|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Virtual Asset Market Outlook 2025: Stablecoins, Blockchain Communication Networks, and the AI-Blockchain Combo Will Lead the Way

Dec 31, 2024 at 08:29 pm

Coinbase, the largest coin exchange in the United States, made the forecast when it released a report containing this year's outlook.

Coinbase, the largest coin exchange in the United States, predicted that the role of virtual assets in traditional finance will be strengthened in 2025 when it released a report containing this year's outlook.

This year's virtual asset market is due to the fact that institutional investors' participation in the market will expand in various directions this year as Bitcoin's entry of existing financial capital has increased significantly since the listing of the spot exchange-traded fund (ETF) in January last year.

Mesari, a virtual asset investment company, predicted, "With Donald Trump's election as the president of the U.S., who claims to be the 'virtual asset president,' the combination with traditional finance will take place in various fields under stable regulation in 2025."

According to the virtual asset industry on the 31st, the main theme of this year's market is expected to be stablecoins, communication networks using blockchain, infrastructure such as power grids, and the combination of artificial intelligence (AI) and blockchain.

Coinbase said in its forecast report for this year, "ETFs have been approved this year, tokenization of real and financial products has soared, and stablecoin's growth has accelerated the integration of the global payment system," adding, "These achievements are just the beginning."

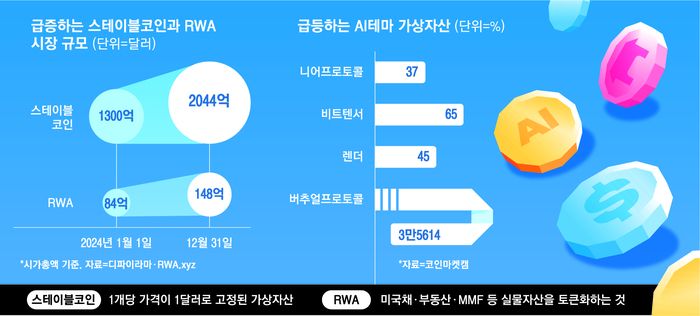

Coinbase's most notable focus is stablecoins and real asset tokenization (RWA). Stablecoins are coins with a fixed price of $1 per coin. Real asset tokenization refers to making real assets such as real estate and government bonds into tokens by placing them on the blockchain.

Stablecoin's market capitalization reached $204.4 billion, up 57.23% year-on-year, with a volume of $27.1 trillion. Based on its fast and inexpensive advantages over traditional payment methods, stablecoin "USDC" has been adopted on payment platforms such as Visa and Stripe.

RWA also grew 76.19% in 2024 market size from $8.4 billion to $14.8 billion. In particular, traditional financial products such as U.S. bonds and money market funds (MMF) have been tokenized.

Coinbase said, "The commercialization and institutionalization of virtual assets are likely to be led by two sectors, stablecoin and RWA. This will bring about fundamental changes in the financial market."

AI is also considered a theme that will lead the virtual asset market. In particular, "AI Agent," which has recently attracted attention, is expected to make a big change in the virtual asset market. An AI agent refers to an AI system that autonomously performs work on behalf of a person's job.

"We expect AI agents to manage virtual asset wallets or interact with smart contracts to open new possibilities for DeFi and decentralized autonomous organization (DAO) operations," Coinbase said.

In the case of Messari, it was expected that the tremendous performance of Bitcoin ETFs this year would accelerate traditional financial companies' entry into the market. Bitcoin spot ETFs net inflow of $35.241 billion.

Messari predicted, "The entry of traditional financial companies in a stable regulatory environment will accelerate, increasing the number of financial products using stable coins, and institutional investors will participate in RWA and DeFi experiments of various assets beyond simple investments."

In the case of Bitcoin, as institutional investor demand is solid, it is predicted that stable price increases will be achieved next year based on ETF demand. Ethereum, on the other hand, analyzed that it needs to find a way to differentiate itself compared to competing blockchains such as Solana and Aptos.

In addition, Messari predicted, "In terms of industry, the combination of blockchain is expected to expand in traditional industries such as wireless communication and data networks, and cases of using new virtual assets using AI agents will increase."

In Korea, Covit Research, affiliated with the coin exchange Covit, gave an outlook for this year. Covit Research predicted, "Global financial companies will accelerate their entry into the stablecoin and bitcoin markets, and competition between countries will intensify due to the U.S. Bitcoin Strategic Assets Act."

In particular, he said, "The approval of bitcoin spot ETFs and the stance of central banks in major countries to cut interest rates will act as a factor in raising bitcoin prices," adding, "It is expected that altcoins such as Solana and Ripple will also accelerate their entry into the institutional sphere."

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- Trust Wallet will host an AMA on X, featuring representatives from 1inch and MoonPay

- Apr 03, 2025 at 12:40 pm

- Trust Wallet is set to host an AMA on X, featuring representatives from 1inch and MoonPay. The conversation will focus on the challenges and requirements of onboarding the next 1 billion users to the blockchain network.

-

-

-

-

-

-