|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在比特幣減半事件中,礦工成為了意想不到的受益者。 Riot Platforms 本週上漲 36.3%,Marathon Digital 上漲 20.1%,Cipher Mining 上漲 20.3%。雖然減半通常會減少區塊獎勵,但同時也會減少挖礦市場的競爭,使實力更強的公司能夠利用更高的市場份額。

Bitcoin's Halving Unlocks Unexpected Benefits for Miners, Despite Income Statement Impact

儘管影響損益表,比特幣減半仍為礦工帶來了意想不到的好處

Bitcoin's (CRYPTO: BTC) much-anticipated halving event has concluded, and surprisingly, it has ushered in a wave of optimism for miners, despite the potential impact on their revenue streams.

比特幣(CRYPTO:BTC)備受期待的減半事件已經結束,令人驚訝的是,它給礦工帶來了一波樂觀情緒,儘管這可能對其收入流產生影響。

Miners Emerge as Unlikely Beneficiaries

礦工成為不太可能的受益者

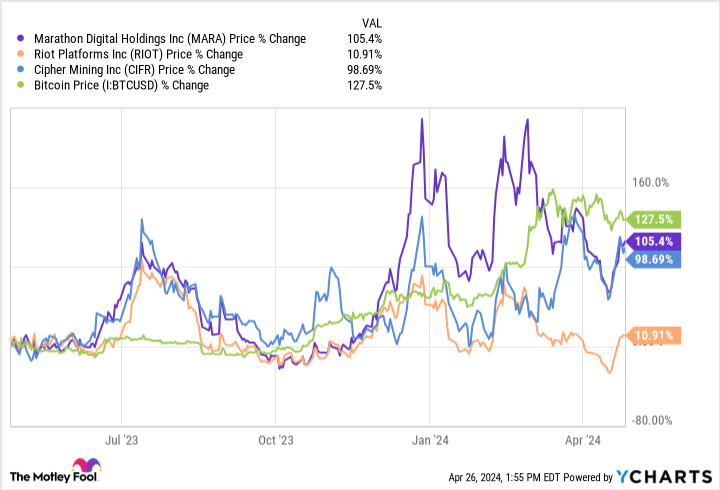

Data from S&P Global Market Intelligence reveals a surge in stock prices for publicly traded miners. Riot Platforms (NASDAQ: RIOT) emerged as the biggest winner, soaring by an astonishing 36.3% this week. Marathon Digital (NASDAQ: MARA) followed closely behind, gaining 20.1%, while Cipher Mining (NASDAQ: CIFR) experienced a 20.3% increase. As of 2 p.m. ET Friday, these stocks had risen by 33.1%, 17.8%, and 19%, respectively.

標準普爾全球市場情報的數據顯示,上市礦商的股價飆升。 Riot Platforms(NASDAQ:RIOT)成為最大贏家,本週飆升了驚人的 36.3%。 Marathon Digital(納斯達克股票代碼:MARA)緊隨其後,上漲 20.1%,而 Cipher Mining(納斯達克股票代碼:CIFR)則上漲 20.3%。截至下午 2 點截至週五東部時間,這些股票分別上漲了 33.1%、17.8% 和 19%。

Understanding the Halving's Dynamics

了解減半的動態

Bitcoin's halving event, which occurs approximately every four years, involves a significant reduction in the block reward for miners. In this instance, the reward was cut nearly in half. Theoretically, this should lead to a decline in revenue for miners, as they receive fewer Bitcoins per block.

比特幣減半事件大約每四年發生一次,導致礦工的區塊獎勵大幅減少。在這種情況下,獎勵幾乎減少了一半。從理論上講,這應該會導致礦工的收入下降,因為他們每個區塊收到的比特幣更少。

However, the reality is more nuanced. With fewer competitors entering the market, miners with low margins may find themselves forced out, leaving stronger companies to capitalize on the remaining market share. This consolidation, coupled with a potential rise in the price of Bitcoin, could pave the way for increased profits.

