|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密貨幣新聞文章

Bitcoin and Crypto Prices Crash as Elon Musk Issues Surprise Bitcoin Price Warning

2025/01/09 16:31

The price of bitcoin has fallen sharply after Tesla billionaire Elon Musk warned that the cryptocurrency could be set for a sell-off in late March.

Despite a Wall Street investment bank making a massive bet on a bitcoin game-changer, the world's biggest cryptocurrency dropped to around $92,000 on Friday, down from a high of over $100,000 earlier this week.

Now, as the bitcoin and crypto market braces for an "imminent" Musk X bombshell, legendary crypto investor Arthur Hayes has predicted that the bitcoin price and crypto market will crash in late March.

California Wildfire Live Updates: Officials Say 5 Dead As Another Fire Breaks Out In Hollywood Hills

5 Reasons Why The Los Angeles Wildfires Are The Start Of A New Normal

Port Workers Avoid Potential Major Strike—What To Know As Union Reaches Deal With Port Operators

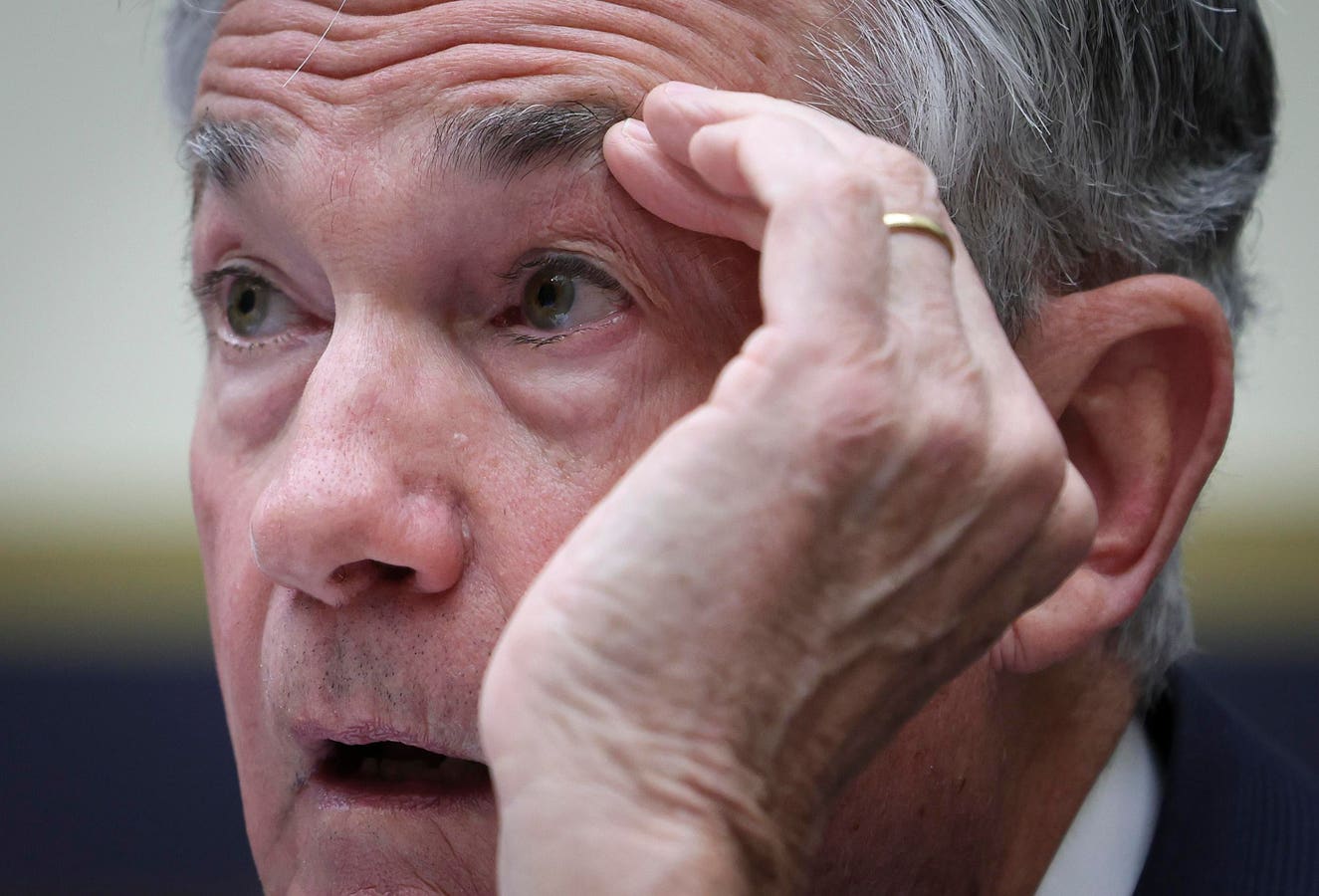

Federal Reserve chair Jerome Powell is predicted to help support the bitcoin price until the end of ... [+] the first quarter of 2025.

"Right on schedule, just like almost every other year, it will be time to sell in the late stages of the first quarter ... and wait for positive fiat liquidity conditions to re-emerge in the third quarter," wrote Hayes, a cofounder of bitcoin and crypto derivatives pioneer BitMex who went on to set up the Maelstrom investment fund, in a blog post.

The price of bitcoin and the crypto market rallies as dollar liquidity increases and falls as dollar liquidity declines, according to Hayes, who had earlier predicted the bitcoin price would collapse around incoming U.S. president Donald Trump's inauguration.

"I still believe that is a potential negative factor that could weigh upon the market in the short term, but against that, I must balance the dollar liquidity impulse," wrote Hayes. "Bitcoin, for now, jukes and jives as the pace of dollar emissions changes."

According to Hayes, the Treasury's general account will be close to being emptied towards the end of the first quarter, as the U.S. approaches the debt ceiling and the April 15 tax payment deadline.

The price of bitcoin has fallen this week as traders reassess the 2025 outlook for Federal Reserve interest rate cuts in light of the latest robust data showing the U.S. economy has remained strong.

The price of bitcoin has fallen back slightly but remains far higher than where it was a year ago.

"The Trump-dump that some had anticipated taking place after his inauguration as U.S. president has seemingly been fast-tracked as the cryptocurrency market dives deep into the red zone," said Petr Kozyakov, the chief executive of crypto payment platform Mercuryo, in emailed comments.

In December, Trump confirmed he plans to set up a U.S. bitcoin strategic reserve. "We're gonna do something great with crypto because we don’t want China, or anybody else … but others are embracing it, and we want to be ahead," Trump told CNBC.

"Markets are no longer euphoric over bitcoin entering a new age where even the U.S. will hold a strategic bitcoin reserve. Instead, bitcoin's role as an ultra risk-on, risk off asset has surfaced once again amid signs that the U.S. Federal Reserve may keep interest rates elevated for longer than previously expected."

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

- 比特幣的崛起:機構採用,法規清晰度和宏觀經濟因素推動了市場績效

- 2025-02-24 15:00:27

- 公司,政府,機構投資者和高淨值個人的持續興趣為比特幣的強勁市場表現做出了貢獻。

-

-

-

- 佛羅里達州的比特幣是否包含國家投資的未來?

- 2025-02-24 15:00:27

- 正如佛羅里達州認為接受比特幣進行國家投資的那樣,居民和企業可以開始將數字貨幣整合到日常生活中。

-

-

- Skale將於2月25日舉行網絡研討會,討論Unity 6和Skale如何增強遊戲開發

- 2025-02-24 15:00:27

- 該活動將重點介紹Web3技術的集成,以提供無縫和無天氣的遊戲體驗。

-