|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apex加密貨幣在周一早上的低點為97,791美元,然後在撰寫本文時回彈了100,000美元。

Bitcoin BTC/USD experienced a sharp decline on Monday morning, tumbling below the $98,000 mark. This significant drop of over 7% occurred amid a wider sell-off in the tech sector.

比特幣BTC/USD在周一早上經歷了急劇下降,低於98,000美元的成績。在技術領域的拋售中,這種大幅下降的速度超過7%。

The apex cryptocurrency reached a low of $97,791 on Monday morning, before rebounding to trade above $100,000 at the time of writing.

週一早上,Apex加密貨幣達到了97,791美元,然後在撰寫本文時反彈以超過100,000美元的貿易。

Among other major cryptocurrencies, Solana SOL/USD, BNB BNB/USD and Dogecoin DOGE/USD are trading down 11.5%, 4.4% and 11% respectively, according to data from CoinGecko.

根據Coingecko的數據,在其他主要加密貨幣中,Solana Sol/USD,BNB BNB/USD和Dogecoin Doge/USD分別下跌了11.5%,4.4%和11%。

What Happened: In a note sent to Benzinga, Geoffrey Kendrick of Standard Chartered said a 3% decline in Nasdaq futures drove the digital assets liquidation overnight.

發生的事情是:在發送給本辛加的一張紙條中,《憲章》的杰弗裡·肯德里克(Geoffrey Kendrick)表示,納斯達剋期貨的下降了3%,使數字資產一夜之間推動了清算。

Kendrick highlighted that Bitcoin’s correlation with the Nasdaq is significantly stronger than its correlation with gold.

肯德里克(Kendrick)強調,比特幣與納斯達克(Nasdaq)的相關性明顯高於其與黃金的相關性。

He noted that if the Nasdaq sell-off continues, particularly ahead of this week’s earnings releases, Bitcoin could approach a critical support level, specifically the average purchase level for Bitcoin ETFs since the presidential election, which now stands at $96,400.

他指出,如果納斯達克售罄繼續,尤其是在本週的收益發行之前,比特幣可以達到關鍵的支持水平,尤其是自總統大選以來比特幣ETF的平均購買水平,該總統大選現在為96,400美元。

According to data from CoinGlass, positions worth $883.9 million got liquidated over the last 24 hours, of which 811.3 million were long liquidations.

根據Coinglass的數據,價值8.839億美元的職位在過去24小時內被清算,其中81.113億次清算。

Kendrick also commented on the recent announcement from the Trump administration regarding a “digital stockpile,” instead of a “digital reserve,” which had led some in the community to believe that assets would be seized.

肯德里克(Kendrick)還評論了特朗普政府最近的關於“數字儲備”的消息,而不是“數字儲備”,這使社區中的一些人相信將扣押資產。

He noted that the executive order from the Trump administration will need congressional approval, which will take time.

他指出,特朗普政府的行政命令將需要國會批准,這將需要時間。

"The disappointment for me was two-fold," Kendrick said.

肯德里克說:“對我來說,失望是兩方面。”

He added that this disappointment has reduced the "hope phase" in the market, which could help it transition from "phase 1 to phase 2" in a list of Bitcoin market phases.

他補充說,這種失望減少了市場上的“希望階段”,這可以幫助其從比特幣市場階段列表中從“第1階段到第2階段”過渡。

Adding to the market uncertainty is the rise of China’s Deepseek AI model, according to QCP Capital.

QCP Capital稱,增加市場不確定性是中國DeepSeek AI模型的興起。

“A week into Trump’s presidency and BTC dipped back below $100,000 … as news of China’s Deepseek continue to spread from the weekend.”

“特朗普擔任總統的一周,而BTC下跌了100,000美元……隨著中國深表人的消息從周末開始蔓延。”

The firm highlighted that the Chinese AI technology could disrupt the U.S. equity markets and that the Trump administration may need to take retaliatory steps.

該公司強調,中國人工智能技術可能會破壞美國股票市場,而特朗普政府可能需要採取報復性步驟。

“The Chinese LLM poses a potential threat to US equity markets by disrupting U.S. AI dominance … We’ll have to wait and see what drastic measures his administration might take to save the US equity market.”