然而,現實情況更加微妙。隨著進入市場的競爭對手減少,利潤率低的礦商可能會發現自己被迫退出,讓實力更強的公司利用剩餘的市佔率。這種整合,加上比特幣價格的潛在上漲,可能為增加利潤鋪路。

Historical Precedent and Market Speculation

歷史先例與市場猜測

Historically, Bitcoin's halving events have coincided with sharp increases in its price. This is attributed partly to market speculation and partly to the fact that the halving requires a higher price to maintain block production profitability.

從歷史上看,比特幣減半事件與其價格急劇上漲同時發生。這部分歸因於市場投機,部分歸因於減半需要更高的價格來維持區塊生產的獲利能力。

However, it remains uncertain whether this trend will continue. The exponential growth in computing power and energy consumption required for Bitcoin mining has made it increasingly capital-intensive, requiring hundreds of millions of dollars in investment.

然而,這種趨勢是否會持續仍不確定。比特幣挖礦所需的算力和能源消耗呈指數級增長,使其資本日益密集,需要數億美元的投資。

Challenges Ahead for Miners

礦工面臨的挑戰

Despite the potential for increased market share, miners face ongoing challenges that could hinder their profitability. The rising interest rate environment and escalating utility costs add significant headwinds to their operating expenses.

儘管市場份額有增加的潛力,但礦商仍面臨著可能阻礙其獲利能力的持續挑戰。不斷上升的利率環境和不斷上升的公用事業成本給他們的營運支出帶來了巨大的阻力。

Moreover, the competition for computational power is expected to intensify, further pressuring revenue streams. The rising price of Bitcoin is the ultimate antidote, but even that has its limits. Bitcoin's market capitalization is currently $1.3 trillion, and much of the tailwinds from ETF approvals have dissipated.

此外,計算能力的競爭預計將加劇,進一步給收入帶來壓力。比特幣價格上漲是最終的解藥,但即便如此也有其限制。比特幣的市值目前為 1.3 兆美元,ETF 批准帶來的大部分推動力已經消散。

Investor Outlook and Alternative Opportunities

投資者前景和替代機會

Investors should closely monitor both the price of Bitcoin and the operating costs faced by miners. The Motley Fool Stock Advisor analyst team has identified 10 stocks that they believe have the potential to generate exceptional returns in the coming years. Notably, Riot Platforms is not among these recommended investments.

投資者應密切注意比特幣的價格和礦商面臨的營運成本。 Motley Fool Stock Advisor 分析師團隊已經確定了 10 隻股票,他們認為這些股票有潛力在未來幾年產生非凡的回報。值得注意的是,Riot Platforms 並不在這些推薦投資之列。

Given the uncertainties surrounding Bitcoin mining and the potential for substantial losses during market downturns, some investors may prefer to explore alternative investment options with a proven track record of success.

考慮到比特幣挖礦的不確定性以及市場低迷期間可能造成的巨額損失,一些投資者可能更願意探索具有成功記錄的替代投資選擇。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

- SpacePay旨在改善我們的發送和接收方式,針對日常用戶

- 2025-05-09 17:00:12

- 許多加密解決方案都試圖改善我們的寄出和收入方式,但是當涉及現實世界可用性時,大多數解決方案都缺乏。

-

- 我們都被敦促檢查我們的更改是否稀有2英鎊的硬幣,價值超過500英鎊

- 2025-05-09 17:00:12

- 專家強調了稀有的硬幣,稀有的硬幣仍被認為是流通的,並且具有使其非常有價值的錯誤。

-

-

- DN礦工免費云採礦平台已成為方便購買比特幣和Dogecoin的理想選擇

- 2025-05-09 16:55:13

- 隨著數字貨幣的快速發展,對加密資產的高效和安全收購已成為投資者的重點。

-

-

-