|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Skybridge Capital的創始人兼執行合夥人Anthony Scaramucci在接受CNBC的採訪時重申了他對比特幣的信念。

Anthony Scaramucci, the founder and managing partner of Skybridge Capital, has once again expressed his belief that bitcoin is a valuable long-term strategic asset during an interview on CNBC.

Skybridge Capital的創始人兼執行合夥人Anthony Scaramucci再次表達了他的信念,即比特幣是CNBC採訪時有價值的長期戰略資產。

As the U.S. government prepares to allow bitcoin as part of its strategic reserves alongside traditional assets like gold and oil, Scaramucci praised the efforts to build bipartisan support for bitcoin and stablecoin legislation.

當美國政府準備允許比特幣與黃金和石油等傳統資產一起作為其戰略儲備的一部分時,Scaramucci讚揚為建立對比特幣和Stablecoin立法的兩黨支持的努力。

“If you look forward over the next three to six months, you’ll see a lot more institutional buying. And the fact that the United States is going to hold this asset means that other countries, Andrew, are going to end up buying this asset as well,” Scaramucci said in an interview with CNBC’s Andrew Ross Sorkin on Monday.

“如果您期待接下來的三到六個月,您會發現更多的機構購買。 Scaramucci在周一接受CNBC的Andrew Ross Sorkin採訪時說:“美國將持有這一資產的事實意味著安德魯最終也將最終購買該資產。”

However, Scaramucci acknowledged that older investors and policymakers might not understand, but the U.S. needs to adapt as other countries, like China, are also planning to increase their bitcoin holdings. He added that a failure to do so could leave the U.S. in a worse position.

但是,Scaramucci承認,年長的投資者和政策制定者可能不了解,但是美國需要適應其他國家,例如中國,也計劃增加其比特幣持有量。他補充說,失敗可能會使美國處於更糟糕的位置。

Moreover, Scarucci highlighted the efforts of Trump’s Crypto Czar David Sacks to integrate bitcoin at a governmental level, calling his approach “brilliant.”

此外,Scarucci強調了特朗普的加密沙皇大衛·薩克斯(David Sacks)在政府層面整合比特幣的努力,稱他的方法“出色”。

Addressing concerns about taxpayer funds being used to acquire bitcoin, Scaramucci clarified that the current strategy involves revenue-neutral methods. For instance, if the government seizes $1 billion in forfeited assets like cash, oil, or real estate from criminals, it could use a portion, say $500 million, to acquire bitcoin.

Scaramucci解決了對納稅人資金用於獲取比特幣的擔憂,Scaramucci澄清說,當前的策略涉及收入中立的方法。例如,如果政府從犯罪分子那里奪取了10億美元的沒收資產,例如現金,石油或房地產,則可以使用一部分(例如5億美元)購買比特幣。

This approach, Scaramucci explained, is no different from the government selling seized oil to replenish its strategic petroleum reserve or selling forfeited real estate to acquire another property. He emphasized that bitcoin could serve a similar function, rotating among approved financial institutions to generate interest income for the Treasury.

Scaramucci解釋說,這種方法與銷售扣押的石油以補充其戰略石油儲備或出售沒收的房地產以收購另一家財產的政府沒有什麼不同。他強調,比特幣可以發揮類似的功能,在批准的金融機構之間旋轉,以為財政部產生利息收入。

“If you believe what I believe—that this is a digital store of value and it’s equivalent to digital gold—when you go into the future 10 or 15 years from now, I do think the United States is going to want to have this as a reserve asset in order to maintain the stability of the dollar and the supremacy of the dollar,” Scaramucci added.

“如果您相信我所相信的 - 這是一個價值的數字存儲,相當於數字黃金 - 當您從現在開始10或15年後,我確實認為美國將希望將其作為儲備資產,以保持美元的穩定性和美元至上的美元,” Scaramucci補充說。

As fiat currencies like the dollar face inflationary pressures due to excessive supply, bitcoin stands in stark contrast with its limited supply of 21 million units. This scarcity makes bitcoin an attractive reserve asset as it maintains value despite inflation.

