|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Articles d’actualité sur les crypto-monnaies

3 Stocks Funding Trump's Inauguration That Might Deliver Outsized Gains in 2025

Jan 07, 2025 at 08:30 pm

As President-elect Donald Trump prepares to return to the White House, several companies across sectors are donating millions to his upcoming inauguration ceremony. These contributions, which aim to establish favorable relations with the new administration, come at a time when the market is anticipating strong gains in the coming years. In this article, I have identified three companies funding Trump’s inauguration, which might enable them to deliver outsized gains in 2025.

1. Ford Motor (NYSE:F)

With a market capitalization of nearly $40 billion, Ford Motor is among the largest automobile companies in the world. It is part of a mature sector that has grossly underperformed the broader market for over two decades. For instance, Ford stock has lost 16% in the past 52 weeks and lost 25% over the past 20 years. In comparison, the S&P 500 Index (SPX) is up 26% over the past 52 weeks and 403% over the past 20 years.

However, Ford recorded a strong performance in 2024. Retail sales grew by 6% year-over-year, double the industry average, primarily due to its diverse powertrain strategy. Total sales rose 4% year-over-year in 2024, while vehicle shipments soared by 9% in the fourth quarter. The company’s F-series lineup held its position as America’s best-selling truck for the 48th consecutive year, with Q4 sales rising 21% in Q4.

Notably, Ford’s electric vehicle sales (including hybrids) grew 38% to 285,291 units. The company also dominated the commercial vehicle segment, maintaining its leadership in full-size vans for the 46th consecutive year.

Priced at just 5.8 times forward earnings, Ford Motor stock is extremely cheap, given it currently offers shareholders a dividend yield of 6.1%. Out of the 19 analysts tracking Ford stock, four recommend “Strong Buy,” 10 recommend “Hold,” one recommends “Moderate Sell,” and four recommend “Strong Sell.” The average target price for the auto stock is $11.26, 14% above the current trading price.

2. Coinbase (NASDAQ:COIN)

Valued at a market cap of $68 billion, the performance of Coinbase stock is tied to the prices of cryptocurrencies such as Bitcoin (BTCUSD) and Ethereum (ETHUSD). Coinbase is the world’s second-largest cryptocurrency exchange and generates most of its revenue from commissions, which depend on trading volumes. Typically, trading volumes surge during bull markets and take a hit when sentiment turns bearish.

During the last Bitcoin bull run in 2021, Coinbase reported record sales of $7.8 billion. In the last 12 months, its top line has almost doubled year-over-year to $5 billion. With Bitcoin hitting new record highs in recent months, there is a good chance Coinbase stock will deliver outsized gains to shareholders in 2025. Moreover, the Trump administration is expected to provide a crypto-friendly environment. It might even hold BTC in a strategic reserve, which should act as a long-term tailwind for Coinbase.

Coinbase continues diversifying its revenue base as transaction sales have accounted for 60% of the top line in the past year, down from over 85% in 2021.

Out of the 23 analysts covering COIN stock, eight recommend “Strong Buy,” one recommends “Moderate Buy,” 13 recommend “Hold,” and one recommends “Strong Sell.” The average target price for COIN stock is $294.77, indicating upside potential of 8.5% from current levels.

3. Intuit (NASDAQ:INTU)

The final stock on the list is Intuit, which has already returned 650% to shareholders since early 2015, after adjusting for dividends. Valued at a market cap of $176 billion, Intuit is a fintech company that provides financial management and tax compliance solutions. Its products serve consumers, small businesses, self-employed individuals, and accounting professionals.

Intuit has reported revenue of $16.6 billion in the last four quarters, up from $4.2 billion in fiscal 2015 (ended in July). Moreover, its operating income has grown from $886 million to $3.82 billion in this period.

Analysts tracking INTU stock expect sales to surpass $22.5 billion in fiscal 2027. Further, adjusted earnings per share are forecast to touch $25 in fiscal 2027, up from $16.94 in 2024. If INTU stock is priced at 3

Clause de non-responsabilité:info@kdj.com

Les informations fournies ne constituent pas des conseils commerciaux. kdj.com n’assume aucune responsabilité pour les investissements effectués sur la base des informations fournies dans cet article. Les crypto-monnaies sont très volatiles et il est fortement recommandé d’investir avec prudence après une recherche approfondie!

Si vous pensez que le contenu utilisé sur ce site Web porte atteinte à vos droits d’auteur, veuillez nous contacter immédiatement (info@kdj.com) et nous le supprimerons dans les plus brefs délais.

