|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Solana (SOL) Price Jumps 12% as Memecoins Drive Demand for Network Space

Oct 19, 2024 at 04:46 am

Solana's native token, SOL, gained 12.1% from Oct. 11 to Oct. 18 and data suggests that the upward momentum was partially driven by demand for memecoins.

Solana's native token, SOL, enjoyed a 12.1% gain over the past week, fueled in part by the surging demand for memecoins on the network.

As traders debate the sustainability of the memecoin craze and its impact on SOL's price, let's delve into the network's performance and how it compares to the broader market.

Memecoins drive SOL higher, but how much?

While there's no fundamental basis for the exploding demand for memecoins, their presence is undeniable, especially with influential social media accounts directing traders' attention to these tokens.

For instance, pwnlord69's post on Oct. 12 sparked a massive rally in Goatseus Maximus (GOAT) coin, which saw its market cap soar to $400 million in just a week.

The memecoin mania on the Solana network also saw sharp price increases for several other tokens in October, including a 379% gain for SPX6900 (SPX), a 170% rally for Apu Apustaja (APU), and a 134% surge for FWOG, as per Cryptorank.io data.

As these memecoins appreciate in value, they garner increasing attention from social networks and media, creating a positive feedback loop that ultimately benefits Solana's native token, SOL.

Solana network activity supports a higher SOL price

Now, let's address the burning question: How does this movement significantly impact SOL’s price, and how has the network performed in comparison to its competitors?

A crucial metric for this analysis is total value locked (TVL), which measures the total funds deposited in the network’s smart contracts. This metric provides insight into the demand for SOL as a store of value within the network.

Solana's total deposits recently surged to a two-year high, reaching nearly 41 million SOL, up 13% month-over-month.

In comparison, Ethereum's TVL remained flat at 17.7 million ETH, while BNB Chain's TVL also showed little change, hovering around 7.9 million BNB. Among Solana's decentralized finance (DeFi) protocols, Raydium saw a 70% increase in deposits over the past 30 days, and Sanctum saw a 32% gain in TVL.

While measuring deposits is important, to truly gauge demand for SOL, one must analyze onchain activity. A decentralized exchange (DEX), for example, can record high volumes without necessarily having significant TVL.

In this context, Solana's impressive network activity recently secured its position as the leader, surpassing even Ethereum over the past week.

Solana's 43% weekly growth in DEX volumes is particularly noteworthy among its direct competitors. Even Ethereum’s layer-2 solutions, which benefit from lower transaction fees, couldn't match Solana’s performance.

For instance, Arbitrum recorded $3.74 billion in weekly volume, which is still 64% lower than Solana's $11.16 billion.

Ultimately, Solana appears well-positioned to capture growth in areas like artificial intelligence infrastructure, Web3 applications, gaming, prediction markets, and more.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

- The Fascinating World of Rare British 50p Coins: From Benjamin Bunny to Kew Gardens

- Nov 23, 2024 at 04:25 am

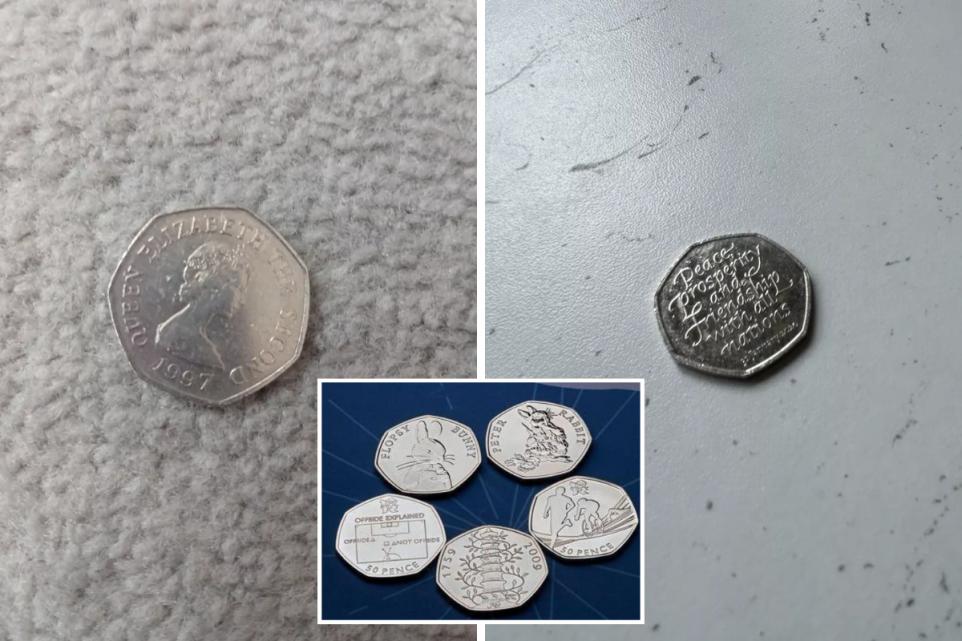

- The world of coin collecting has seen a surge in interest over the years, with certain rare coins fetching eye-watering prices at auctions and on marketplaces like eBay. Among the most sought-after coins in the UK are 50p pieces, particularly those that feature unique designs or commemorate significant national events.

-

- The King Charles III 50p Coin: A New Era of Collectibles

- Nov 23, 2024 at 04:25 am

- The Royal Mint has released a series of 50p coins featuring the portrait of King Charles III, but one particular coin has quickly surpassed even the iconic Kew Gardens 50p coin in terms of desirability. With the growing interest in coin collecting, it’s now more important than ever to check your change — you may be holding onto a hidden treasure that could be worth much more than its face value.

-

-