Pantera Capital's Liquid Token Fund has achieved a 66% gain in the first quarter of 2024, primarily driven by Solana and smaller-cap tokens. The fund has reduced its Bitcoin and Ethereum holdings while rotating into alternative assets. This performance outpaces Bitcoin and Ethereum growth in the same period and is comparable to the broader DeFi index. Notably, Pantera has invested $250 million in locked Solana tokens from FTX's bankruptcy estate, subject to ongoing legal disputes.

Pantera Capital's Liquid Token Fund Experiences Substantial Gains in First Quarter of 2024

Pantera Capital, a prominent asset management firm dedicated solely to blockchain technology and digital assets, has announced a notable 66% gain for its Liquid Token Fund in the first quarter of 2024.

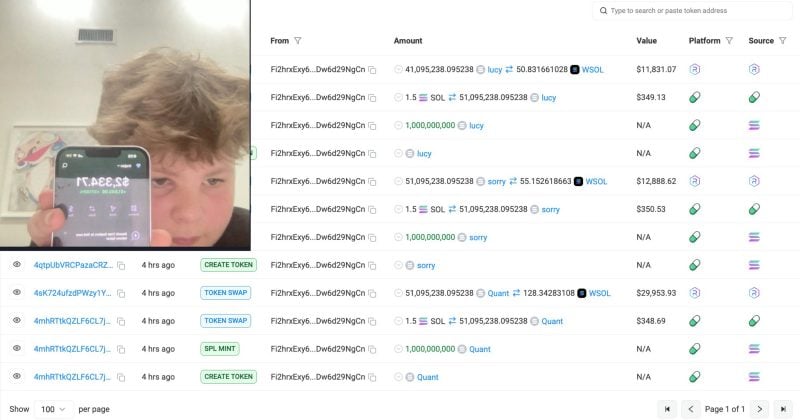

According to a report by Bloomberg, the fund's impressive performance was primarily driven by the strong performance of Solana (SOL) and various small-cap tokens, including Ribbon Finance (RBN), Aevo, and Stacks (STX). Conversely, the fund strategically reduced its holdings of tokens based on Bitcoin (BTC) and Ethereum (ETH).

Speaking to Bloomberg, the manager of Pantera's Liquid Token Fund disclosed that the fund has been consistently reducing its "heavy" Bitcoin holdings throughout the year. Additionally, the fund has gradually exited positions related to Ethereum-based tokens due to diminishing optimism regarding the approval of Ethereum ETFs in May.

A comparative analysis conducted by The Block revealed that the Liquid Token Fund's gains are comparable to Bitcoin's 66% year-to-date growth. However, the fund outperformed Ethereum and The Block's DeFi index.

In a previous report by The Block, Pantera Capital established a $250 million fund for the purpose of acquiring locked Solana tokens from the FTX bankruptcy estate. This move has sparked legal disputes regarding the ownership of the tokens.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.