|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Stablecoins: A Game-Changer in the Cryptocurrency Space

May 22, 2024 at 06:53 pm

Stablecoins have emerged as a game-changer in the cryptocurrency space, offering a stable and reliable alternative to traditional cryptocurrencies.

Stablecoins have taken center stage in the cryptocurrency arena, emerging as a critical component in the digital asset landscape. They serve as a bridge between the inherent volatility of traditional cryptocurrencies and the stability required for mainstream adoption. As the world embraces Web3 technologies, stablecoins are poised to play a pivotal role in shaping the future of finance.

In essence, stablecoins are cryptocurrencies that are designed to maintain a stable value, typically pegged to a fiat currency like the US dollar. This stability is achieved through various mechanisms, ranging from centralized reserves to algorithmic adjustments. The goal is to create a cryptocurrency that can be used for everyday transactions, without the fear of drastic price fluctuations.

The Need for Stability in Cryptocurrency

One of the key challenges in making cryptocurrencies more accessible and useful for the general public is their volatility. Traditional cryptocurrencies like Bitcoin and Ethereum can experience large price swings over short periods, making them less suitable for use in everyday transactions or as a stable store of value.

Stablecoins, on the other hand, aim to minimize these price fluctuations by linking their value to a more stable asset. This stability makes them better suited for a wider range of use cases, including payments, remittances, and savings.

Types of Stablecoins

There are several different types of stablecoins, each with its own approach to maintaining a stable price. The main types include:

Centralized stablecoins: These stablecoins are backed by a centralized entity, usually a company, that holds a reserve of the fiat currency or other assets that the stablecoin is pegged to. Examples include Tether (USDT) and Binance USD (BUSD).

Decentralized stablecoins: These stablecoins are not backed by a single entity but rather by a protocol or algorithm that automatically adjusts the stablecoin's supply or demand to maintain its price peg. Examples include MakerDAO (DAI) and Fei Protocol (FEI).

Algorithmic stablecoins: These stablecoins use a combination of centralized and decentralized elements to maintain their price peg. They are typically backed by a basket of other cryptocurrencies, and their price is managed by an algorithm that adjusts the supply or demand of the stablecoin. Examples include FRAX and LUSD.

Each type of stablecoin has its own advantages and disadvantages in terms of stability, decentralization, and transparency. Centralized stablecoins are generally more stable but less decentralized, while decentralized and algorithmic stablecoins are more decentralized but may be less stable.

Advantages of Stablecoins

Compared to traditional cryptocurrencies, stablecoins offer several advantages:

They are less volatile, making them more suitable for everyday use and as a stable store of value.

They can be used to earn interest through lending or staking protocols, providing a passive income stream.

They facilitate faster and cheaper transactions compared to traditional financial systems, especially for cross-border payments.

Use Cases and Adoption of Stablecoins

Stablecoins have seen widespread adoption across different industries and use cases, including:

Payments: Stablecoins are increasingly being used to make payments in both the digital and physical worlds. They offer fast, low-cost, and secure transactions, making them ideal for everything from online shopping to in-store purchases.

Remittances: Sending money abroad can be slow, expensive, and inefficient through traditional channels. Stablecoins provide a cost-effective and convenient solution for migrant workers and families to send remittances quickly and securely.

Savings: Stablecoins can also be used as a savings tool, especially in countries with high inflation or economic instability. They offer a stable way to preserve the purchasing power of savings, and some stablecoins even provide interest-earning opportunities.

Challenges and Risks

Despite the many benefits of stablecoins, there are also several challenges and risks to consider:

Centralization: Many of the most widely used stablecoins are centralized, which means that a single company has a lot of control over the stablecoin's issuance, redemption, and price stability mechanism. This centralization can introduce counterparty risk and raise concerns about the transparency and stability of the stablecoin.

Peg risk: Stablecoins are designed to maintain a stable value relative to the asset they are pegged to. However, in some cases, the stablecoin's price may deviate significantly from the peg, especially during periods of high volatility or if there is a loss of confidence in the stablecoin. This deviation can result in financial losses for users who are holding or transacting with the stablecoin.

Regulatory uncertainty: The regulatory landscape for stablecoins is still evolving in many jurisdictions. This uncertainty can impact the legality, use cases, and adoption of stablecoins, and it also raises questions about consumer protection and the role of stablecoins in the broader financial system.

Future Outlook and Impact

Despite these challenges, the future looks promising for stablecoins. They have the potential to revolutionize global finance by offering a more efficient, transparent, and inclusive financial system. As stablecoins continue to evolve and gain mainstream adoption, they are likely to play a crucial role in shaping the future of money.

Stablecoins

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

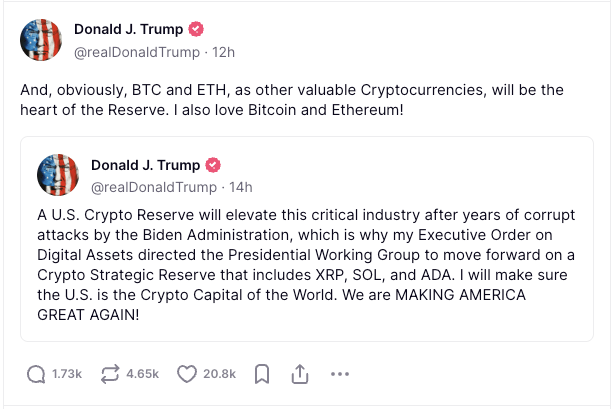

- US President Trump Proposes a Strategic Reserve Plan for Cryptocurrencies Including XRP, SOL, and ADA

- Mar 04, 2025 at 02:55 pm

- On the evening of March 2, Beijing time, U.S. President Trump stated on social media that he would instruct the presidential task force to advance a strategic reserve plan for cryptocurrencies

-

-

-

-

-

-

-

-