|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Solana (SOL) Faces PayFi Competition as Coldware Unveils New Web3 Ecosystem

Mar 09, 2025 at 10:30 pm

Amid ongoing turbulence in the cryptocurrency market, Solana (SOL) faces rising competition from a new and innovative blockchain solution: Coldware (COLD).

Solana (SOL) has faced a turbulent few months, with recent indicators suggesting a potential comeback despite persistent technical issues and a 30% price decline from its key support. As Solana (SOL) continues to navigate this instability, a new and promising blockchain solution has been emerging—Coldware (COLD).

Offering a unique PayFi model and a Web3 ecosystem that leverages mobile devices for network validation, Coldware (COLD) is rapidly positioning itself as the next-generation alternative in decentralized finance.

Solana (SOL): Temporary Recovery or Lasting Instability?

Despite recent reports highlighting a potential recovery for Solana (SOL), investors remain largely pessimistic. Over the past month, Solana (SOL) has lost substantial market momentum, undergoing a 30% price decline from its key support around $293.

This downward trend has seen Solana (SOL) hit a recent low near $125, even though a recent short-lived 10% rally managed to briefly stall the bearish pressure. However, analysts suggest this volatility signals an uncertain future for Solana (SOL), prompting investors to consider safer alternatives like Coldware (COLD).

Furthermore, technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) point toward only temporary bullishness in the Solana (SOL) market.

High market volatility driven by reduced meme coin activity and decreasing on-chain volume continues to plague investor confidence. Even new projects like Solaxy, which raised significant presale funds, haven’t fully alleviated doubts about Solana (SOL)’s ability to sustain long-term growth.

How Coldware (COLD) Is Capitalizing on Solana (SOL)’s Weaknesses

Precisely where Solana (SOL) falters—persistently sustaining investor interest—is where Coldware (COLD) thrives. With its own unique Web3 ecosystem, Coldware (COLD) introduces a groundbreaking model that utilizes mobile devices for decentralized network validation.

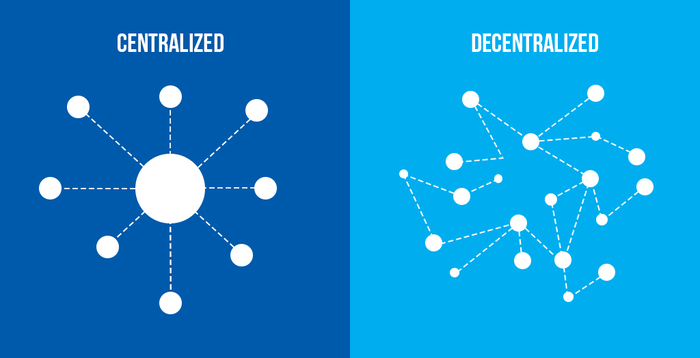

This mobile-based validation drastically lowers the barrier to entry, positioning Coldware (COLD) as a strong competitor to Solana (SOL) by enabling broader participation, improved scalability, and true decentralization—key areas where Solana (SOL) has historically struggled.

Investors are responding positively, as indicated by Coldware (COLD)’s presale rapidly exceeding the $1.4 million mark. This initial success demonstrates substantial market belief in Coldware (COLD)’s approach, differentiating it clearly from the uncertainties faced by Solana (SOL).

Coldware (COLD): Revolutionizing Web3 With PayFi

The integration of blockchain payments within everyday mobile applications—a concept Coldware (COLD) terms 'PayFi'—poses a direct competitive threat to established blockchain platforms like Solana (SOL).

While Solana (SOL) once commanded significant attention due to its impressive speed and scalability, it failed to offer sustainable real-world payment utility. Coldware (COLD)’s PayFi model addresses these issues head-on, leveraging mobile validation to deliver faster, cheaper, and more user-friendly financial services.

This innovation stands in stark contrast to Solana (SOL), whose decentralized applications (dApps) have faced challenges due to network outages and scalability issues.

In comparison, Coldware (COLD) promises stable and scalable mobile blockchain services, providing the reliability investors originally sought from Solana (SOL).

Solana (SOL)’s Layer-2 Hope Overshadowed By Coldware (COLD)

In a recent attempt to regain investor interest, Solana (SOL) introduced Layer-2 solutions like Solaxy, aiming to improve network scalability and reduce inflationary pressures.

Despite these efforts briefly boosting optimism, Solana (SOL)’s technical limitations, like its reliance on Proof-of-Stake (PoS) and vulnerability to malicious actors, continue to be a point of contention for investors, especially in light of Coldware (COLD)’s seamless integration of blockchain technology into mobile devices.

While Solana (SOL) struggles with the complexities of its ecosystem, Coldware (COLD) provides a robust, built-from-scratch blockchain optimized for mobile use, sidestepping the issues that have burdened Solana (SOL)’s ecosystem.

With its presale already exceeding $1.4 million in funding, Coldware (VOLD) is quickly amassing the capital necessary to launch and maintain its operations, a feat that remains uncertain for Solana (SOL) despite its recent pivot towards Layer-2 scaling solutions.

Why Investors Are Choosing Coldware (COLD) Over Solana (SOL)

Investors who were initially drawn to Solana (SOL)’s high-speed blockchain are now shifting loyalties to Coldware (COLD) as it aligns better with evolving user demands.

Coldware (COLD)‘s mobile-first blockchain facilitates a truly decentralized and widely accessible PayFi solution, in contrast to Solana (SOL)’s persistent technical hurdles that limit its broader adoption.

The Coldware (COLD) network's validation via mobile devices drastically reduces barriers, enabling everyday smartphone users worldwide to participate directly in blockchain validation, thereby democratizing network control and enhancing

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- Bitcoin (BTC) Price Dips Below $80,000, Sending Jitters Across Crypto Market

- Mar 10, 2025 at 06:30 pm

- Bitcoin took another blow on March 10, retreating below $82,000 and sending jitters across the crypto market. The latest loss in value for the world's top digital asset comes after weeks of decent gains.

-

-

- Bitcoin (BTC) Is Close to Printing a Local Bottom: Analyst Accurately Called the Correction in Q1 of 2024

- Mar 10, 2025 at 06:30 pm

- An analyst who accurately called Bitcoin's correction in Q1 of 2024 believes BTC is close to printing a local bottom based on a technical momentum indicator. By Lucas Outcalt.

-

-

-

- With the Bybit hack taking the market by storm, traders are looking for safe options to secure their wealth

- Mar 10, 2025 at 06:25 pm

- With the Bybit hack taking the market by storm, traders are looking for safe options to secure their wealth. Meanwhile, XRP and Cardano are going through a consolidation phase

-

- Etena (ENA) also holds stablecoins like USDC as reserves for safety. So with dollar hegemony. It adds strength to the U.S.-led economic order.

- Mar 10, 2025 at 06:25 pm

- Etena is the most high-profile crypto-native asset since Terra. It provides virtual asset-based money solutions without relying on traditional banking system infrastructure.

-

-