由於諸如Dollar這樣的法定貨幣由於供應過多而面臨通貨膨脹壓力,比特幣與其2100萬台單位的有限供應形成鮮明對比。這種稀缺性使比特幣成為有吸引力的儲備資產,因為它仍然具有通貨膨脹的價值。

Despite political divisions over digital assets, Scaramucci urged lawmakers to approach bitcoin ownership pragmatically. He highlighted the bipartisan efforts to pass legislation that would regulate stablecoins and provide the Treasury Department with limited authority to seize bitcoin from bad actors.

儘管有關於數字資產的政治分歧,但Scaramucci還是敦促立法者務實地對待比特幣所有權。他強調了雙方通過立法的努力,該立法將規範穩定幣,並為財政部提供有限的權力,可以從壞演員那里奪取比特幣。

Finally, Scaramucci encouraged more education on the subject, especially among older generations who might not be familiar with it. He concluded by reinforcing his belief that bitcoin is a crucial financial tool for the future, especially as the U.S. seeks to navigate the evolving landscape of global finance.

最後,Scaramucci鼓勵對該主題進行更多的教育,尤其是在可能不熟悉它的老年中。他的結論是強化了自己相信比特幣是未來的關鍵財務工具,尤其是當美國試圖瀏覽全球金融的不斷發展的景觀時。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 血月的月食可能是催化看漲逆轉的銀色襯裡

- 2025-03-12 02:55:48

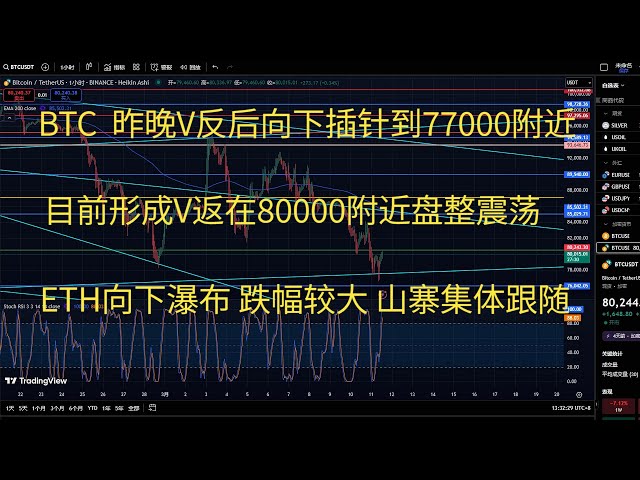

- 這種殘酷的拋售是由於比特幣(BTC)突然崩潰在周末低於80000美元。即將到來的血月月食可能是一線希望

-

- 隨著全球經濟滑坡,比特幣(BTC)泡沫正在破裂

- 2025-03-12 02:55:48

- 多年來,經濟預測者警告說,大流行後的繁榮是不可持續的。現在,裂縫正在顯示,數據清楚

-

- XRP價格預測:阿里·馬丁內斯(Ali Martinez

- 2025-03-12 02:50:48

- 廣泛關注的分析師和交易員阿里·馬丁內斯(Ali Martinez)依靠看漲,這是一個針對跨境支付的大型加密項目。

-

-

- Dawgz AI(DAGZ)是現在購買的最好的加密貨幣預售 - 這就是為什麼

- 2025-03-12 02:50:48

- 如果您正在尋找最好的加密貨幣預售,那麼您已經知道這筆交易 - 早期推動者得分最大。

-

- 最佳以太坊(ETH)競爭對手可以作為ETHBTC下降到4年低點

- 2025-03-12 02:50:48

- 加密貨幣市場仍然波動,以太坊的交易低於2,000美元,在最近的更正後面臨阻力。

-

-

-

- 加密貨幣市場正在恢復,XRP在價格回收2.1美元後成為人們關注的焦點。

- 2025-03-12 02:50:48

- 在大規模售罄的情況下,XRP開放興趣將其回收率在一小時內將1.66%轉移到13.9億硬幣。