Check's analysis also showed that long-term holders, sometimes referred to as "old hands," are largely sitting on their Bitcoin. Those who have held for 182 days or more are displaying the highest level of passivity.

同時,Check 的分析也表明,長期持有者(有時被稱為「老手」)大部分都持有比特幣。那些持有 182 天或以上的人表現出最高程度的被動性。

"As it stands, Old hands are sitting on their coins, with volumes aged 6 months and older being remarkably dormant," Check noted.

Check 指出:“就目前情況而言,老手們都坐在他們的硬幣上,6 個月及以上的硬幣數量明顯處於休眠狀態。”

On the other hand, Bitcoin holders with a holding period of 155 days or less are sitting on an unrealized loss at current BTC price levels, Bitbo data shows.

另一方面,Bitbo 數據顯示,以當前 BTC 價格水平,持有期限為 155 天或更短的比特幣持有者正面臨未實現的損失。

The average price at which short-term investors have purchased Bitcoin, also known as the short-term holder realized price, is $62,426, according to the latest available data.

根據最新數據,短期投資者購買比特幣的平均價格(也稱為短期持有者實現價格)為 62,426 美元。

Several crypto analysts have highlighted indicators suggesting that Bitcoin price is likely to break out of its consolidation zone soon.

幾位加密貨幣分析師強調了一些指標,顯示比特幣價格可能很快就會突破盤整區域。

"Bitcoin consolidation setting up for a الكبير move. Lower time frame support holding strong. Expecting a breakout soon," blockchain investor Ash Crypto noted in a post on Oct.10.

區塊鏈投資者 Ash Crypto 在 10 月 10 日的一篇文章中指出,“比特幣整合為進一步的走勢做好了準備。較低的時間框架支撐保持強勁。預計很快就會突破。”

Moreover, investor Mike Alfred's analysis pointed to a potential breakout in either direction, with a close above $61,000 signaling a move toward $65,000 and a drop below $57,000 setting the stage for a slide to $52,000.

此外,投資者麥克·阿爾弗雷德(Mike Alfred)的分析指出,任何方向都有可能突破,收盤價高於61,000美元預示著價格將走向65,000美元,跌破57,000美元則為跌至52,000美元奠定了基礎。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

-

-

- 比特幣(BTC)價格預測:漲勢會持續嗎?

- 2024-11-15 00:20:02

- 11 月 14 日星期四,比特幣 (BTC) 交易價格為 91,200 美元,今年迄今漲幅達 115%。

-

-

-

-