|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Solana (SOL) Rebounds from Recent Lows, Backed by Strong Onchain Metrics and Derivatives Data. Could SOL Rally Toward $300 and Challenge Its All-Time High?

Nov 28, 2024 at 03:57 pm

Solana's native token, SOL has surged 8% since hitting a low of $222 on Nov. 26, following a sharp correction from its all-time high of $263.80 on Nov. 23.

Solana’s native token (SOL) has seen a surge of 8% since hitting a recent low of $222 on Nov. 26, following a sharp correction from its all-time high of $263.80 on Nov. 23. At the time of writing on Nov. 27, SOL is trading at $237.98, with onchain and derivatives data suggesting a potential continuation of the bullish trend.

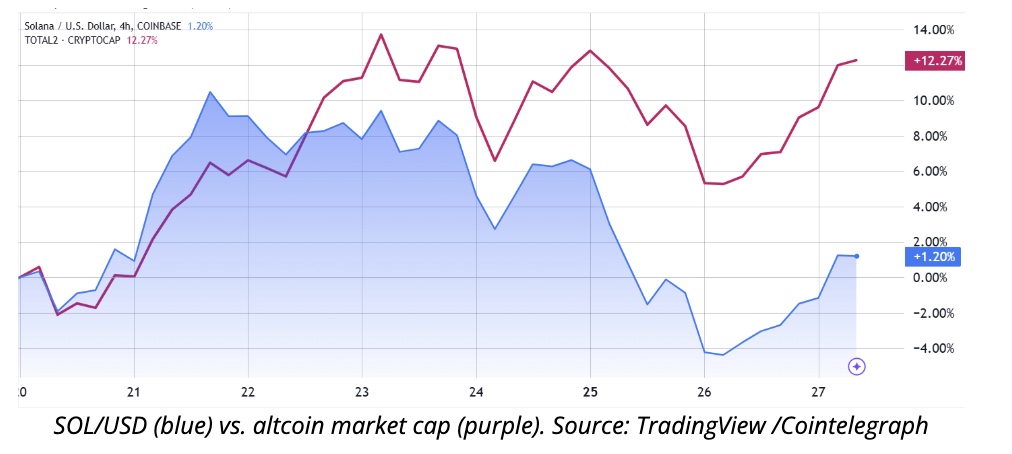

A glance at the market performance shows that SOL has seen a modest gain of 1% over the past seven days. However, during the same period, the total market capitalization of major altcoins has surged by 12%. Leading tokens like Stellar (XLM), Celestia (TIA), and Uniswap (UNI) have posted gains of over 40%, outpacing SOL's performance and leaving some investors questioning the momentum.

Despite lagging the broader market, Solana’s fundamentals are strengthening and painting a bullish picture. Here are some key highlights:

Total Value Locked (TVL) in Solana DeFi has surged by 48% over the past 30 days, outpacing growth on BNB Chain (+14%) and Tron (+13%).

