|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Video

Bitcoin big crash coming | Cryptocurrency technical analysis

Apr 22, 2024 at 10:57 am Everything Is Planned - US Stock Market Trader

Predicting market crashes, especially in volatile assets like Bitcoin, is highly speculative and prone to error. While technical analysis can provide insights into market trends and potential price movements based on historical data and chart patterns, it's important to remember that it's not a foolproof method for predicting crashes.

That being said, here are a few technical indicators that some analysts might look at when assessing the potential for a Bitcoin crash:

1. **Moving Averages**: Analysts often use moving averages to identify trends and potential trend reversals. If the price of Bitcoin falls below key moving averages, such as the 50-day or 200-day moving average, it could signal a bearish trend.

2. **Support and Resistance Levels**: Support and resistance levels are price levels where a cryptocurrency tends to find buying (support) or selling (resistance) pressure. If Bitcoin breaks below a significant support level, it could indicate a potential downturn.

3. **Relative Strength Index (RSI)**: The RSI is a momentum oscillator that measures the speed and change of price movements. An RSI reading above 70 indicates overbought conditions, while a reading below 30 indicates oversold conditions. If Bitcoin's RSI is in overbought territory and starts to decline, it could suggest a potential reversal in price.

4. **Volume Analysis**: Changes in trading volume can provide insights into the strength of a price movement. A decrease in trading volume during a rally could indicate weakening momentum and the possibility of a correction.

5. **Chart Patterns**: Analysts often look for chart patterns, such as head and shoulders patterns or double tops, which could indicate potential trend reversals.

It's important to note that technical analysis should be used in conjunction with other forms of analysis, such as fundamental analysis and market sentiment, to make informed investment decisions. Additionally, no analysis method can accurately predict market crashes with certainty, so it's crucial to manage risk appropriately and be prepared for unexpected price movements.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- Bitcoin bottom and top indicators! Can Wall Street bastards pull BTC again?

- Feb 08, 2025 at 02:48 pm Shu Crypto

- OKX~~20% rebate 👉️ https://www.okx.com/join/13810873942 Invitation code 13810873942 Discord~~Trading group 👉️ https://discord.gg/qUPrJb66Tu Twitter~~https://twit ter.com/ shu8126 Bybit-- 👉️ https://partner.bybit.com/b/36916...

-

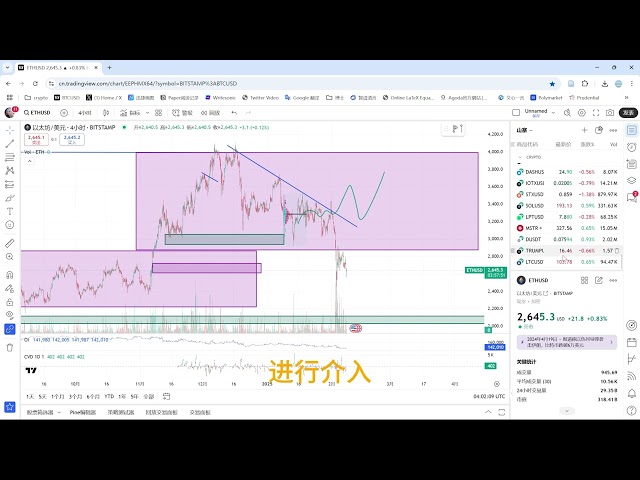

- Bitcoin short orders won again on February 8! Follow this key position? After gold breaks through, it is accurate to grasp it. How should we make a plan after the V fall next week?

- Feb 08, 2025 at 02:06 pm 子安观市

- Bitcoin short orders were won again! Follow this key position? After gold breaks through, it is accurate to grasp it. How should we make a plan after the V fall next week?

-

- PENGU COINBASE CONFIRMED!! (BUY NOW?!) PENGU ATH IS COMING!! PUDGY PENGUINS COIN PRICE PREDICTION

- Feb 08, 2025 at 02:04 pm Umar Khan

- PENGU COINBASE LISTING CONFIRMED!! (BUY NOW?!) PENGU ATH IS COMING!! PUDGY PENGUINS COIN PRICE PREDICTION Memecoin Millionaires Club is live! My free crypto insight / signal group! - https://t.me...

-

-

- Keep waiting, maybe second-detective, don't bet | Bitcoin market analysis | Blockchain | Currency Circle | WEB3 | BTC | Second-detective | Trump | US Stocks

- Feb 08, 2025 at 02:02 pm 奥德瑞瑞

- Keep waiting, maybe second-detective, don't bet | Bitcoin market analysis | Blockchain | Currency Circle | WEB3 | BTC | Second-detective | Trump | US Stocks

-

-

-

- After-hours analysis of US stocks: SPY DIA QQQ IWM Bitcoin Chinese Stocks Treasury Bonds/TLT VIX 20250207

- Feb 08, 2025 at 01:54 pm JC美股分析

- ~~~ Welcome to subscribe to the JC US Stock Briefing I wrote. This briefing is mainly used to share US stock trends, knowledge about US stock investment and stock trading, as well as some of my experiences in stock trading. Subscription link: https://www.jcstocktrading.com/newsletter

-

- If you already know the future of Bitcoin, do you still care about short-term fluctuations? Will the copycat season be absent? Are there any leading AI and RWA tokens? ~ Robert Lee Blockchain Diary 2376

- Feb 08, 2025 at 01:54 pm Dr Robert Lee 李波

- Advocate of new digital civilization. Focus on investment, management and research in the knowledge service industry. Purpose of knowledge sharing: Help elites make beer, prevent people from blowing bubbles, and expose scammers to cut leeks. Join a member: https://www...