|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Solana's Stablecoin Trading Dominance Surpasses Ethereum

Apr 01, 2024 at 07:15 pm

Solana outperforms Ethereum in stablecoin trading volume, with a peak of $97.5 billion on March 30 compared to Ethereum's $9.3 billion. Despite FTX's estate selling off its Solana holdings at a discount, SOL maintains high stablecoin transaction volume due to the activity of MEV bots and Phoenix, a decentralized exchange. While SOL's price has recently risen to $195, it faces resistance at the $200 threshold due to market headwinds.

Solana Surges Ahead: Stablecoin Trading Volume Dominates Ethereum

Solana, the high-performance blockchain, has consistently outperformed Ethereum in terms of stablecoin trading volume, cementing its position as a formidable force in the cryptocurrency market. Despite recent market volatility, SOL, the native token of Solana, has demonstrated resilience and is poised for continued growth.

Unstoppable Momentum in Stablecoin Market

Solana's dominance in the stablecoin market has been unwavering, with daily trading volume consistently eclipsing that of Ethereum. Notable spikes were recorded on March 30, where Solana's volume soared to $97.5 billion compared to Ethereum's $9.3 billion. This unprecedented gap in trading activity underscores Solana's growing popularity as a preferred platform for stablecoin transactions.

Market Resilience Amidst FTX Turmoil

Despite the recent setback caused by the liquidation of FTX's Solana holdings at a significant discount, Solana has exhibited remarkable resilience. The stablecoin trading volume on its network has remained robust, indicating that the underlying fundamentals remain strong.

SOL Price Fluctuations: A Growth Trajectory

SOL's price has been subject to recent fluctuations, reaching a high of $208 on March 18 before experiencing a dip to $167 on March 20. However, the token has since recovered to $195, marking a 2% increase over the past week.

MEV Bots and Phoenix: Key Drivers of Volume

Artemis, a leading provider of crypto on-chain analytics, has identified MEV bots and Phoenix, a decentralized cryptocurrency exchange, as the primary contributors to the high volume on Solana. MEV bots, automated programs designed to maximize profitability, have been actively seeking arbitrage opportunities on the Solana blockchain.

Solana Ecosystem Flourishes

The Solana ecosystem is experiencing rapid expansion, evidenced by the positive on-chain metrics and the increase in token prices. SOL's recent price surge has reversed the previous week's decline, indicating growing bullish sentiment.

Conclusion:

Solana's dominance in the stablecoin market, coupled with its robust on-chain metrics and the positive trajectory of SOL, positions it as a leading force in the cryptocurrency landscape. Despite temporary market fluctuations, Solana's underlying fundamentals remain strong, paving the way for continued growth and innovation in the blockchain ecosystem.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

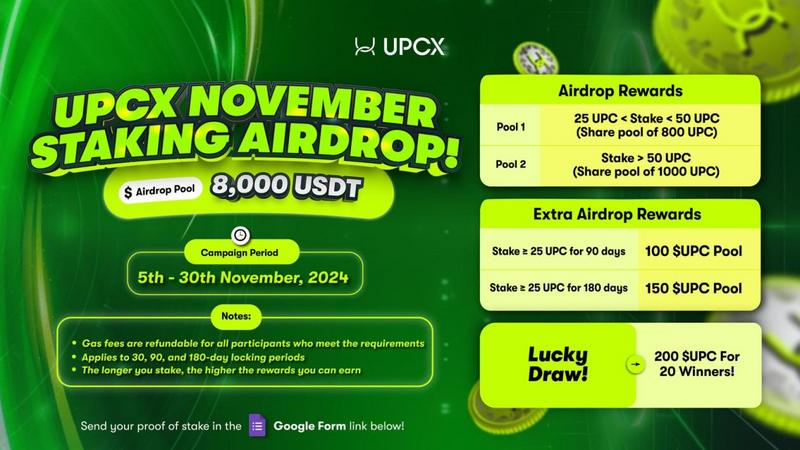

- UPCX Launches Native Token $UPC on MEXC, Bitget, Gate.io, and Websea, Hosts Staking Event to Promote Financial Democratization

- Nov 08, 2024 at 10:20 am

- UPCX, an open-source payment system based on efficient optimization blockchain technology, has launched its native token $UPC on several renowned exchanges

-

- Eastern European Crypto Companies Position Themselves as Leaders Ahead of MiCA Regulation

- Nov 08, 2024 at 10:20 am

- As Europe stands on the precipice of its most comprehensive cryptocurrency regulation to date, an unexpected trend is emerging – Eastern European crypto companies are increasingly positioning themselves as leaders in the evolving digital assets landscape.

-

-

-

-

-