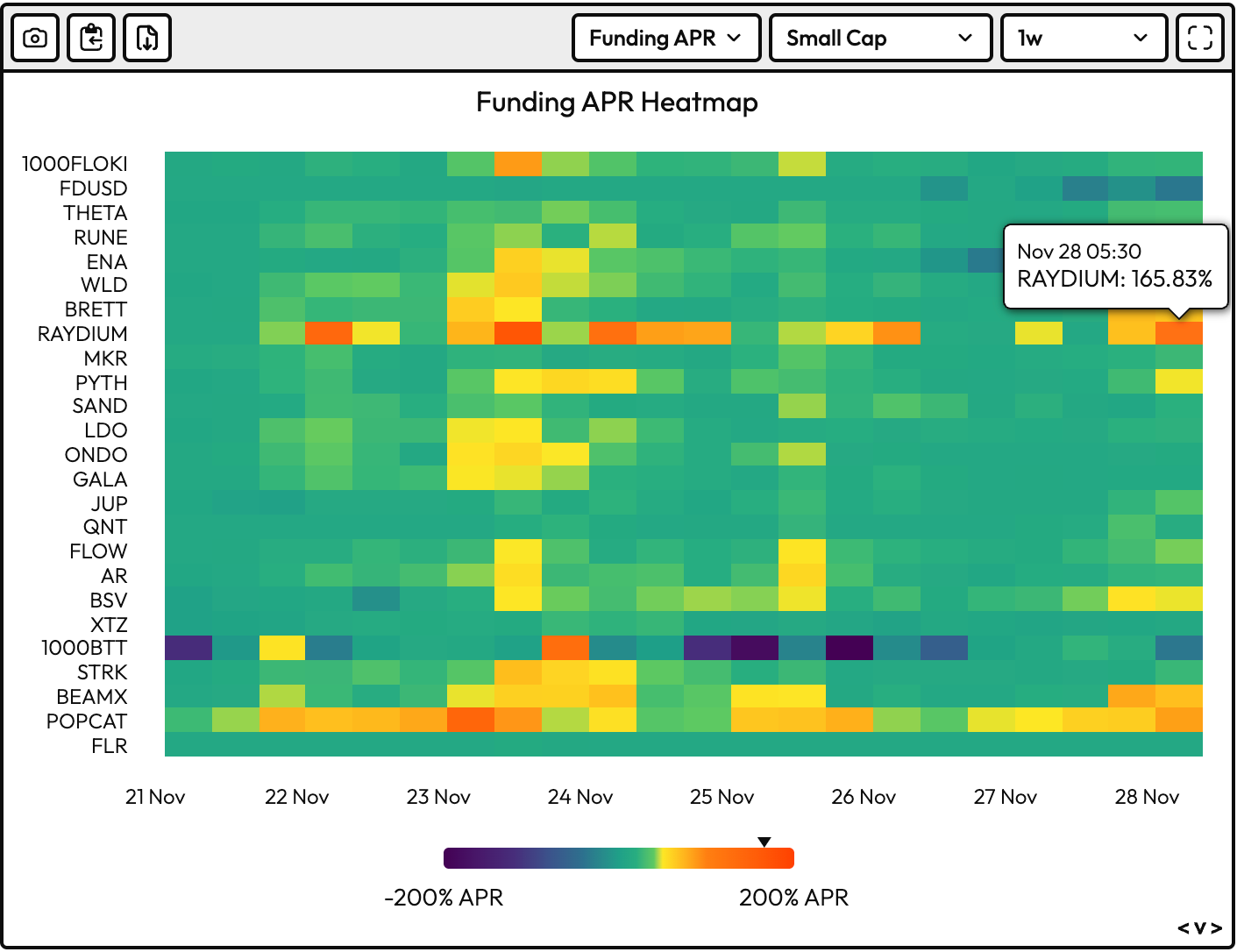

Major protocols driving the TVL growth include Jito liquid staking ($3.4 billion TVL, +44%), Jupiter decentralized exchange ($2.4 billion TVL, +50%), and Raydium ($2.2 billion TVL, +58%).

Solana and Ethereum are both seeing growth in different areas without direct competition. Here's how:

Ethereum is dominating the decentralized finance (DeFi) space, with Uniswap and CoW Swap seeing a 62% and 71% increase in trading volumes, respectively, over the past 30 days.

Meanwhile, Solana is leading in memecoin trading, with tokens like BONK and POPCAT driving up speculative trading volumes and catering to a different market segment.

While Solana's memecoin activity has contributed to the overall increase in activity on the network, it also introduces volatility risks. Speculative hype may not be sufficient to sustain long-term growth.

بررسی اجمالی بازار ارز دیجیتال: بیت کوین در محدوده ۱۷۵۰۰ دلار باقی ماند؛ شیبا اینو با افزایش ۴۰ درصدی پیشتاز بازار شد

In futures markets, the premium on SOL futures has reached an annualized 23%, the highest it has been in seven months. This indicates strong optimism in the market. However, it is worth noting that excessive bullishness, especially above 40%, could amplify liquidation risks during any price corrections.

Solana's market capitalization currently stands at $113.7 billion, which is a 73% discount compared to Ethereum's market capitalization of $429.4 billion. This valuation gap, combined with the strong onchain metrics, suggests that there could be further upside potential for SOL.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- ED seizes additional assets in India and Dubai linked to 'HPZ Token' money laundering scheme

- Nov 28, 2024 at 06:25 pm

- The Enforcement Directorate (ED) has taken significant action by seizing additional assets in India and Dubai as part of its investigation into the 'HPZ Token' money laundering scheme on Thursday.

-

-

- Kraken NFT Marketplace to Shut Down on November 27, Citing Shift in Strategy

- Nov 28, 2024 at 06:25 pm

- In an email to clients, Kraken confirmed that the platform will enter a withdrawal-only phase on November 27. Users will have a three-month window to transfer their NFTs before the marketplace shuts down completely.

-

-

![LCX [LCX] Regains Bullish Market Structure, But Can It Beat the $0.33-Resistance? LCX [LCX] Regains Bullish Market Structure, But Can It Beat the $0.33-Resistance?](/uploads/2024/11/28/cryptocurrencies-news/articles/lcx-lcx-regains-bullish-market-structure-beat-resistance/image-1.jpg)

-

-