|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bitcoin Halving Sparks Speculation and Excitement in Cryptocurrency Market

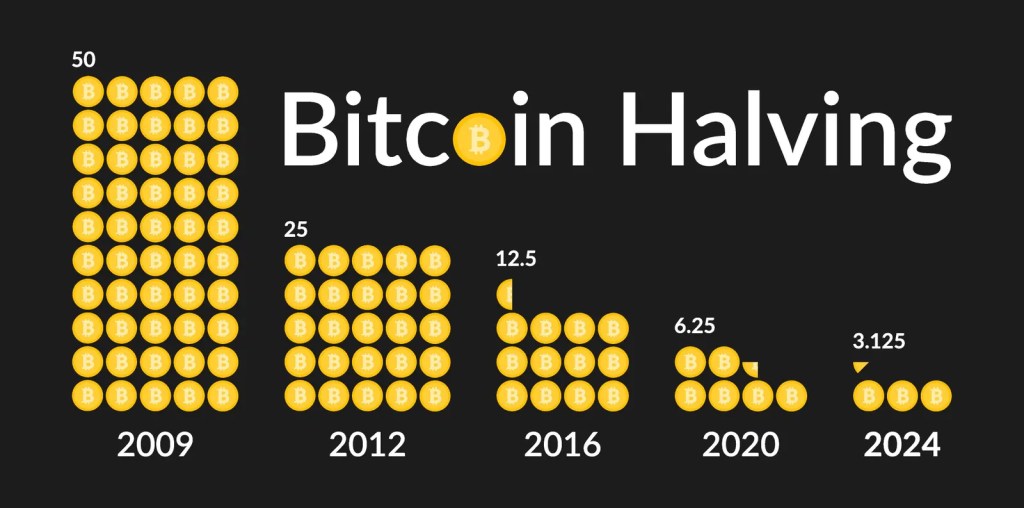

Bitcoin (BTC), the world's leading cryptocurrency, has successfully completed its fourth halving event, marking a significant milestone in its evolution. The halving, which occurred on April 19, 2024, has reduced the reward given to Bitcoin miners for each block they create by 50%, from 6.25 BTC to 3.125 BTC.

Historically, Bitcoin halving events have been followed by notable price appreciation. This is largely attributed to the reduced supply of newly minted Bitcoins, which creates a supply-demand imbalance in favor of price increases. Bitcoin's price has already been on a bullish trajectory in recent months, and the halving is expected to further fuel its upward momentum.

Within the last 24 hours, Bitcoin's price has risen by 3.7%, currently hovering just below $64,000. Analysts believe that the price appreciation will continue in the coming weeks and months, driven by the halving-induced supply reduction.

GrayScale, a leading cryptocurrency investment firm, has conducted an analysis that predicts a less significant drop in buying pressure to sustain Bitcoin's price at its current levels. This reduction in selling pressure, coupled with increased demand due to the halving, is expected to lead to a positive price trajectory.

Bitcoin has experienced three previous halving events, all of which have occurred approximately every four years. The first halving took place in 2012, reducing the block reward from 50 BTC to 25 BTC. Subsequently, in 2016, it was further reduced to 12.5 BTC. The most recent halving occurred in May 2020, bringing the reward down to 6.25 BTC.

The halvings are programmed into Bitcoin's code and are designed to gradually decrease the issuance of new Bitcoins over time. This mechanism aims to control inflation and maintain the cryptocurrency's scarcity, which contributes to its value.

Despite the reduction in block rewards, Bitcoin miners still earn transaction fees for each block they mine. These fees, along with the potential for price appreciation, continue to incentivize miners to participate in the Bitcoin network and secure its blockchain.

Beyond the halving, Bitcoin's fundamentals and use cases have strengthened significantly in recent years. The introduction of ordinal inscriptions and BRC-20 tokens on the Bitcoin blockchain has brought renewed interest and activity to the network. These innovations have facilitated the creation of non-fungible tokens (NFTs) and fungible tokens, expanding Bitcoin's capabilities beyond its original purpose as a medium of exchange.

The latest development on the Bitcoin network is the introduction of the Runes protocol, a token standard that has generated excitement within the Bitcoin community. Launched in conjunction with the halving, the Runes protocol is touted as a more efficient and accessible way to create altcoins on Bitcoin.

Proponents of the Runes protocol believe that its launch alongside the halving is strategic, as it will stimulate on-chain activity and increase Bitcoin's network fees. This increase in fees, they argue, will help mitigate the decrease in miner revenue caused by the halving.

As Bitcoin continues to evolve and gain mainstream adoption, its halving events serve as significant catalysts for price appreciation and renewed interest in the cryptocurrency. With the network's strong fundamentals and the potential for further innovation, Bitcoin is well-positioned to maintain its dominance in the cryptocurrency market for years to come.

Haftungsausschluss:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- Bitcoin setzt Rückgänge aufgrund schwacher Handelsvolumina zum Jahresende fort

- Dec 27, 2024 at 05:15 pm

- Der Rückgang von Bitcoin setzte sich am Freitag aufgrund schwacher Handelsvolumina zum Jahresende fort, während die Anleger hinsichtlich der Aussichten für Kryptowährungen vorsichtig blieben, nachdem die Federal Reserve letzte Woche eine restriktive Haltung einnahm.

-

-

-

- Coach JV prognostiziert, dass XRP 100 US-Dollar erreichen wird, und warnt Anleger, dass sie es bereuen werden, nicht unter 7 US-Dollar zu kaufen

- Dec 27, 2024 at 05:05 pm

- Ein Marktanalyst geht davon aus, dass Anleger, denen es nicht gelungen ist, XRP unter einem dreistelligen Preisniveau zu kaufen, ihre Entscheidung bereuen werden.

-

- KI-Agentenkriege: AI16Z vs. VIRTUAL

- Dec 27, 2024 at 05:05 pm

- Virtual Protocol on Base ist angesichts seiner Marktkapitalisierung von 3 Milliarden US-Dollar derzeit führend in der Erzählung von KI-Agenten. Sein steiler Aufstieg zum Einhornstatus wurde durch sein robustes Modell vorangetrieben, das VIRTUAL mit neuen Agenten verbindet und so eine konstante Nachfrage schafft.

-

- Angesagte Meme-Münzen zum Anschauen: Doge Eat Doge, Wat, Flockerz, Dogelon Mars

- Dec 27, 2024 at 05:05 pm

- Während Meme-Coins weiterhin die Fantasie des Kryptomarktes anregen, sind Anleger auf der Suche nach dem nächsten großen Ding. Ob es um das Potenzial für explosives Wachstum, eine starke, engagierte Community oder die Begeisterung für die Unterstützung durch Prominente geht, Meme-Coins bieten eine aufregende, wenn auch volatile Chance.

-

- Was Sie von der bevorstehenden Einführung von XRP-ETFs erwarten können: Ein umfassender Überblick

- Dec 27, 2024 at 05:05 pm

- Die führende amerikanische Krypto-IRA-Plattform iTrustCapital hat kürzlich die bevorstehende Einführung von XRP-ETFs hervorgehoben und wichtige Erkenntnisse geteilt, um Anleger zu informieren

-