|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Articles d’actualité sur les crypto-monnaies

Tech view by Sathvik Vishwanath, Co-Founder & CEO, Unocoin

Jan 08, 2025 at 01:29 pm

Did you know that the price of Bitcoin (CRYPTO: BTC) can change drastically within seconds? Such rapid price movements can make it difficult for investors to obtain accurate answers to their questions.

However, ETMarkets.com has got you covered with its curated list of courses on stock trading, technical analysis and more. These courses are designed to provide investors with the knowledge and skills they need to navigate the financial markets successfully.

Here's a snapshot of some of the top courses available on the platform:

Masterclass on Value Investing and Company Valuation: This course covers the fundamentals of value investing, including topics like financial statement analysis, company valuation and more. It's ideal for investors who want to learn how to identify undervalued stocks.

Kickstart Your F&O Adventure: This course is a beginner's guide to options trading, covering the basics of F&O markets, option strategies and practical applications. It's suitable for traders who want to enhance their understanding of options trading.

Technical Analysis for Everyone: This course provides a comprehensive overview of technical analysis, including candlestick patterns, chart formations, trading indicators and more. It's designed for traders who want to learn how to use technical analysis to make informed trading decisions.

Stock Markets Made Easy: This course covers the basics of the stock market, including topics like types of stocks, stock exchanges and more. It's ideal for beginners who want to gain a fundamental understanding of the stock market.

Renko Chart Patterns Made Easy: This course focuses on Renko charts, covering their construction, patterns and trading applications. It's suitable for traders who want to learn how to use Renko charts to identify trading opportunities.

An Insight into Trendlines and Momentum: This course covers the basics of trendlines, including their types, construction and use in technical analysis. It also discusses momentum indicators like RSI, Stochastics and MACD, and their applications in trading.

Mastering Sentiment Indicators for Swing and Positional Trading: This course provides an overview of sentiment indicators, including the VIX, Advance-Decline Line and Put-Call Ratio, and their use in swing and positional trading. It also covers topics like market internals and their applications in trading.

Dow Theory Made Easy: This course covers the basics of Dow Theory, including its principles, construction and applications in the stock market. It's suitable for traders who want to learn how to use Dow Theory to identify trading opportunities.

Market 103: Mastering Trends with RMI and Techno-Funda Insights: This course covers the basics of the Relative Momentum Index (RMI), including its construction, interpretation and applications in technical analysis. It also provides an overview of techno-funda trading and its use in the stock market.

ROC Made Easy: Master Course for ROC Stock Indicator: This course covers the basics of the Rate of Change (ROC) indicator, including its construction, interpretation and applications in technical analysis. It also provides an overview of different ROC variations and their use in the stock market.

Heikin Ashi Trading Tactics: Master the Art of Trading: This course covers the basics of Heikin Ashi candles, including their construction, patterns and applications in technical analysis. It also provides an overview of different Heikin Ashi trading tactics and their use in the stock market.

RSI Made Easy: RSI Trading Course: This course covers the basics of the Relative Strength Index (RSI) indicator, including its construction, interpretation and applications in technical analysis. It also provides an overview of different RSI variations and their use in the stock market.

Introduction to Technical Analysis & Candlestick Theory: This course covers the basics of technical analysis, including its history, types and applications in the stock market. It also provides an overview of candlestick theory and its use in technical analysis.

These courses are just a small sample of the wide range of educational resources available on ETMarkets.com. Whether you're a seasoned investor or just starting out, these courses can help you enhance your knowledge and skills in the financial markets.

So, don't miss out on this opportunity to empower yourself with valuable insights and practical trading techniques. Visit ETMarkets.com today and kickstart your trading journey with confidence.

Clause de non-responsabilité:info@kdj.com

Les informations fournies ne constituent pas des conseils commerciaux. kdj.com n’assume aucune responsabilité pour les investissements effectués sur la base des informations fournies dans cet article. Les crypto-monnaies sont très volatiles et il est fortement recommandé d’investir avec prudence après une recherche approfondie!

Si vous pensez que le contenu utilisé sur ce site Web porte atteinte à vos droits d’auteur, veuillez nous contacter immédiatement (info@kdj.com) et nous le supprimerons dans les plus brefs délais.

-

-

-

- Binance révèle la mise à jour sur les greffons de doodles (dood): détails

- May 09, 2025 at 04:50 pm

- Le dernier buzz chaud du marché de la cryptographie, Doodles (Dood), continue d'être sur les radars des commerçants et des investisseurs alors que sa binance aérienne se profile directement à l'horizon.

-

- 2025 Ripple Whales parie tranquillement grande sur cette opportunité d'extraction de nuages - voici pourquoi

- May 09, 2025 at 04:50 pm

- Le cloud Mining est depuis longtemps un favori parmi les amateurs de crypto-monnaie en raison de sa facilité d'utilisation et de son accessibilité. Contrairement à l'exploitation traditionnelle, il ne nécessite pas de matériel coûteux, d'expertise technique ou de surveillance constante.

-

-

-

-

- USD1 Stablecoin soutenu par World Liberty Financial (WLFI) a atteint une capitalisation boursière de 2,1 milliards de dollars

- May 09, 2025 at 04:40 pm

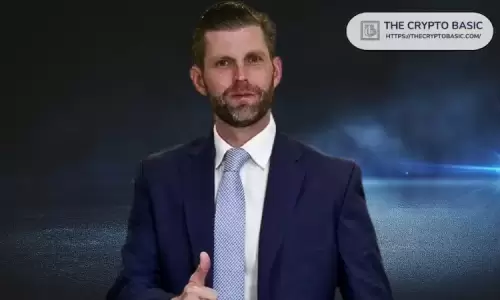

- Eric Trump, fils du président américain Donald Trump, a reconnu la croissance rapide de l'USD1, l'écu-ceron soutenu par World Liberty Financial (WLFI).

-