“中國LLM通過破壞我們的AI主導地位對美國股票市場構成了潛在的威脅……我們必須拭目以待,看看他的政府可能採取的巨大措施來拯救美國股票市場。”

QCP Capital further noted the market volatility surrounding the upcoming FOMC meeting this Thursday.

QCP Capital進一步指出,圍繞即將舉行的FOMC會議的市場波動。

Despite the current dip, QCP believes that Bitcoin will continue to trade within a range.

儘管目前下降了,QCP認為比特幣將繼續在一個範圍內進行交易。

They suggest that Bitcoin’s resilience will be tested this week and anticipate that “BTC should remain relatively resilient as it continues to trade in this familiar range.”

他們建議,本週將對比特幣的彈性進行測試,並預計“ BTC應該保持相對彈性,因為它繼續在這個熟悉的範圍內進行交易。”

What’s Next: The analysts at Standard Chartered and QCP Capital both suggest potential for a rebound.

接下來是:標準特許和QCP Capital的分析師都暗示了反彈的潛力。

Kendrick's analysis notes a significant drop in UST (United States Treasury) yields, which could mean the sell-off has reached its potential floor.

肯德里克(Kendrick)的分析指出,UST(美國財政部)的收益率顯著下降,這可能意味著拋售已經達到了潛在的地面。

Kendrick advises investors to "buy the dip."

肯德里克(Kendrick)建議投資者“購買蘸醬”。

Similarly, QCP suggests that “risk reversals remain skewed in favor of Calls only from March onwards,” signaling optimism beyond the immediate market turmoil, and that a potential Trump intervention could provide a catalyst for growth.

同樣,QCP建議“風險逆轉仍然偏向於從3月開始的呼籲”,這表明了超出市場動蕩的樂觀情緒,並且潛在的特朗普干預可以為增長提供催化劑。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

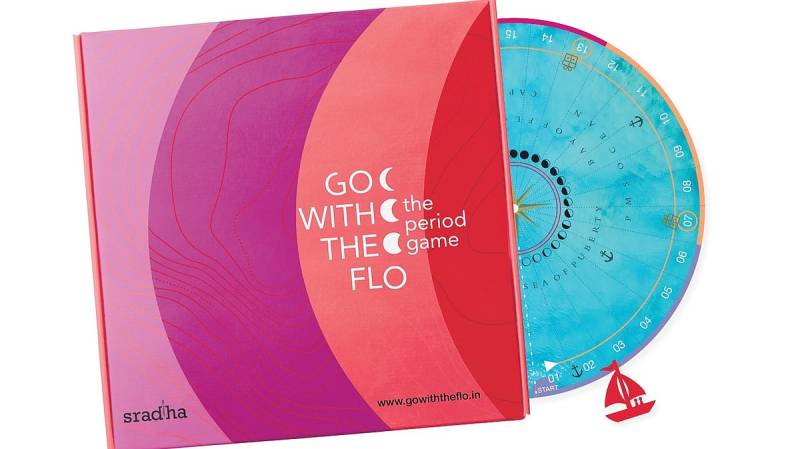

- “使用Flo”:一個簡化與月經有關的複雜主題的棋盤遊戲

- 2025-01-30 16:30:52

- 該遊戲具有超過60多個月經相關的術語,簡化了複雜的主題。 “最有意義的部分是看著我的兒子和他的同齡人在玩遊戲。

-

- 在黑客排幹他的幻影錢包之後

- 2025-01-30 16:30:52

- 禮物是在布蘭斯特特(Branstetter)的幻影錢包被黑客排幹兩天之後,以消滅660萬個UFD硬幣,價值約120萬美元

-

- 長期比特幣(BTC)持有人正在出售,這是看漲的標誌

- 2025-01-30 16:30:52

- 但是,根據觀察歷史趨勢的分析師的說法,敘述在加密貨幣市場上有所不同,在加密貨幣市場中,這種銷售表明了看漲。

-

-

-

- 比特幣在2024年的機構突破

- 2025-01-30 16:30:52

- 隨著機構採用的加速,比特幣去年達到了新的里程碑。現貨比特幣ETF的批准使主要財務參與者可以直接接觸BTC

-

-

- 硬幣Rush:Cred宣佈為期三天的獎勵節,成員可以在其中交換信用硬幣作為優質產品和經驗

- 2025-01-30 16:30:52

- 硬幣搶購使成員可以訪問硬幣的罕見和遙不可及的放縱。

-