|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在最近的市場動盪中,比特幣價格下跌與美國現貨比特幣 ETF 的資金流出有關。然而,彭博分析師 Eric Balchunas 提出了相反的觀點,強調這些資金流出相對較小,僅佔 ETF 淨流入的 1%,僅佔管理資產的 0.4%。

Amid the relentless turbulence that has enveloped the cryptocurrency market, the recent downturn in Bitcoin prices has garnered widespread attention. Analysts and market observers have scrutinized the correlation between this price decline and outflows from the United States Spot Bitcoin Exchange-Traded Fund (ETF). However, a fresh perspective has emerged from Eric Balchunas, a seasoned ETF analyst at Bloomberg. His assessment, which offers a beacon of hope in the face of uncertainty, underscores the comparatively inconsequential nature of these outflows.

在加密貨幣市場持續動盪的背景下,近期比特幣價格的低迷引起了廣泛關注。分析師和市場觀察家仔細研究了價格下跌與美國現貨比特幣交易所交易基金(ETF)資金流出之間的相關性。然而,彭博社經驗豐富的 ETF 分析師 Eric Balchunas 提出了一個新的觀點。他的評估為面對不確定性提供了希望的燈塔,強調了這些資金外流相對無關緊要的性質。

Balchunas, in his meticulous analysis, emphasizes that the recent outflows from the Bitcoin ETF do not warrant undue alarm. He substantiates this assertion with several cogent observations. Firstly, he notes that these outflows constitute a minuscule fraction of the Bitcoin ETF's net inflows since its inception, amounting to a mere 1%. With characteristic understatement, Balchunas has aptly characterized the current outflow as "microscopic."

Balchunas 在細緻的分析中強調,近期比特幣 ETF 的資金流出並不值得過度恐慌。他用幾個令人信服的觀察結果證實了這個斷言。首先,他指出,這些資金流出僅佔比特幣 ETF 自成立以來淨流入的一小部分,僅佔 1%。巴爾丘納斯以特有的輕描淡寫的方式,恰當地將當前的資金外流描述為「微觀的」。

Furthermore, Balchunas provides a broader context by examining the assets under management (AUM) of the Bitcoin ETF. The outflows, when viewed in this light, represent a negligible 0.4%. Additionally, he clarifies that the net outflows are primarily attributable to the Grayscale Bitcoin Trust (GBTC), while other ETFs have actually experienced inflows.

此外,Balchunas 透過檢查比特幣 ETF 的管理資產 (AUM) 提供了更廣泛的背景。從這個角度來看,資金流出量僅佔 0.4%,可以忽略不計。此外,他澄清說,淨流出主要歸因於灰階比特幣信託基金(GBTC),而其他 ETF 實際上已經出現了流入。

Balchunas also addresses the recent price drop in Bitcoin, positing that it is primarily driven by existing Bitcoin holders rather than institutional investors. Despite this downturn, he underscores Bitcoin's impressive long-term performance, particularly in comparison to traditional assets such as the Invesco QQQ.

Balchunas 也談到了最近比特幣價格下跌的問題,認為這主要是由現有比特幣持有者而非機構投資者推動的。儘管經濟低迷,他還是強調了比特幣令人印象深刻的長期表現,特別是與 Invesco QQQ 等傳統資產相比。

In light of these insights, it is imperative to maintain a balanced perspective regarding the recent developments in the cryptocurrency market. While market fluctuations are an inherent aspect of investing, it is crucial to avoid knee-jerk reactions and instead rely on rational analysis when making investment decisions. The insights provided by Balchunas serve as a timely reminder that even during periods of uncertainty, a measured and informed approach is essential for navigating the complexities of the financial markets.

鑑於這些見解,必須對加密貨幣市場的近期發展保持平衡的看法。雖然市場波動是投資的一個固有方面,但在做出投資決策時避免下意識反應並依靠理性分析至關重要。巴爾丘納斯提供的見解及時提醒我們,即使在不確定時期,謹慎而明智的方法對於應對金融市場的複雜性也至關重要。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- 比特幣 (BTC) ETF 節日後恢復正值

- 2024-12-28 08:35:01

- 2024 年可以說是比特幣史上最有趣的一年之一。 2025 年也會一樣好嗎?

-

-

-

-

- BTFD幣預售優勢,貓狗世界穩定上升,小狗狗幣成為最值得購買的加密貨幣預售

- 2024-12-28 08:35:01

- 當市場暴跌時,精明的投資者就會立即介入。豐厚的回報。

-

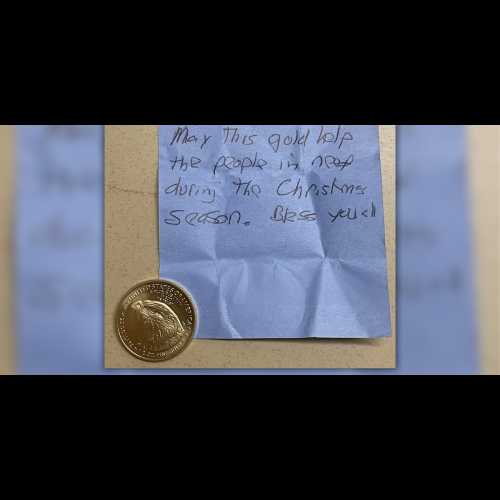

- 亞利桑那州救世軍志工在紅水壺底部發現半盎司美國鷹金幣

- 2024-12-28 08:35:01

- 鳳凰城救世軍雷和瓊克羅克中心表示,其標誌性的紅色水壺收到了一枚半盎司美國鷹金幣的捐贈。

-

-

-

- W Token (W):您的下一個加密貨幣大機會?

- 2024-12-28 08:25:02

- 加密貨幣正在改寫財富創造規則,W Token(W)正在成為 DeFi 領域的潛在明星。