|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Standard Chartered Raises Bitcoin Price Goal to $150,000 Amidst Crypto Surge

Apr 02, 2024 at 04:01 pm

Standard Chartered has raised its Bitcoin price prediction to $150,000, citing the coin's bullish price movements. Amidst this bullish crypto market, KangaMoon (KANG), an emerging meme coin, has surged 180% and incorporated utility into its token, offering investors a promising earning opportunity. Binance Coin investors are doubling down on KANG due to its strong ROI and potential to reach $1 during its presale.

Bitcoin's Soaring Trajectory: Standard Chartered Raises Price Forecast to $150,000

Introduction

The cryptocurrency market has witnessed a significant surge in the past year, with Bitcoin (BTC) leading the charge. Driven by a confluence of factors, including institutional adoption, rising inflation, and geopolitical uncertainties, Bitcoin's price has skyrocketed, prompting analysts to revise their predictions for its future value. One such institution, Standard Chartered, has recently updated its Bitcoin price forecast, projecting a bullish outlook that paints a positive picture for the crypto market.

Standard Chartered's Revised Bitcoin Forecast

Standard Chartered, a leading multinational banking and financial services group, has become the latest institution to adjust its Bitcoin price prediction. In a recent report, the bank revised its previous forecast of $100,000, now predicting that Bitcoin could reach a staggering $150,000 by the end of 2024. This upward revision is attributed to Bitcoin's unexpected price surge in the first quarter of 2024, which has defied previous market expectations.

According to Geoffrey Kendrick, Standard Chartered's head of forex and crypto research, the bank's bullish stance stems from the strong momentum exhibited by Bitcoin in recent months. Kendrick noted that Bitcoin's price surge has been driven by several factors, including increasing institutional adoption, a flight to safe-haven assets amid geopolitical tensions, and the growing popularity of decentralized finance (DeFi).

Factors Driving Bitcoin's Bullish Momentum

The surge in Bitcoin's price can be attributed to a number of factors that have converged to create a favorable environment for cryptocurrencies. The rising tide of institutional adoption has been a major catalyst, with several large banks, hedge funds, and pension funds allocating a portion of their portfolios to Bitcoin. This institutional interest has brought a sense of legitimacy to the cryptocurrency, attracting new investors and further boosting demand.

The current macroeconomic climate has also played a role in Bitcoin's surge. The ongoing inflation concerns have eroded the purchasing power of fiat currencies, leading investors to seek alternative store-of-value assets like Bitcoin and gold. Bitcoin's limited supply and decentralized nature make it an attractive hedge against inflation, further fueling its price appreciation.

The Role of Gold in Bitcoin's Price Estimation

In estimating Bitcoin's medium-term price potential, Standard Chartered's report uses gold as a reference point. The bank believes that Bitcoin's price trajectory could follow a similar pattern to that of gold, particularly in terms of the impact of exchange-traded funds (ETFs).

The report notes that if Bitcoin ETFs experience significant inflows, reaching a level of $75 billion, or if reserve managers increase their Bitcoin holdings, the cryptocurrency's price could potentially reach $250,000 by 2025. This highlights the growing institutional interest in Bitcoin and its potential to become a more widely accepted asset class.

Technical Analysis and Market Sentiment

Bitcoin's technical indicators also support the bullish outlook. The cryptocurrency's 50-Day Simple Moving Average (SMA) and 200-Day SMA are both trending upwards, indicating a positive price momentum. The Relative Strength Index (RSI), a measure of buying and selling pressure, is also above the 50-mark, suggesting that buyers are in control of the market.

Market sentiment towards Bitcoin remains bullish, with many analysts predicting further price gains in the coming months. The positive sentiment is driven by the belief that institutional adoption will continue to grow, providing a strong foundation for Bitcoin's price appreciation.

KangaMoon: The Rising Star of the Meme Coin Universe

Amidst the excitement surrounding Bitcoin, a new altcoin has emerged as a potential contender in the meme coin space: KangaMoon (KANG). The KangaMoon project aims to create a community-based platform that combines social media and gaming elements into a captivating experience.

KANG, the native token of the KangaMoon platform, has several unique features that set it apart from other meme coins. The token can be used for in-game purchases, enhancing character abilities, and participating in community governance. This utility adds intrinsic value to KANG, making it more than just a speculative asset.

KangaMoon's Presale Success and Future Prospects

KangaMoon is currently in the midst of its presale, which has generated significant interest from investors. The token has already appreciated by 180% since its initial offering price, providing early investors with a substantial return on investment (ROI).

