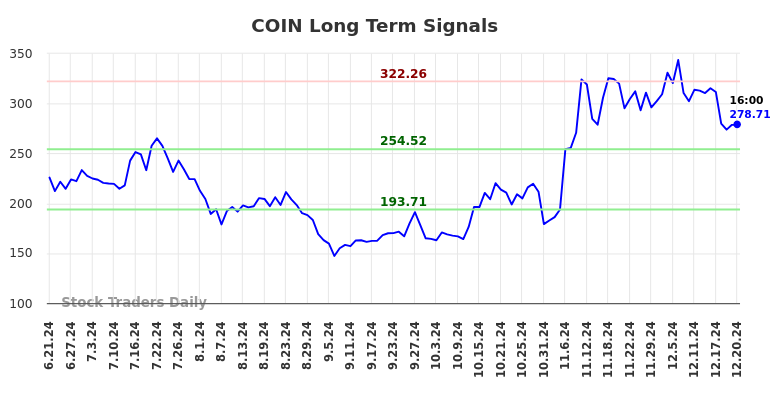

The technical summary data tells us to buy COIN near 254.52 with an upside target of 322.26. This data also tells us to set a stop loss @ 253.78 to protect against excessive loss in case the stock begins to move against the trade.

Coinbase (NASDAQ:COIN) is a cryptocurrency exchange that went public in April 2021. It quickly became one of the most popular stocks among retail traders. However, COIN has been struggling in recent months as rising interest rates and regulatory concerns have put pressure on the stock price.

Now let's take a look at some technical trading strategies for COIN.

The technical summary data tells us to buy COIN near 254.52 with an upside target of 322.26. This data also tells us to set a stop loss @ 253.78 to protect against excessive loss in case the stock begins to move against the trade. 254.52 is the first level of support below 278.71 , and by rule, any test of support is a buy signal. In this case, support 254.52 is being tested, a buy signal would exist.

The technical summary data is suggesting a short of COIN as it gets near 322.26 with a downside target of 254.52. We should have a stop loss in place at 323.19 though. 322.26 is the first level of resistance above 278.71, and by rule, any test of resistance is a short signal. In this case, if resistance 322.26 is being tested, a short signal would exist.

If 299.22 begins to break higher, the technical summary data tells us to buy COIN just slightly over 299.22, with an upside target of 322.26. The data also tells us to set a stop loss @ 298.36 in case the stock turns against the trade. 299.22 is the first level of resistance above 278.71, and by rule, any break above resistance is a buy signal. In this case, 299.22, initial resistance, would be breaking higher, so a buy signal would exist. Because this plan is based on a break of resistance, it is referred to as a Long Resistance Plan.

The technical summary data is suggesting a short of COIN if it tests 299.22 with a downside target of 272.97. We should have a stop loss in place at 300.08 though in case the stock begins to move against the trade. By rule, any test of resistance is a short signal. In this case, if resistance, 299.22, is being tested a short signal would exist. Because this plan is a short plan based on a test of resistance it is referred to as a Short Resistance Plan.

If 299.22 begins to break higher, the technical summary data tells us to buy COIN just slightly over 299.22, with an upside target of 322.26. The data also tells us to set a stop loss @ 298.52 in case the stock turns against the trade. 299.22 is the first level of resistance above 278.71, and by rule, any break above resistance is a buy signal. In this case, 299.22, initial resistance, would be breaking higher, so a buy signal would exist. Because this plan is based on a break of resistance, it is referred to as a Long Resistance Plan.

The technical summary data is suggesting a short of COIN if it tests 299.22 with a downside target of 276.2. We should have a stop loss in place at 299.92 though in case the stock begins to move against the trade. By rule, any test of resistance is a short signal. In this case, if resistance, 299.22, is being tested a short signal would exist. Because this plan is a short plan based on a test of resistance it is referred to as a Short Resistance Plan.

These are just a few technical trading strategies for COIN. As always, it is important to do your own research and consult with a financial advisor before making any trades.