|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

It’s been an exciting year for everyone at Hedera and the HBAR Foudation, the organization and the token have come a long way. In the meantime the price of HBAR has reached recent highs. This has gone hand in hand with multiple use cases being confirmed by Hedera itself. Today we look at how strong will HBAR be in 2025. And whether it’s still worth getting involved.

The price of HBAR has seen some wild swings in recent years, but what does the future hold for the native token of Hedera? In this article, we will take a look at some of the factors that could affect the value of HBAR in 2025 and whether it is still worth getting involved.

At the time of writing, HBAR is trading at $0.30, which is a significant increase from the $0.05 it was trading at in October 2023 when we first covered it on DisruptionBanking.

This price increase has been driven by a number of factors, including the increasing adoption of Hedera technology by institutions and the growing interest in digital assets from retail investors.

As a result of this price increase, HBAR has now entered the top 20 digital assets by market cap on Coinbase. This is a major achievement for Hedera and its community, and it is sure to attract even more attention to the HBAR token in 2025.

However, it is important to note that the price of HBAR is also affected by the broader market conditions, and it is possible that the token could experience some price decreases in 2025.

If you are considering investing in HBAR, it is important to do your own research and understand the risks involved. With that being said, let’s take a look at how strong will HBAR be in 2025.

Institutions are showing increasing interest in Hedera and the HBAR token. For example, if the Texas Stock Exchange really takes off in 2025, it is likely to be built on Hedera, as the company is based out of Texas.

If the SEC’s planned move to tokenizing the supply chain gains impetus, Hedera is already one of the most important use cases. And there is also talk of a HBAR ETF being issued in 2025.

Another factor that could affect the value of HBAR in 2025 is the increasing use of the Hedera network for real-world asset tokenization.

For example, abrdn, the oldest asset manager in Europe, is using Hedera to tokenize money market funds, and Avery Dennison Corporation is partnering with the HBAR Foundation on sustainability initiatives.

These are just a few of the many examples of how Hedera is being used to tokenize a wide range of assets, and this activity is sure to continue and expand in 2025.

Finally, another factor that could affect the value of HBAR in 2025 is the addition of new council members. There are currently 32 council members, and some of them will need to renew their membership in 2025.

One of the council members whose membership expires in 2025 is Chainlink Labs, and on May 19th the leading digital assets business will need to renew its membership of the governing council. This is by no means a ‘given’. It very much depends on what other solutions may still appear on the market. For now, Hedera is in a unique position. It is an advanced DLT solution that some refer to as the ‘quantum’ of blockchains.

Whoever joins the remaining seven remaining slots on the Hedera Council could also make a big impact on the price of the HBAR token. Just consider Tesla or Apple joining in the near future. They could have the same effect on the price of the token as the story about BlackRock from earlier in 2024.

Overall, there are a number of factors that could affect the value of HBAR in 2025, and it is possible that the token could reach new highs next year.

However, it is also important to remember that the price of digital assets can be volatile, and there is always the potential for losses. If you are considering investing in HBAR, it is important to do your own research and understand the risks involved.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- Can Solana Flip Ethereum in 2025? Why Remittix Could Outshine ETH and SOL

- Jan 08, 2025 at 07:45 am

- As we enter 2025, crypto analysts are making predictions concerning the market performance and price action of tokens. Often dubbed the “Ethereum Killer,” Solana has steadily climbed the ranks in the market with its blazing-fast transactions and low fees. Now, analysts predict SOL will likely overtake ETH in 2025 and beyond.

-

-

-

- BlockDAG Emerges as the Next Big Crypto to Buy, Targeting $1 Post-Launch as Presale Nears Sellout

- Jan 08, 2025 at 07:25 am

- As we approach the year's end, traders are scouting for the next big opportunities and movers in the market. Cardano (ADA) is capturing attention with an ambitious price target of $6

-

-

-

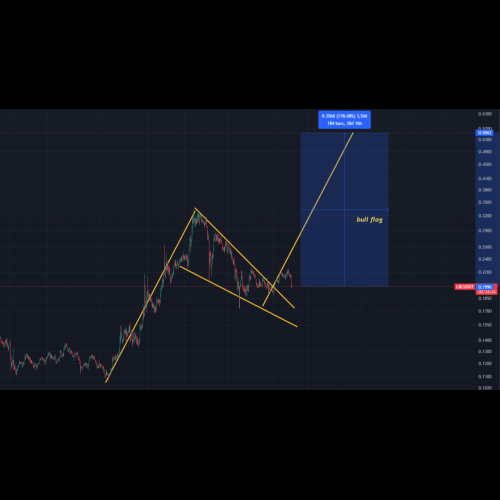

- #LRC/USDT LONG signal

- Jan 08, 2025 at 07:10 am

- as you can see lrc coin created a huge bullish pattern it's called ascending triangle. now lrc holding huge volume profile support zone and ascending triangle support line. It's a huge buying opportunity for spot. after breakout this bullish pattern it will touch technically .29 as you can see in longer timeframe lrc coin created a huge bull flag now that bull flag broken. so that we can buy some coin in our spot wallet. in longer timeframe btc dominance is bearish because btc dominance also breaks it's bull flag support line. that's why lrc coin is bullish usdt dominance in longer timeframe bearish because after a huge dump usdt.d created head and shoulder pattern so that I am bearish on usdt.d. when usdt.d will dump crypto market will pump hard negative correlation.

-

-