-

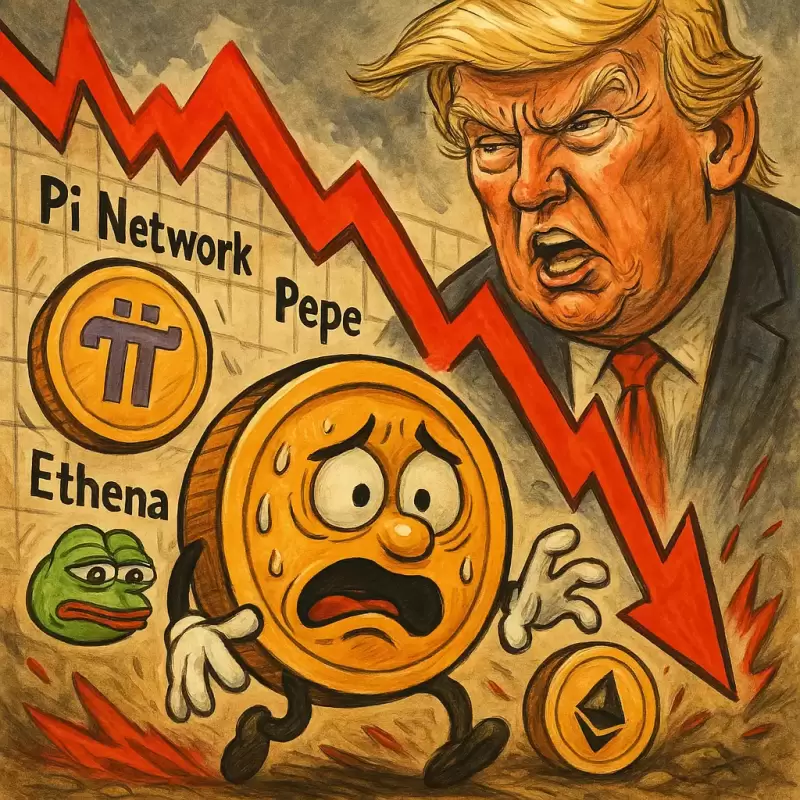

- L'espace de monnaie meme a vu une baisse de 10 milliards de dollars

- Apr 04, 2025 at 02:00 pm

- L'espace Meme Coin a connu une baisse de 10 milliards de dollars entre le 27 mars et le 3 avril, avec ses principaux tokens Pepe (Pepe), Dogecoin (Doge) et d'autres enregistrant tous des pertes à deux chiffres au cours de la semaine.

-

-

-

- Dogecoin & XRP éprouve une baisse significative de la rentabilité au cours des 30 derniers jours

- Apr 04, 2025 at 01:55 pm

- Les données récentes sur la chaîne met en évidence une tendance frappante: Dogecoin (DOGE) et XRP ont connu les diminutions les plus fortes de l'offre de profit parmi les principales crypto-monnaies.

-

- Présentation de la délicieuse facilité de Cloud Mining

- Apr 04, 2025 at 01:50 pm

- Avouons-le, la plupart d'entre nous entendons «l'exploitation bitcoin» et des salles d'image immédiatement remplies d'ordinateurs coûteux, de câblage sans fin et d'une facture d'électricité plus effrayante qu'un film d'horreur.

-

- Les sous d'une valeur de 124 millions de dollars et des milliards de dollars 1976 Les trimestres du bicentenaire sont des canular, prévient PNG

- Apr 04, 2025 at 01:50 pm

- Des histoires en ligne récentes sur les sous-jours d'une valeur de 124 millions de dollars et des dollars du trimestre du bicentenaire de 1976 sont soit faux ou grossièrement trompeurs

-

-

- Cryptocurrency Exchange Gemini, soutenu par Cameron et Tyler Winklevoss, prévoit de déménager dans un espace de bureau de la région de Miami

- Apr 04, 2025 at 01:45 pm

- Comme l'affaire l'application de la Commission des valeurs mobilières et de l'échange (SEC) des États-Unis peut avoir atteint sa fin. Selon un poste du 31 mars de Sterling Bay Properties

-

- Dogecoin (Doge) étend son déclin en dessous de 0,17 $ mais clignote l'un des signaux les plus optimistes depuis des années

- Apr 04, 2025 at 01:40 pm

- Dogecoin a prolongé son déclin inférieur à 0,17 $ au cours des dernières 24 heures, mais clignote maintenant l'un des signaux les plus optimistes depuis des années.