Analysts are predicting that KangaMoon has the potential to rise to $1 upon its listing on a Tier-1 cryptocurrency exchange in the second quarter of 2024. This optimism is fueled by the growing popularity of play-to-earn (P2E) games and the increasing adoption of blockchain-based gaming platforms.

Binance Coin: Maintaining Strength Despite Market Downturns

While the broader cryptocurrency market has experienced some volatility, Binance Coin (BNB) has remained resilient, trading above the $500 mark. Despite the recent dip in altcoin prices, BNB has held its ground, reflecting its underlying strength and the confidence of investors in the Binance ecosystem.

BNB's technical indicators paint a positive picture, with its 50-Day SMA and 200-Day SMA both positioned below its current price range. The RSI is also above the 50-mark, indicating that bullish sentiment remains intact. Analysts are forecasting a potential rise to $694.99 for BNB in the coming weeks as the altcoin continues to benefit from the growth of the Binance ecosystem.

Conclusion: A Bullish Outlook for Cryptocurrencies

The revised Bitcoin price forecast from Standard Chartered and the emergence of promising altcoins like KangaMoon and Binance Coin paint a bullish picture for the cryptocurrency market. Institutional adoption, rising inflation, and increasing interest in blockchain technology are all contributing to a positive environment for cryptocurrencies.

Investors seeking to participate in this growth should conduct thorough research and invest wisely. The cryptocurrency market remains volatile, and while there are opportunities for significant returns, there are also risks involved.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- 3 Altcoins Positioned to Challenge Ethereum and Solana, Offering Early Investors the Chance to Turn $1,000 Into a Life-Changing Fortune

- Nov 09, 2024 at 04:25 am

- While Ethereum and Solana are choices, in the industry there are intriguing platforms valued at less, than $1 that are gaining attention for their strong utility, innovative technology, and promising development plans

-

-

-

-

-

-

-

-

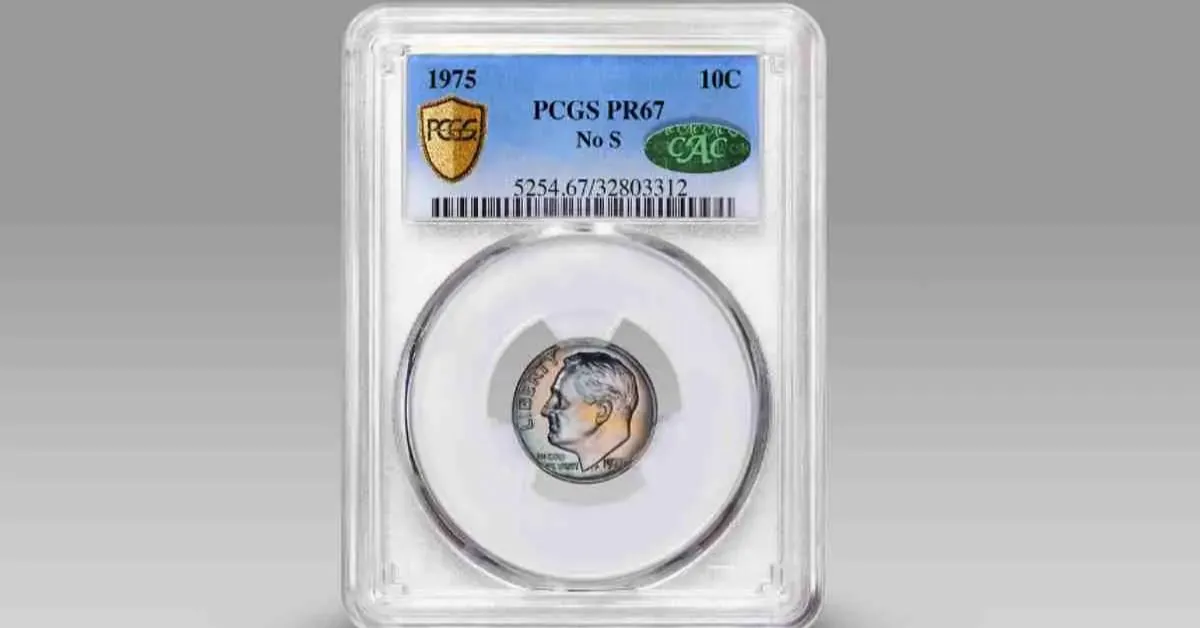

- The 1975 ‘No S’ Proof Dime: A Coin with a Remarkable Error

- Nov 09, 2024 at 04:25 am

- Minted in San Francisco, the 1975 proof dime was part of a larger collection that includes proof sets issued by the United States Mint. However, two of the dimes in this set were discovered to be missing their “S” mint mark—a feature that usually indicates the San Francisco Mint’s origin.