|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

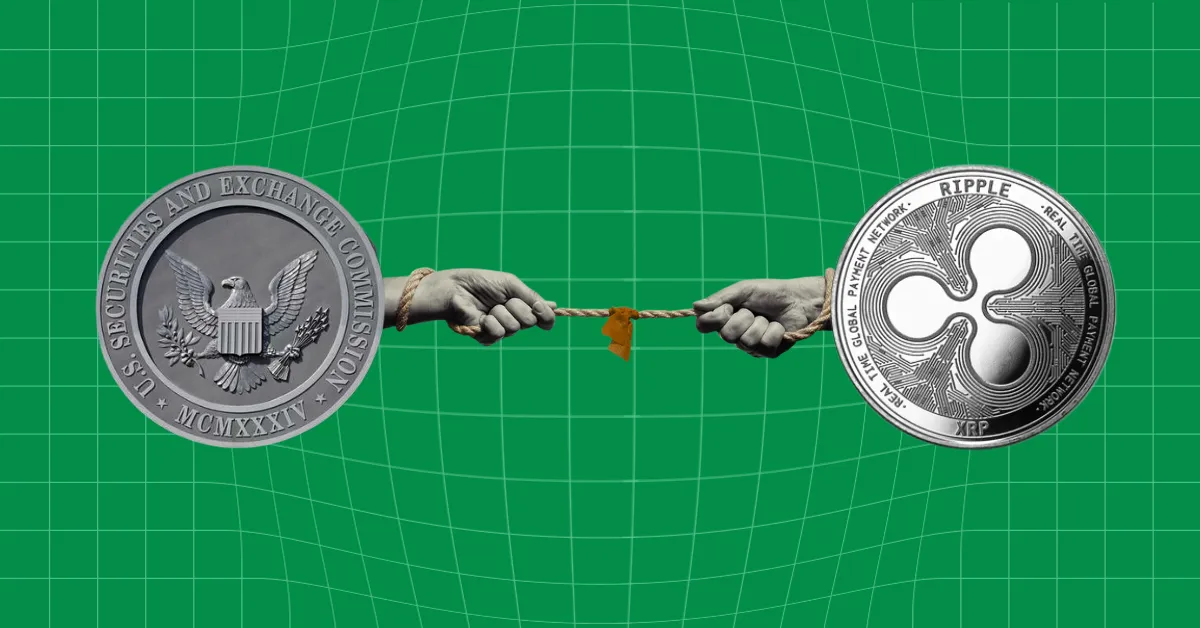

Ripple vs. SEC: Pivotal Court Case to Shape Cryptocurrency Industry

Apr 15, 2024 at 09:36 pm

The SEC alleges that Ripple sold XRP tokens as unregistered securities, leading to a pre-trial conference set for tomorrow. Speculations of a settlement have emerged, fueled by recent developments and legal precedents that could weaken the SEC's position. The XRP community remains optimistic, anticipating a positive outcome that could influence crypto industry regulations.

Ripple vs. SEC: A Pivotal Battle for the Cryptocurrency Industry

Introduction

The Securities and Exchange Commission's (SEC) lawsuit against Ripple Labs, Inc. has sent shockwaves through the cryptocurrency industry. The outcome of this high-stakes legal battle has far-reaching implications for the regulation of digital assets and the future of the industry as a whole.

The Accusations

In December 2020, the SEC filed a complaint against Ripple, alleging that the company had conducted an illegal sale of unregistered securities through its XRP token. According to the SEC, Ripple raised over $1.3 billion from the sale of XRP tokens without registering them with the agency, a violation of federal securities laws.

The Impact on Ripple

The SEC's lawsuit has had a significant impact on Ripple. The company has been forced to spend millions of dollars on legal fees and has seen its market capitalization decline by billions of dollars. The uncertainty surrounding the case has also cast a shadow over the entire cryptocurrency industry, raising concerns about the regulatory landscape for digital assets.

The Trial Date Looms

The trial in the Ripple case is scheduled to begin on April 23, 2024. Both sides have been preparing for the trial for months, and the outcome is expected to have a major impact on the industry. If the SEC wins, it could establish a precedent that would make it more difficult for companies to sell digital assets without registering them as securities. This would have a chilling effect on innovation in the cryptocurrency space.

Recent Developments

In the lead-up to the trial, there have been several significant developments in the case. Ripple has released 500 million XRP tokens from escrow, a move that some analysts believe could strengthen the company's financial position. Additionally, the SEC has submitted its proposed remedies and judgment brief, which failed to identify a single investor who suffered financial loss due to the sale of XRP tokens. This could weaken the SEC's case, as it is a key argument in their lawsuit.

The Community Response

The XRP community has been closely following the case and has been vocal in its support for Ripple. They have organized protests against the SEC's actions and have raised funds to help pay for Ripple's legal expenses. The community's support has been a source of encouragement for Ripple as it prepares for the trial.

A Possible Settlement

In recent weeks, rumors of a possible settlement between Ripple and the SEC have been circulating. Some analysts believe that a settlement could be reached as early as the upcoming Final Pretrial Conference on April 16, 2024. A settlement would avoid the need for a lengthy trial and would provide certainty for both Ripple and the industry as a whole.

The Implications for the Industry

The outcome of the Ripple case will have far-reaching implications for the cryptocurrency industry. If Ripple wins, it would send a strong signal that the SEC's aggressive approach to regulating digital assets is not sustainable. This would give companies more confidence to operate in the cryptocurrency space and could spur innovation.

On the other hand, if the SEC wins, it would give the agency a major victory in its efforts to bring digital assets under its regulatory umbrella. This could make it more difficult for companies to operate in the industry and could slow the development of the cryptocurrency ecosystem.

Conclusion

The Ripple vs. SEC case is a pivotal battle for the cryptocurrency industry. The outcome of the trial will have a major impact on the regulation of digital assets and the future of the industry as a whole. The community is hopeful that a positive outcome will emerge, but the uncertainty surrounding the case remains. Regardless of the outcome, the case has raised important questions about the regulation of digital assets and the future of the industry.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

- BTC Mining Data Puts Spotlight on Musk's 2021 Tweet

- Dec 31, 2024 at 06:25 am

- As per Woocharts, over 50% of Bitcoin's mining energy mix came from sustainable sources. Notably, Elon Musk, the CEO of Tesla, Inc. tweeted in 2021 that the Electronic Vehicle (EV)-maker would reconsider BTC payments on one condition.

-

- This Week in Crypto Wallets: BWB-BGB Token Merger, Rewards with Karat Galaxy NFTs, and Plus Wallet's Quick Listings

- Dec 31, 2024 at 06:25 am

- The crypto wallet space is buzzing with activity this week. Bitget has merged its BWB and BGB tokens, making BGB the main token for both its exchange and Bitget Wallet.

-

-

-

- Coin Expert Reveals the 4 Exact Factors to Look for on Your Lincoln Penny to Make It Worth $15,000

- Dec 31, 2024 at 06:25 am

- Coin collecting is a niche hobby that can be confusing to newcomers due to all the jargon and specificities. However, it can be quite lucrative if you know what details to look for.

-

- 1Fuel (OFT) Captivates Crypto Whales as Shiba Inu (SHIB) and Bitcoin Cash (BCH) Whales Shift Focus

- Dec 31, 2024 at 06:05 am

- Shiba Inu and Bitcoin Cash have long captivated the interest of crypto whales, showcasing steady growth and strong community backing. However, the spotlight in the DeFi space is now shifting toward 1Fuel (OFT), an emerging altcoin that investors are predicting will experience exponential growth in 2025.