March was a rough month for markets — US President Donald Trump’s uncertain tariff policies created volatility in Bitcoin and crypto markets

March was a rough month for markets — US President Donald Trump’s uncertain tariff policies created volatility in Bitcoin and crypto markets; meanwhile, decentralized finance (DeFi) struggled with security concerns.

As part of retaliatory tariffs on US goods, China and the European Union hit markets on March 10 and 12, respectively. Amid the tête-à-tête between the United States and its largest trade partners, Bitcoin managed to recover on March 24 to $88,0000 before slumping down again to around $82,000 at the time of writing.

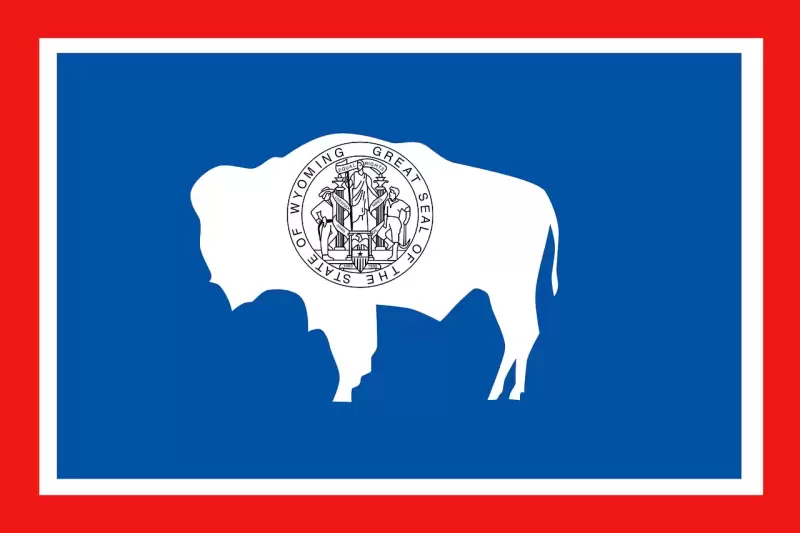

A number of state legislatures are considering Bitcoin- and crypto-related legislation, from bills that would establish a Bitcoin reserve to crypto tax forces and exploring pension fund investment. Such bills moved forward, either in voting or in committee, in 13 US states this month.

The cool-down in memecoin markets has major revenue implications for Solana. After reaching eye-watering highs of $34 billion in January, Solana volumes on decentralized exchanges fell drastically. In March, volumes rarely exceeded $1 billion.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.