|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Shiba Inu's Slip as Crypto Market Uncertainties Loom

Apr 18, 2024 at 05:15 pm

Amidst volatile crypto fluctuations, Shiba Inu (SHIB) encounters technical uncertainty as its 21-day EMA dips below 50-day EMA. Ethereum (ETH) exhibits signs of potential resurgence with "higher lows" and rising trading volume. XRP continues to underperform, lagging behind the market's growth since the beginning of the year.

Shiba Inu's Momentary Setback Amidst Uncertain Market Dynamics

Shiba Inu (SHIB), the enigmatic meme coin that captured the hearts of many investors, has recently exhibited signs of a potential downtrend. A crucial technical indicator, the 21-day exponential moving average (EMA), has dipped below the 50-day EMA, a development not typically associated with major market concerns. However, as reported by U.Today, the momentum of the Shiba Inu market has waned, leaving its future trajectory uncertain.

Currently trading at around $0.000022, Shiba Inu appears to be in a consolidation phase. Its subsequent trajectory will be largely influenced by the overall sentiment prevailing in the cryptocurrency market. The upcoming "halving" event, where the block rewards for mining Bitcoin are halved, is yet to fully manifest its impact. If the event triggers a positive shift and capital flows back into cryptocurrencies, meme coins like SHIB may benefit from renewed attention.

However, standalone factors specific to SHIB are not compelling enough to suggest a bullish resurgence. The market has not bestowed much favor on the asset, and it will likely require an external catalyst from the broader market to regain its upward momentum.

If Shiba Inu were to embark on an upward trajectory, it would face resistance at approximately $0.0000276. Conversely, a further decline would find support around $0.00001635 (200 EMA). These levels are crucial to monitor as they may influence SHIB's path in the coming days.

The future of Shiba Inu remains unclear. While some anticipate the halving effect to propel the asset higher, the cryptocurrency currently lacks intrinsic value and primarily derives its gains from the speculative nature of the crypto market.

Ethereum's Glimmer of Hope Amidst Market Fluctuations

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has displayed an erratic performance, raising questions about the sustainability of its upward trend. Recent price movements suggest that the asset may be gearing up for a resurgence.

On the technical front, Ethereum has been forming "higher lows" - each price dip is not as deep as the previous one, indicating underlying strength and a possible upward trajectory. Additionally, steady trading volume suggests sustained interest in buying and selling the cryptocurrency.

The relative strength index (RSI), a technical indicator that measures the momentum of price changes, is approaching "oversold" territory. This often signifies that an asset is due for a price increase as it has been oversold.

While these technical indicators point towards an upswing for Ethereum, it is important to note that technical analysis alone cannot guarantee market outcomes. A genuine rebound requires a fundamental reason - a shift in market conditions or investor sentiment that stimulates buying activity.

The market is still reeling from the recent Bitcoin halving event, which, contrary to expectations, did not trigger the anticipated surge in buying power. Some investors have grown impatient as hopes for a rapid recovery dwindle. Immediate resistance for Ethereum is around $3,500, while the recent decline has found support near $2,700.

If Ethereum can overcome this obstacle, it may regain higher prices. However, in the absence of a compelling reason for market participants to buy, Ethereum may retest the $2,708 support level.

XRP's Lackluster Performance in a Bullish Market

Ripple's XRP, once a formidable force in the cryptocurrency market, has fallen on hard times. While many other cryptocurrencies have enjoyed a bull run since the beginning of the year, XRP's value has declined by nearly 15%, making it one of the market's weaker performers.

XRP's struggles can be attributed to several factors. The ongoing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) has cast a pall over the asset, deterring many investors from entering or maintaining their positions. Additionally, the lack of significant developments or partnerships has left XRP without a compelling narrative to attract new interest.

Despite its disappointing performance, XRP remains one of the largest cryptocurrencies by market capitalization. It possesses a strong underlying technology and a loyal community of supporters who believe in its long-term potential. However, until the legal and regulatory uncertainties surrounding the asset are resolved, XRP's prospects for a sustained rally remain limited.

Navigating the Uncertain Crypto Market Landscape

The cryptocurrency market continues to be a volatile and unpredictable landscape. While the halving effect is expected to have a positive impact on the overall market, its precise timing and magnitude remain uncertain. Investors should approach their investments with caution and conduct thorough research before making any decisions.

Technical analysis can provide valuable insights into potential market movements, but it is important to remember that it is not a foolproof method. Fundamental factors, such as regulatory developments and shifts in investor sentiment, can have a significant impact on asset prices.

As the crypto market continues to evolve, investors should adopt a holistic approach, considering both technical and fundamental analysis, as well as their own risk tolerance and investment goals. By staying informed, diversifying their portfolios, and exercising sound judgment, investors can navigate the uncertainties of the crypto market and position themselves for potential gains in the long run.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

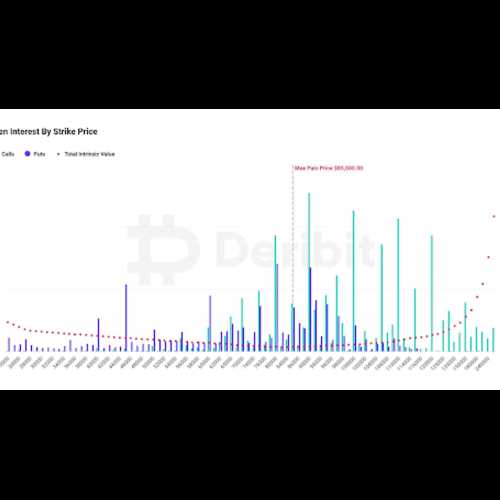

- Bitcoin (BTC) Price Analysis: BTC Options Expiration Coincides With Decline as Resistance Forms on the 4-Hour Chart

- Dec 28, 2024 at 07:05 am

- Bitcoin closed down -3.63% on yesterday's candle after its promising recovery bounce earlier this week. This decline coincides with the expiration of $14.5 billion in BTC options on Deribit

-

-

-

- Tether’s USDT Stablecoin Faces Regulatory Uncertainty as EU’s MiCA Regulation Takes Effect

- Dec 28, 2024 at 07:00 am

- Amid this uncertainty, many on crypto Twitter have been spreading FUD (fear, uncertainty, and doubt) about Tether, speculating on its compliance and future stability under the new rules.

-

-

-